Now is a good time to buy a used car – or soon will be, again. A house, too. Both for the same reason: Rising interest rates are making it more difficult to buy these things. Demand softens, prices lower. Sellers have the choice: Take less or get nothing.

The catch is, you’ve got to be able to afford to buy.

Increasingly, many can’t.

This is why the used car market is collapsing. Or rather, used car prices – and profits – are. Carvana – which was making lots of profit re-selling (re-financing) used cars – is a kind of canary in the coal mine and it just fell off its perch, onto the newspaper below. The value of shares in this once-hot-commodity is down 97 percent – and bankruptcy appears imminent.

“We are lowering our price target from $7 to $30 to reflect a higher likelihood of insolvency by 2024,” said market analyst Colin Sebastian earlier this week. Carvana shares fell to $6.70 on Tuesday – headed toward zero, probably. Chiefly, because Carvana did the opposite of what it’s necessary to do to make rather than lose money.

It bought high – and now must sell low.

Much of Carvana’s inventory of used vehicles was bought up during the time when the supply of new vehicles was low, which drove up demand – artificially – for used vehicles because they were often the only vehicles available. Interest rates on car loans were also low – and this induced a kind of artificial affluence that, for awhile, made it feasible for used car sellers like Carvana to sell used vehicles at new vehicle prices – and for people who really couldn’t afford to pay those prices to finance the purchase.

That’s all unwinding now.

Used car prices are falling – because new cars are generally available, again. Why pay new car prices for a used car? That’s a big problem for those – like Carvana – that banked upon being able to sell used cars for new car prices. It is also a problem for those selling new cars, too – for now a used car is a more affordable alternative to a new car. Assuming you can afford to buy (rather than finance) one.

An interesting storm is brewing.

As interest rates continue to rise, fewer people will be able to finance new cars, irrespective of their availability. This problem will wax as new car inventories stack up and new car prices continue to rise, as they must. This being a function of two facts:

One, the buying power of money is decreasing – which means it requires more to buy the same.

Two, it is not the same. It is more expensive as well as more pricey. The cost of regulatory compliance continues to increase – and those costs can’t just be swallowed. They must be folded into the price of the new car.

On average – just over the course of the past year – new car prices have gone up by $600. It may not seem much in the context of the average price paid for a new car, which is approximately $35,000 as of this year. But when you add increased interest – paid on the increased principle – the cost of the monthly payment inches (and may soon gallop) toward the unaffordable.

That will result in a further weakening sales of new cars, which is already happening, as a recent article in Forbes documents. People are running out of “stimulus” money – and what money they have left has had its buying power diminished by 8-15 percent, depending on whose numbers you use.

This weakening of new car sales will – well, would in ordinary times – result in used car prices going up, as demand for them (as an alternative to a more expensive used car) goes up.

But – aye, here’s where it is going to get interesting – very few people can afford to just buy a used car. Because very few people have the money to buy one. The cash – which is all most private sellers will accept. Used car dealers will, of course, try to finance the buy. But rising interest rates are making such financing – which is always higher to begin with on used cars because their value has already depreciated substantially relative to a new car – harder.

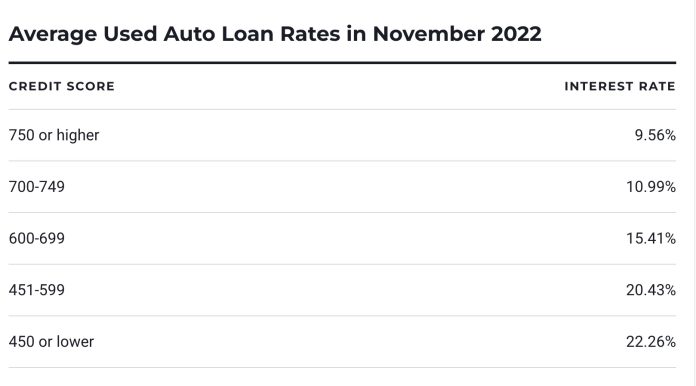

According to NerdWallet, the average cost of money – i.e., of interest – on a used car loan is about 8.33 percent, or almost twice as high as the 4.33 percent interest typically paid in interest on a new car loan.

