Here’s the latest reader question, along with my reply!

Note: This reader sent his question in typed ALL CAPS, which I leave as is for reasons which will become clear.

Joseph asks: ERIC, YOUR AUTO PROP. TAX COMES FROM VEH. REGISTRATION, IF YOU UNREGISTER, NO PROP. TAX. ALL AUTO TAXES AND LAWS COME FROM YOU DRIVING A MOTOR VEHICLE. HOWEVER, IF YOU READ 18 U.S.C. SEC. 31(A)(6), YOU WILL SEE THAT IT IS NOT A MOTOR VEHICLE UNLESS YOU ARE USING IT IN COMMERCE, HAULING PASSENGERS OR GOODS. OTHERWISE, IT IS A PRIVATE PASSENGER AUTOMOBILE, NOT A MOTOR VEHICLE, AND NOT SUBJECT TO MOTOR VEHICLE LAWS. ANOTHER ONE OF THE FRAUDS WE SUFFER FROM. ALSO, PROPERTY TAX ON YOUR HOME IS DUE TO YOUR ATTORNEY RECORDING YOUR DEED UPON CLOSING ON YOUR HOME. NO RECORDING, NO PROPERTY TAX.

My reply: This comes up every so often, like water in my basement. Unlike water in my basement – which is real – this idea that you can legally avoid taxes on property by using the stratagem described above is a fiction as well as risible and dangerous. Which is why I publish this, for the sake of anyone out there reading this who might be tempted to do as as the writer suggests.

Ultimately, what matters is not the law as written but what those who control the law – cops, prosecutor and judges – decree it to be. And they decree that all vehicles are “motor vehicles” and must be registered and decree fees which must be paid. Fail to pay these fees and you will be stopped by an armed government worker who will either issue you fines or impound the vehicle.

The judge will affirm the legality of this.

It is the same with regard to property tax on real estate. The county/state will come after you with its paw out and if you fail to pay, eventually, they will simply seize your property and auction it off to pay what is “owed.”

This isn’t a moral debate about the rightness or wrongness of what’s being discussed. Obviously, I oppose these acts of violence. But that is neither here nor there with regard to whether the government will abstain from doing you violence if you quote 18 USC, Section 31 A to them.

Do that and you’ll end up in cuffs – and a cage.

Possibly one with rubber-padded walls.

. . .

Got a question about cars – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

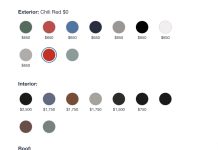

PS: Get an EPautos magnet (pictured below) in return for a $20 or more one-time donation or a $5 or more monthly recurring donation. (Please be sure to tell us you want a sticker – and also, provide an address, so we know where to mail the thing!)

My latest eBook is also available for your favorite price – free! Click here.

All taxes are property taxes.

Better yet check move to Florida – no personal property tax, no state income tax, and if you rent your home no RE taxes. Done.

Why do something that is going to setup red flags when there are more than a few states that will not tax you on every little thing?

Hi RG,

Does Florida not tax real estate? That is the big one, in my book – because it means perpetual enserfment. One can avoid paying income tax if one has no income to tax. Which is feasible, if one owns one’s home and needs no income.

Yes, they do tax real estate. That’s where they get you (unless you rent). You could buy a real cheap piece of land and throw an super nice RV on it though….may not be bad living. 🙂

“A vehicle not used for commercial activity is a “consumer goods”, … it is NOT a type of vehicle required to be registered and a “use tax” paid of which the tab is evidence of receipt of tax” Bank of Boston v. Jones, 4 UCC Rep. Serv. 1021, 236 A2d 484, UCC PP 9-109.14

If you don’t file the deed with the county then the seller still “owns” the property. He/she/they will still get the tax bills and not pay them. County seizes the property either way.

Unless you pay cash then the mortgage company will require the deed to be filed anyway. They won’t turn loose the settlement check to the seller unless everything is done properly.

You could just buy and older RV and register it in a state with a one time permanent plate, and then live in it full time and go where ever you want …?