Just before the Titanic went under, the rear end went up higher – possibly giving those in that end of the ship a false sense of buoyancy. Those who leased a car just before “COVID” hysteria spread across the globe are enjoying something similar.

When the supply of new cars began to dry up in the wake of new car factories and dealerships being closed up – an artificial shortage magnified by the also-artificially-induced shortage of the microprocessors or “chips” needed to finish making new cars – the market value of the cars already in people’s hands went up rather than down.

Desperate-for-inventory dealers were offering to buy people’s used cars for more than what they would have sold for in the used car market just before “COVID”- and then offered them for sale for as much as what they sold for when new.

This, of course, further drove up the asking prices of used cars, resulting in the heretofore-never-happened-before phenomenon of used vehicles appreciating in value.

This was bad news for anyone who wanted to buy a car, new or used. But it was very good news for people who were looking to sell a vehicle they’d bought before “COVID.”

And if you’d leased a car just before “COVID” – in air quotes for the same reason that, per the rules of grammar and style, one puts the title of a play inside quotation marks – you were in luck, too.

Instead of being under water to the tune of several thousand dollars by the time the lease expired – which was a common thing before “COVID” because of the increasingly unfavorable ratio between record-high new car prices at the beginning of a lease and the expected depreciated value at the end of the lease – many lucky leasers discovered they had thousands of dollars in equity in their leased car. They could purchase the car for a price negotiated before the market value of used cars went up like the stern of Titanic. That price – based on expected depreciation, pre-“COVID” – was often thousands less than what the vehicle could be re-sold for during “COVID.”

Many saw an opportunity to make some money, for once – and bought their leased vehicle at the pre-“COVID” agreed-upon depreciated price in their lease contract and them promptly sold it themselves at a “COVID”-inflated price.

According to industry analyst Jeremy Robb of Cox Automotive, “Lessees of 2018 models hit the jackpot, with a positive equity that reached as high as $9,705 in late 2021 and averaged $5,516 for the year.”

He adds that “Leased vehicles from the 2019 model year have averaged $7,970 in positive equity in 2022 through the week ending Nov. 12″ and that “Three-year leases of 2020 models maturing in 2022 have averaged $8,536 in that time.”

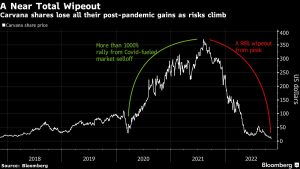

But those times are coming to an end – because they were artificial and for that reason, temporary.

The supply of new vehicles is improving. This makes it harder to sell someone a 2-3-year-old vehicle for about the same price as a new one. There is also the cost of money – interest – to consider. It costs more to finance a vehicle now than it did, pre-“COVID” – and the cost of money on used car loans has always been higher, because (historically) there is less equity in the thing to start with and for that reason the unhappy nexus of owing more on the loan than the car is worth – being under water – arrives sooner. Loan-issuers are well aware of this fact and so charge more for money (interest) to make sure they make money, rather than lose it – when the person making payments realizes he’s under water and stops making those payments.

Robb says equity in used/leased vehicles is on the downward slide now, as is natural. Very much as happened to the back-end of Titanic once a sufficiency of sea water had displaced the buoyancy-providing air remaining in the still-afloat portion of the ship’s hull.

This is very bad news for people who bought into a lease – or bought a new vehicle – over the past year or so. It is probable they will shortly find themselves very much under the water.

Possibly as deep below the water as Titanic is, today.

But this is potentially very good news for those who didn’t buy – or lease – a vehicle during the past year or so. They may soon find unprecedented deals on both used and new cars, the prices of which may soon collapse as depreciation replaces appreciation and a possible glut of dumped leased vehicles and repo’d vehicles (whose former owners stopped making payments on them) floods the market, increasing supply at just the moment when demand has slackened . . . because so many people can no longer afford to buy/lease car anymore, on account of the increased cost of everything else – in tandem with the decreased purchasing power of whatever money they have left.

This will put those who do have money – and don’t need to borrow it – in the catbird seat.

. . .

Got a question about cars, Libertarian politics – or anything else? Click on the “ask Eric” link and send ’em in! Or email me at EPeters952@yahoo.com if the @!** “ask Eric” button doesn’t work!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

I think the 3.8 may even be a better engine than Ed Coles small block Chevy.

Hi Justina,

It’s certainly a contender. One of GM’s best engines. It’s a shame it’s no longer in production…

Something taking a swim….your tax dollars in FTX…….