That was in August, by the way.

Three months down the road and the cost of money for a used car loan approaches 10 percent – for those with high credit. Those with less-than-great credit are looking at paying 11 percent or more for money.

Most haven’t got it to spend.

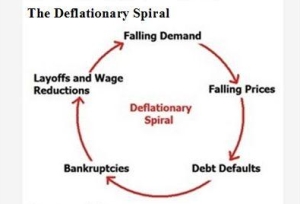

What will be the result? In all likelihood, a deflationary spiral. The prices of new and used cars will fall – to the level at which people can, once again, afford to buy (and finance). In the meanwhile – before that floor is reached – it will be exactly the right time to buy a used or new car, for those who can still afford to actually buy them.

. . .

Got a question about cars, Libertarian politics – or anything else? Click on the “ask Eric” link and send ’em in! Or email me at EPeters952@yahoo.com if the @!** “ask Eric” button doesn’t work!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

Looking for a used truck in Texas right now and prices for trucks 10+ years old are astronomical. Not only is there hardly any inventory, but the prices are absolutely ridiculous. Example: 2008 Toy Tundra-153k and the dealership is asking $15,500. Seems way to high. I refuse to pay such inflated prices. I’m wondering with economy getting worse by the day if we can expect these prices to slowly start going down. Although people seem to be holding on to their old cars (understandably so) and I don’t see them giving them up any time soon.

Hi Mel,

Lots of factors in play but I suspect that as the buying power of the dollar devalues further, prices will go up even more. However, those with money will be able to get deals on things.

Take a gander at what’s going on across the pond:

https://www.dailymail.co.uk/news/article-11310519/Traffic-scheme-splits-cathedral-city-FIVE-zones-fines-drivers-moving-them.html

https://www.thisismoney.co.uk/news/article-11471003/Sadiq-Khan-reveals-wants-Singapore-style-toll-roads-London-controversial-ULEZ-expansion.html

Yes, there is a correlation between interest rates and prices of expensive things. (say cars and houses). The example I remember is a guy I used to work with bought his house in the early 80’s when mortgage interest rates were in the teens of %. So, he got a low price on his house. Then when interest rates came down, and down and down, over the years, he refinanced. When I left the co in 2006, his house was worth 1.something million and his interest rate was about 2.5%.

A corollary is property taxes, we saw some real estate in upstate NY, a small rowhouse in a small town, the price was about $50k, the taxes were $24k per year! So, with real estate taxes being one of the most egregious taxes, you eventually get bled dry, even if you come up with the $50k in cash!

Housing Sales to Institutional Investors Dropped 30% in Third Quarter

a sign that the rise in borrowing rates and high home prices that pushed traditional buyers to the sidelines are causing these firms to pull back, too.

as soon as Joe Biden took office (Jan ’21), and the economic policy became evident

energy policy would drive inflation

As an offset to predictable inflationary policy (the insiders’ game), institutional money (Blackrock, Vanguard etc) was moved into hard assets with tangible value. This shift in asset allocation, institutional sales, helped fuel a false surge in home prices and their valuations. CTH was writing about this in 2021, and sounding alarms as it took place

this 2021 inflationary explosion had nothing to do with the pandemic or supply chain shortages. It is entirely self-created by western governmental policy; the collective ‘Build Back Better’ agenda.

