Washington excels at unintended consequences. A law gets passed or a regulation is imposed that’s meant to do this . . . but ends up causing that.

One example of this phenomenon is the way federal fuel-efficiency mandates (CAFE, in DC-speak) have grossly distorted the market for new cars by inadvertently encouraging people to buy even thirstier pick-up trucks and SUVs – which until very recently were subject to a lower CAFE standard because they were (rightly) categorized as work vehicles rather than vehicles used for A to B transportation.

The government wanted more fuel efficient cars, but the market wanted larger – if thirstier – vehicles. SUVs and pick-up trucks fit the bill. People began to buy them in lieu of cars and for everyday driving.

SUVs and pick-ups – which were once a small portion of the market – now dominate the market. The bureaucrats never saw it coming.

Another example of unintended consequences in-the-making is a proposed new tax on advertising.

Technically, it’s a reduction – by 50 percent – of the currently allowable deduction of advertising costs as a business expense. But it amounts to the same thing because it’s a 50 percent increase in the cost of doing business.

And advertising is as essential to doing business as having a product people are interested in buying. If prospective buyers don’t know a product is available – which tends to happen when it’s not advertised – that product might as well not exist at all.

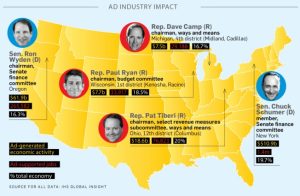

Among the arguments being made to advance the tax – which was first promoted by former House Ways and Means Committee Chairman Dave Camp (R-MI) – is that it will tamp down the burgeoning bubble in the new car market, which many analysts worry will soon pop and very possibly trigger a major economic downturn – not unlike the way the housing bubble triggered the collapse of ’08.

And for similar reasons.

The car industry – like the housing industry – is a huge industry. It’s health – or sickness – affects the economy generally.

The so-called Camp Tax is supposed to curb what many – rightly – see as an overheated market that, to a great extent, increasingly depends on shuck-and-jive financing tactics to get people into new cars – even when many of those people probably shouldn’t qualify for loans.

Zero-down, low-to-no-interest loans and loans pushed out to six years or longer (a record) are driving this and – so goes the argument – it’s advertising that’s driving that.

So, tax the advertising – or at least, make it more expensive to advertise. That’ll cool things off . . . supposedly.

But in fact, making advertising more expensive will only give an artificial advantage to mega-dealers and chains, which can absorb the hit without reducing their advertising campaigns – to the detriment of smaller dealerships, which can’t absorb a 50 percent uptick in their cost of doing business and so will reduce their advertising.

Which will inevitably hurt their sales – but not sales overall.

And here’s where it gets interesting, unintended consequences-wise:

By artificially advantaging the mega-dealers and chain stores, this new tax will distort the market – just as CAFE fuel economy regs have done. The big dealers will not only continue to advertise, they will do so freed from the balancing pressure of smaller, independent dealerships – whose more economically reasonable business practices serve to keep things economically sane.

Smaller dealers can’t afford to give away cars at fire sale prices – or finance buyers with sketchy credit.

The big chain stores can – and do.

Their economies of scale make it feasible for them to sell cars for less per car and even sell cars at a loss when necessary (in order to drive out smaller rivals, who can’t play this game). They can use economically untenable fire-sale deals and “no money down” financing schemes, which other big chains stores then emulate and which then become the de facto industry standard.

Such creative financing has become the rule rather than the exception.

Just as happened prior to the housing bubble popping. Lots of economic activity, but much of it artificial.

Followed by the inevitable crash.

But this isn’t an advertising problem. It’s a sketchy financing problem. Very much of a piece with what happened back in ’08.

The solution, then, isn’t to punish advertising but rather to deal with the sketchy financing deals that are the real problem.

Ron Paul is among those who’ve publicly criticized the Camp Tax. “The companies who will be hurt are smaller and newer businesses,” he says.

Exactly.

No matter the intent of the tax, its unintended consequence will be to punish smaller businesses with sound business practices while artificially advantaging the established players – and not doing anything to tamp down “irrational exuberance” in the car business.

If anything, it will make matters worse.

Leave it to the government – and the politicians who think taxing things helps things.

. . .

Got a question about cars – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here, please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: EPautos stickers are free to those who send in $20 or more to support the site. Also, the eBook – free! – is available. Click here. Just enter you email in the box on the top of the main page and we’ll email you a copy instantly!

Hermmmm. Most small, local dealers already only advertise on Craigslist, Autotrader, etc, and do okay. The Big Guys advertise there as well, buy savvy shoppers know how to filter them out. Another unintended consequence will be a noon to the right kind of selective advertising and a shift to its effectiveness.

Move, not noon. Damn auto correct.

The sales pitch for any new restrictive law or tax is going to be a lie. A con game. There is always a group on the inside that knows exactly what it is for. They know what we know, they can see like we can see, but the other 93% of the population can’t. When there is a bill to make a basic business practice more expensive it is for one reason only, to hurt the small player. That is the intention.

Dave Camp… He’s always been a douche. My neighbor’s uncle socked him in the head back in high school. His father did the same to that other asshole Bill Schutte.

Hi Grant,

They all fit the profile… I picture them swapping Cleveland Steamers and partaking of Monroe Transfers in the cloakroom…

I had to look up what those terms meant. Your knowledge of deviant sexual acts is pretty good.