The first article, The Keystone of Corruption: Ukraine and the FTX Scandal, lists what it considers to be key facts about the corrupt activities of FTX:

1. Tens of billions of U.S. dollars have been funneled to Ukraine

2. The money was laundered through FTX

3. The laundered money now in the form of FTX cryptocurrency was funneled back to Democrats and the Bidens

4. All of that money is now gone and FTX is bankrupt

5. FTX gave at least $40 million to Democrats in advance of the 2022 midterms

6. FTX funded congressional campaigns for members overseeing the Commodity Futures Trading Commission (CFTC), [oversees regulation of the cryptocurrency industry]

7. FTX’s ex-CEO Sam Bankman-Fried aggressively lobbied the CFTC

8. FTX is currently under investigation by the CFTC and the Securities and Exchange Commission (SEC)

9. The investigation was opened after Bankman-Fried allegedly moved $10 billion in client assets at FTX to his trading firm Alameda Research

10. A liquidity crisis at FTX caused the company to file for bankruptcy

11. FTX is directly involved with and related to Ukraine

12. In March, the Washington Post reported that Ukraine was dealing in cryptocurrency

13. The Ukrainian government gathered more than $42 million in cryptocurrency donations

14. Approximately a week after Ukraine gathered the cryptocurrency donations, FTX engaged with Ukraine

15. Respective to the Russian invasion of Ukraine FTX/Sam Bankman-Fried formulated a cryptocurrency donation project in Ukraine

16. Bankman-Fried announced that FTX would support the Ukrainian Ministry of Finance and other communities in collecting cryptocurrency donations for the nation

17. The Ukrainian government has received over $60 million in cryptocurrency donations globally

18. Bankman-Fried cited humanitarian aid and access to global financial infrastructure as causes

19. Bankman-Fried indicated that cryptocurrency exchanges should enforce sanctions announced by the government

20. Bankman-Fried was the #2 donor to the Democratic party; George Soros was #1

21. The money laundering circle was: Democrats vote to send funds to Ukraine, Ukraine invests in FTX, FTX cryptocurrency was funneled back to the same Democrats

https://politicalmoonshine.com/…/the-keystone-of…/

The Keystone of Corruption: Ukraine and the FTX Scandal

Coffeezilla interviewed SBF sam bankman-fried of the FTX scandal….

Its bad when a youtuber is doing more journalism than the New York Times. Coffeezilla is keeping real journalism alive right here on YouTube

It’s incredible how quickly he goes from genius wiz kid to incompetent buffoon the second he actually gets asked detailed questions

It’s so awkward to listen to him struggle to respond to pretty basic questions.

https://www.youtube.com/watch?v=AfmBdKoqq1o

A Grand Unified Theory of the FTX Disaster

The money laundering circle was: Democrats vote to send funds to Ukraine, Ukraine invests in FTX, FTX cryptocurrency was funneled back to the same Democrats

https://roundingtheearth.substack.com/p/a-grand-unified-theory-of-the-ftx

Wolf Richter put up an interesting article today about what a Ford truck costs:

https://wolfstreet.com/2022/12/05/1768-a-month-with-10407-down-5-apr-on-a-ford-pickup-update-on-q3-new-vehicle-finance/

“To illustrate the data we’re going to look at in a moment, I “built” a 2023 model year F-250 Lariat on Ford’s website: MSRP $104,070. I could build something more expensive in the F-350 lineup. Ford suggested to finance it with Ford Credit. With a down payment of $10,407, and a term of five years, at 5% APR, I would end up with a monthly payment of $1,768.”

“I also “built” a 2023 F-150 Lariat, and it ended up with an MSRP of $90,780. Ford suggested to lease it from Ford Credit with $9,014 down, over 48 months, for $1,007 per month.”

—————–

Who in hell has that kind of money to throw around for a depreciating asset? The truck payments are on par with a house payment. Houses generally go up, and vehicles go down.

https://caredge.com/ford/f-150/depreciation

https://www.autopadre.com/static/depreciation_curves/ford-f-150-depreciation-curve.webp

And full size trucks do not get very good fuel economy.

https://www.fuelly.com/car/ford/f-150

Note how real world mpg is far below the EPA estimate.

https://fueleconomy.gov/feg/bymodel/2022_Ford_F150.shtml

The EV trucks burn more fuel then the ice trucks….lol

These new EV’s burn way more fuel the ice vehicles….lol

2022 Ford F-150 Lightning Platinum 4WD Automatic, curb weight 6855 lb.

fuel economy combined = 66 mpg.

The trick is they always quote mpg at the wall plug, to green idiots electricity just comes out of a wall plug, end of story.

In the real world the reality is different.

NOTE:

Thermal efficiency of power plants using coal, petroleum, natural gas or nuclear fuel and converting it to electricity are around 33% efficiency, natural gas is around 40%. Then there is average 6% loss in transmission, then there is a 5% loss in the charger, another 5% loss in the inverter, the electric motor is 90% efficient so another 10% loss before turning the electricity into mechanical power at the wheels.