25% of all real estate purchases were being made by institutional investors.

https://theconservativetreehouse.com/blog/2022/11/24/housing-sales-to-institutional-investors-dropped-30-in-third-quarter/#more-240225

It drives me crazy when some moron says prices are up (a symptom of inflation, defined as an increase in the money supply) ‘cuz scrovid. I just came across this in a piece on another site I visit regularly. Some idiot says:

“This year feels a lot easier and more relaxed with travel regulations, but the cost of everything due to the after-effects of Covid seems a lot more expensive, which sucks…”

It’s just so casual and banal and… wrong. Actual misinformation from the mouths of the misinformed.

Over at world-o-meters the number of new cars and trucks manufactured so far this year is over 75,000,000 today.

Projected to be 80.4 million cars and trucks by the end of the year. Just too many car owners out there, increase prices so nobody can afford them.

Governments and corporations buy a lot of them, then private buyers go for the gusto.

Russians have to have vehicles to move troops in Ukraine. Some get bombed, have to replace the ruined trucks.

A new clown car for Klaus.

Always demand for vehicles one way or another. Accidents claim a lot of cars and trucks. Yours wears out, got to have something different and soon.

A market for cars and trucks exists because there is demand, hence, the supply. Have to drive to the grocery store for some vittles, you gotta eat. You’ll die if you don’t eat.

Today, a hundred million turkeys were eaten by three hundred million Americans, it’s turkey genocide and nobody cares. Just all crocodile tears for the poor turkeys.

It is an outrage.

Weve had at least 2 generations now (arguably many more) with absolutely no experience of scarcity or hardship. Nobody is going to survive what’s coming unscathed, even we who saw our parents relocate in 1979 and get stuck with a 21 percent mortgage.

I have lived, worked, and saved accordingly.

Sadly the idiots have kept it going for vastly longer than I thought possible, by playing games I wouldn’t ever consider. The consequences are going to be epic. And the same evil crooked fux who caused it will resort to world communism to retain control, and when that fails they’re going to start tossing nukes around.

People who are coming into a payout on their pensions will be in a good position to buy a new car for cash.

That’s how I got mine 3 1/2 years ago. It was out of the blue, I thought I hadn’t become vested in the job I had 30 years ago. Turned out I had paid in for 3 years before the factory closed and voila! I got enough to buy a new car and a nice wee sum monthly.

Jim H.’s comment made me laugh my ass off:

“Passive riders in the Fed’s clownmobile have gone from pinned against their seatbacks to having their faces slammed through the windshield.”

This is exactly what is happening, and it was predicted by Ludwig von Mises a long time ago, it is the infamous analogy of grabbing a tiger by the tail meaning that once the fools in charge abandon the gold standard, they unleash forces they can not control.

https://fee.org/articles/inflation-a-tiger-by-the-tail/

Why ‘oh why did Congress approve of the Federal Reserve Act?

Because on a gold standard you must pay for federal spending by raising taxes. But on the fiat money standard, you can spend all you want and not raise taxes, thus you can pork barrel spend in your district and stay elected, and the cost is put off on everyone in the future by inflation – and then as a scumbag politician you can blame inflation on a third party – just as Nixon did blaming oil price inflation on the Arab ragheads rich oil sheik bastards – who don’t vote. LOL

But of course there is a downside to free money – the Fed is forced to monetize the ever increasing debt AND having to control inflation. So the nation (and the world because the USA is the hegemon currency) is whipped from one end of the spectrum to the other.

And then you have the evil clown show, the WEF run by this weirdo evil genius psychophant Klaus Schwab who understands all of this and wants to cash in on it and create a new order based on his perverted vision of owning everything and you owning nothing.

The Fed BTW is not onboard with his clown train, they want to maintain the current system with themselves in charge. So the Fed is run by fairly level headed PhDs who want the Federal Government to reign in spending so they can do their job.

How this train wreck ends is anyone’s guess. But like any train wreck it is going to be ugly. And now you have competition with Fed bucks, you have cryptos trying to take the place of the national currency. And you have gold. And you have state sovereignty movements, where states will leave the union and create their own currency, like in Idaho which has enough silver to do so.