Hi Escher,

I must know about such things; I am, after all, a writer!

Now that I know what those two things are, I think I’ll take a shower and brush my teeth even though I didn’t say either out loud.

Sometimes when you palpate cattle they get anxious and get the runs so that when your arm is all the way in the glove can not cover your entire arm sleeve and the ejected mass goes inside your shirt and hopefully stops at your waist. Not sure what to call that but a hot mess. It’ll learn you to not wear a sleeveless shirt.

Hi Eight!

Sounds a lot like Munging… don’t look that one up on a full stomach!

eric, you broke me of looking up anything. I’ll have a nightmare about that. I always thought I had a large imagination and so my friends have told me many times. Turns out I’m milk toast, cream on rye, no imagination at all……and I now understand I like it that way. You are a bad, bad man. God, I have indigestion and am headed for the ranitidine. sunny beaches

Capitalism works just fine if government can be kept away from it.

Think about it. People hate capitalism mostly because they associate it with banks, health insurers and cable companies – all large-scale near-monopolies with extensive state influence.

Hi Ice Age,

That is a top drawer observation – about people hating capitalism when what they really hate is government. Amen.

Health insurance is an obvious and excellent example. I hate the insurance mafia – but only because it is a mafia. A legally-empowered one. Not because I object to insurance as such.

It is my experience that a monopoly cannot exist unless it has the sanction of government. This is due to the entry of other actors that want a piece of the action the big fish in the pond has.

I thought it funny when the feds went after MS using the anti-trust act claiming it was a monopoly, when in fact the fed is Microsoft’s largest customer. I guess a show trial had to be done to placate those that railed against Microsoft’s overwhelming market share.

Sure Apple computers are used in businesses but not where it counts in numbers. Graphic Arts departments, people that deal with typesetting, newpapers, magazines and such and the Music Industry are the commercial users of Apple products in the work place.

Many commercial concerns are now starting to use Linux, mostly Red Hat Enterprise Linux, for their server farms. However, MS still has a large server market share.

MS is a de facto monopoly but merely because the fed, state and local governments support them by specifying their OS as standard entirely across the board. To put it bluntly, Bill Gates and Co. are members of the club and Apple & the Linux community aren’t.

NoneYaBiz

That’s because the schools intentionally teach people that free markets lead to monopolies and don’t teach about how government is a partner of monopolists.

Eric,

If you think these are unintended consequences, you are sadly mistaken.

The reason the pimple faced kid at the store can’t make change for a dollar ISN’T unintended.

The Department of Education works as it was intended.

It is no coincidence that the same people who gave us the Salem Witch Trials also gave us Harvard.

You are starting to sound like the folks who claim “we are starting down a slippery slope towards a police state”.

We slid down that slope at least a generation ago.

Hi Tuanorea,

Have you read this http://blog.independent.org/2013/09/13/all-government-policies-succeed-in-the-long-run/ from Robert Higgs?

From the essay: “People label a policy as a failure because it does not bring about its declared objective. For example, drug policies do not reduce drug use; educational policies do not educate children better; national-security policies do not make Americans more secure; and so forth. The mistake is to take seriously the announced policy objectives, to forget that virtually everything the government does is a fraud.”

“…theoretical tinkering and policy appraisal fills many pages in mainstream economics journals.

But it’s all a waste of time insofar as the attainment of the ostensible policy objectives is concerned, because these objectives are not the policy-makers’ real objectives, but only the public rationales they use to disguise their true objective, which invariably is to bring about the enrichment, aggrandizement, and other benefit of the politically potent individuals and interest groups…”

Cheers,

Jeremy

Thanks for the article Jeremy.

Speaking of that…

http://www.autofinancenews.net/credit-acceptance-expands-subprime-lending-while-losses-spike/

“The lender originated 77,317 loan contracts in the quarter… The originations rise has allowed the company to grow its overall portfolio size to $4.6 billion in the second quarter — a 21% increase year over year.

However, the company charged off $6.2 million in the quarter, compared to $4.2 million in the prior-year period — a 47% increase. That was not paired with a dramatic rise in recoveries, which brought $500,000 back to the balance sheet, up from $400,000 the year prior.”

So the 21% YOY increase in portfolio size was not accompanied by 21% increase in losses. It was accompanied by a 47% increase in losses.

And this is a good business model…

My guess is that is the last good picture we’ll ever see of Mr Camp. If this passes the already dead mass media, who depend on advertising revenue, much of it from the automotive industry, will do whatever they can to get him out of office.

Never mess with a man’s income, especially if you depend on that man for yours.

It’s incredible that no legislation, no matter how bad, is ever repealed. Someone will put a band aid on it in the future to make it even worse, and so forth. A couple of recent examples are that President Trump and a Republican majority couldn’t touch the ACA, and they won’t be able to change the tax code either.

My favorite example of unintended consequences concerns the mobile phone. When we had flip phones, we tapped furiously with our right thumbs with the phone at steering wheel level so we could see.

But then, that became illegal.

Now, we hold smartphones down where they can’t be seen, texting on a keyboard that’s nearly impossible to use accurately with one hand and without looking.

Another bill written by big businesses to shut out the little guys.

Lame but not surprised.

If they wanted to curb “reckless” ads, restrict only large companies with big ad budgets. But of course that’s not what they want.

The worst car dealers are the big group ones. Some places there aren’t any little guys left (at least selling new vehicles).