33% – 6% – 5% – 5% – 10% = 25% efficiency for EV’s. In very cold weather EV’s are 12% efficient

EV’s are 25% efficient, so at the wall plug 75% of the original source of energy (coal, oil, gas, etc.) has been lost, wasted, so you have to look back at how much fuel was actually used.

EV pushers lie 24/7 about this quoting fuel economy at the wall plug, they think electricity comes to the wall plug magically, they are insane…lol….

2022 Ford F-150 Lightning Platinum 4WD Automatic fuel economy combined = 66 mpg. To get the real fuel economy just divide by 4 = 16.5 mpg

test drivers got 54 mpg divide by 4 = 13.5 mpg

but that is in ideal conditions, in really cold conditions it is half that = 7 mpg.

Claimed range 230 miles. That is in ideal conditions, 30 mph, flat road, no wind, 70 degrees out, no accessories on, AC, etc…

but you are supposed to use only 60% of the battery capacity…60% of 230 miles = 138 miles range….lol….

138 miles in ideal conditions driving slowly with no accessories on, AC, etc… on a flat road…lol

Another problem because of lithium fire bomb battery fire danger they are recommending only using 60% of the battery capacity, don’t run down battery below 30%, don’t charge over 90% because it can damage the battery and it might catch fire and burn your house down….lol.

Towing 6000 lb range drops to 85 miles.

At WOT wide open throttle range drops 90%.

Compared to a new ice truck:

2022 Toyota Tundra gas ice curb weight 5798 lb. V6 turbo 389 hp fuel economy combined 23 mpg

EV pushers lie 24/7 about this quoting fuel economy at the wall plug, they think electricity comes to the wall plug magically, they are insane…lol….

It does in a sense, nobody cares how much fuel was actually burnt to charge the EV….it is subsidized at below production costs through a government run utility, paid for by ice vehicle driving taxpayers, who also subsidized the purchase price of the EV with their tax dollars, they also pay for the roads used by parasitic lithium fire bomb EV drivers, they pay nothing, they are free loaders.

95% of lithium fire bomb batteries are not recycled, the biggest ecological nightmare in history, brought to you by leftist/communist/globalists.

EV’s and hybrids are starting to get banned in underground or above ground parking, if you see one parked report it……lol

All the most important components in the new EV’s are all made in china. low quality = fire hazard.

There is many very serious, dangerous problems with EV’s the public was never informed of, EV’s were just jammed down our throat, by telling lies about them 24/7, disinformation and disinformation….lol…..they think people are too stupid to figure it out….

Think or swim, isn’t that what they say?

Ford was under five dollars per share in 2019. It is 13 USD today, has a 60 cent dividend. Ford has deep pockets, did receive some money a few years back from Uncle Sam, needed a helping hand. So did GM and Dodge.

After Christmas, the market will drop some, it’ll be time to buy to gain the dividend from Ford, it’ll pay something. There are tickers on the exchanges that pay a good dividend and not at a high price to buy in.

The DOW index is not necessarily an indicator. John Deere was 26 USD per share during the GFC, ca. 2008/09. Deere is 437 USD today. Deere went global. Nothing runs like a Deere.

Ford stock purchase to gain the dividend is the only choice when banks pay maybe one percent on savings. Ford has been around a long time, can’t argue with success. Better than a bank, it seems so, anyway.

GE’s locomotive division should keep them alive, provide the life support. Westinghouse Air Brakes is all in on GE locomotive.

All investments in wind turbine development need to be abandoned, the energy gained is useless, all feckless attempts to go GreeNazi don’t work. Shut it all down. Bird and bat choppers that kill trillions of bugs is pure lunacy.

Maybe a few ocean installations, nothing on land masses, too invasive for human well-being. Tear down all wind turbines that cause humans to suffer. Save the raptors, bats and bugs!

Klaus wants everybody to eat bugs, there’ll be a bug shortage, you’ll still starve. 25 billion chickens living on the planet at all times can eat bugs, they’ll be fine.

Termite ecosystems are expanding, termites are increasing in population, termites also produce methane where they live. Termites have the habitat to survive in huge numbers.

They’re killing the planet! We need a termite pogrom!

The solution is to eat the termites to control the termite populations on earth. Send in the chickens. Send in Klaus and Justin and all idiots in the WEF. They can eat termites, be good for them.

Capture termite methane and you’ll be swimming in gopher gravy.

Just because Klaus wants you to eat bugs doesn’t mean you will.

You can train a horse for polo, you can train a horse to pull a plow, you can lead a horse to water but you can’t make him drink.

You can fill the bit bag with bugs and the horse will give you a good hard kick in the teeth.

You have to realize that Klaus is not all that sharp of a tool in the shed. Klaus spouts complete nonsense, not worth listening to the nut so don’t.

Rambling is over.