So what should we do? Give thanksgiving for being in a non war zone. We don’t have Russian cruise missiles zooming overhead taking out electrical substations. Are lights are still on. Pay off your debts, live simply, own a good fuel efficient car, hope for the best, but prepare for the worst.

“Carvana… is a kind of canary in the coal mine and it just fell off its perch, onto the newspaper below.” Hahahaha.

I agree with the deflationary prognosis. Rising rates are going to kill high prices on anything that is typically financed. The question is how high will rates go?

One measure I use and have forecasted is that 10 year Treasury Notes are below their 200 year average.

https://i.imgur.com/e1L6vT6.png

This chart was made back in 2017, when it was technically obvious a giant megaphone technical pattern was forming:

https://i.imgur.com/BkShxQt.png

(Back in 2017 such a forecast for skyrocketing interest rates was viewed as a crazy conspiracy theory. Now the pundits are only beginning to suspect this.)

Currently, rates have only started their epic rise, which will result in an epic deflation during the epic inflation. The Fed says they will keep raising rates to stop inflation. Jerome Powell has vowed again and again to keep raising rates until the inflation rate is back to 2%.

Well I hate to inform you Mr. Fed Chairman that it doesn’t work that way, the Fed system of stimulus followed by credit starvation is causing huge “waves” of destruction, it is oscillating to greater extremes with each decade.

https://i.imgur.com/oUw8AnM.jpg

It is like a Dodge truck with the front end “death wobble”, eventually the whole axle falls off.

Mortgage rates have shot up from record lows to the 7% range. I figure that when the magic 8% range is penetrated the MSM will start screaming. Well Virginia, why should rates stop there? How about 20% mortgage rates like 1979?

Amerika is a banana republic, spending is out of control. The Biden thing said this week he wants to send another 4.5 billion to Ukraine. Like what the hell, the Ukraine war is already lost. This is Biden’s second major war failure. They already sent over 100 billion to the Ukraine shit hole, we could have streets paved in gold for that kind of money.

And they got caught money laundering FTX funds from Ukraine to Demonrats. Corruption is not only widespread, it is endemic to the system now, and no one is accountable. Thus in the near future as confidence is lost, Treasuries rates are going to the moon 3rd world banana style.

It has been my opinion for some time now interest rates are going to shoot higher than they were in 1979-1980.

That should cause some deflation in those things financed. Cash will be king.

Then watch for the Fed to be politicized, and if so, expect a hyperinflation when the deflation ends.

This article is the wrong forecast:

https://www.deseret.com/2022/11/21/23471490/how-much-fed-federal-reserve-rate-hikes-terminal-2023-predictions

A terminal rate of 5% is unlikely when you look at how much the (((Bernanke and Yellen))) irresponsible money printing:

https://fred.stlouisfed.org/series/M1SL

They ignited inflation with the huge increase in the money supply, and now they are way the hell behind the power curve to raise rates to get inflation down. Thus they must raise rates above the inflation rate just to slow the inflation beast, and they are not there yet. Inflation is 9% and Fed Funds are 4%.

If interest rates go up more, and keep going up, those with cash will be kings.

Imagine all the home owners who took out equity lines of credit, when interest rates were low and their home price at record high. Rising rates are going to kill the home price “value” and send a whole lot of people underwater – and the bank probably has it in fine print to make a margin call.

The fool who borrowed their house equity to buy an overpriced Tesla will now have to pony up capital for the bank to be satisfied with their loan. The only situation you want to be in is to own your house outright, and only have to come up with the property tax to survive.

Raising rates will not help the FED control inflation They have been raising rates for several months and inflation continues to rise because inflation is caused by an increase in the money supply. I believe Milton Friedman won a Nobel prize for saying that. Increasing rates only reduces demand which further depresses the economy so the Fed is wrong once again.

Hi Rik,

Yup. I always use devaluation when speaking of “inflation” because that’s functionally what it is. The buying power of money decreases in relation to the increased supply of fiat currency that has no intrinsic value, as such. So, raising interest rates only serves to further decrease people’s ability to buy (finance) things. Those who can afford to buy outright – and who have money (gold and silver) may end up doing very well.

Very Dramatic Carvana CVNA stock chart:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=CVNA&x=56&y=16&time=9&startdate=1%2F4%2F1999&enddate=9%2F16%2F2019&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=4&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

1929esque

I think the price of new cars rising has more to do with artificial, manufactures induced scarcity than anything else. I wanted to buy a new Maverick for my wife, looked across Az and Nv, couldn’t find a new one, a few used ones with high miles for 10-20% more than the cost of new. No thanks, I’ll pass.

As prices fall the only danger in holding cash, is holding the bag as the dollar goes down in flames. I did very well in the last Realestate bust. Have cash will deploy, but I think we are are a long way from the bottom. You know what they say about catching a falling knife. You’ll lose your digits, and people will start calling you ‘Pieces.’

A house we bought a little over a year ago is up about 80k. I financed it at less than 3% on my VA loan, we still have no debt other than that. No way money will ever be that close to free again in our lifetimes. Now might be a good time to divest some Realestate I hold in Az and find some greener pastures. The cotton fish stank emanating from the capitol can now be smelled across the whole state. The only place I see better politically, where I would live is Florida. Problem Florida property is in nose bleed territory. So I’ll be rooting for a mythic collapse at this point.

The great reset has the ability to cut both ways. The Masters of the Universe have the potential to lose big if it goes beyond their control, or becomes kinetic. They have sowed the wind with their skullduggery. May they reap the whirlwind.

Ee che ling gou autocorrect. rotten, not cotton.

I wonder how long it will be before there’s a new round of Cash for Clunkers, but this time with “Clunker” defined as anything that runs on petroleum.

Euthanize your reliable-but-climate-changing IC vehicle and get $60k, which you’ll only be allowed to spend on an approved Playstation-on-wheels.

What could go wrong?

I think used car prices will drop even more as the “fair weather” car dealers are unwilling/unable to sell inventory at a loss. Auction prices are already falling off a cliff, in six to nine months cash buyers will just about be able to name their price for used cars. Like the housing crisis in 08-09, car prices could get stupid low. I’ll continue to stack cash and see what is available in the near future as I’m about to replace my work van. Current prices are getting back to normal-ish, I’m holding out for the real deals.

New cars are off the table for me. I can’t see dropping 50-70K fo a work truck that’s going to log 30-40,000 mile per year get scratched all to hell, full of dust and doesn’t make me a nickle more than a 15-20K vehicle

‘The prices of new and used cars will fall.’ — eric

Perhaps the greatest delusion of the US fedgov is that it can manage the economy. Clowngress ignited the used car bubble with multiple rounds of stimmy checks. Suddenly people who couldn’t even raise a down payment could drive away in a shiny new ride. Used car prices popped like never before.

Now the other wing of the fedgov’s economic fluffers, the Federal Reserve, is cranking interest rates to brake the inflation it created earlier by recklessly ‘buying’ trillions worth of bonds and mortgages with kited checks.

Passive riders in the Fed’s clownmobile have gone from pinned against their seatbacks to having their faces slammed through the windshield.

Letting PhDs with badges jerk interest rates up and down is as foolish as authorizing 535 reckless Congressclowns to run unlimited deficits with ‘free money.’ You don’t need to be no fortune teller to forecast a train wreck dead ahead.

The irresistible force meets the immovable object. New car, and home prices are well above most anyone’s ability to pay, without debt. With the incurring of that debt depleting one’s resources to pay cash for any large purchase. Including a used car or an existing home. Both of which are penalized in the debt market. Or even a new water heater. People of the West have been financing their life style with debt for far too long, and the piper will be paid. May even being paid as we speak.