Nissan is under seven dollars per share, in 2012, Nissan was 20 dollars per share and paid a dividend. A CEO did some shenanigans and the price has suffered ever since. Another fall from grace.

It happens, happened to a utility in Kansas, you can buy a stock for a bargain when the idiot CEO did something stupid.

Buy stock in a corporation that any idiot can run, because eventually any idiot will. When they do, the stock will probably tank, time to buy.

It’s a funny old ride.

we lost prolly 10 million units of production. it will take time for the market to adjust.

Like everything else. Your mileage may vary.

My wife ordered a new Macan S back July. After a few missed dates it showed up at the dealership with our name on it. The price has grown a bit since we ordered it and the dealer now wants to buy it back for $5500 more than the price we locked in back in July.

There may not be new Porsches out of Stuttgart for a while.

Thinking of flipping it.

So the dealer will cut you a check for $5,500 to NOT go through with buying it? TAKE THE MONEY.

The Bubble Economy’s Credit-Asset Death Spiral

Who believed that central banks’ financial perpetual motion machine was anything more than trickery designed to generate phantom wealth? Once the death spiral reaches its devastating end-game, the true believers will have fallen silent…”>

Keep effective interest rates near zero, pump the stock and housing markets with TRILLIONS of vapor dollars and the lemmings will borrow and spend. They in effect, used debt to buy themselves jobs.

The government did the same, easy Fed $$ and spent with limitless debt, now over $31 TRILLION. The debt-ridden fools bought boats, cars, RVs, McMansions, I-Toys, etc. and now the f***ing bills are coming due!

Expect TRILLIONS more government debt to send out emergency stimmy checks as the Ponzi unwinds fast and furious. This was all preventable but the disgusting DC politicians (both parties) had to kick the can again and again to buy votes and get re-elected. Sad ending to the party and the hangover will be bad.

https://www.zerohedge.com/markets/bubble-economys-credit-asset-death-spiral

Attacking the poor people, starving them out ……while creating asset growth for the .0001% billionaires

The multiple global crises we are facing have led to a decline in real wages.

“It has placed tens of millions of workers in a dire situation as they face increasing uncertainties,” ILO Director-General Gilbert F. Houngbo said in a statement, adding that “income inequality and poverty will rise if the purchasing power of the lowest paid is not maintained.”

While inflation rose faster in high-income countries, leading to above-average real wage declines in North America (minus 3.2 percent) and the European Union (minus 2.4 percent), the ILO finds that low-income earners are disproportionately affected by rising inflation.

As lower-wage earners spend a larger share of their disposable income on essential goods and services, like food and energy, which generally see greater price increases than non-essential items, those who can least afford it suffer the biggest cost-of-living impact of rising prices.

https://www.zerohedge.com/personal-finance/global-wages-take-hit-inflation-eats-paychecks

Attacking the poor people, starving them out …..in one G7 country MAID medical assistance in death is being offered to poor people that can’t afford food, housing and energy….they want to get rid of the useless eaters anyways

Cull the herd, stage one injections, stage 2 lack of affordable food. Can you survive the next stage? Uncle Klaus has new stages planned until we meet Uncle Bills population reduction, er climate change goals.

The Titanic up ending is an interesting way of looking at the finance economy having a heart attack. The question everyone asks, when will it all end, or will it every end.

Lumber prices also went through wild swings in the last two years. Lumber is probably one of the most non-volatile commodities, boring to trade, but it went through huge price swings in the past 2 years, here is a chart:

https://i.imgur.com/ddkAwpK.gif

Normally, lumber is worth $200 to $400 for a thousand board feet of it. But the Covid hoax caused an artificial shortage of supply during the last blow off wave of the housing bubble. The result was a wild ride up to $1700 down to $450 back up $1500 and now back down below $400.

I figure that was the last heart attack before the flat lining – because now as interest rates skyrocket – I expect them to climb right back up to the 1980 highs then go higher – housing prices will go down – this will kill the speculation in the flipping market and the institution investors who were buying whole subdivisions to rent to people who should be buying.

The housing market had become a financial instrument to beat inflation, not a home to live in, but something you occupy to flip or drain equity to buy a new overpriced new car. Hopefully the financial mania is over and things settle down.

Where did all this money come from to push car prices to the moon? Who in the hell has $75,000 to buy an electric car or big SUV or an F-150? Prices are ludicrous. Interest rates have been going up, and most people finance their cars, so that means as rates rise they can afford less of a car. I suspect people have been borrowing home equity to buy food and cars.

Then we have the Fed which jacked up the Money Supply M1 by a whopping 16 trillion, and this new money has ignited inflation:

https://fred.stlouisfed.org/series/M1SL

The general consensus that Fed pivot is imminent is wrong, maybe way wrong.

blob:null/9203f389-a76f-4da8-a114-282bfa3f98fd

Thus the Fed is going to be fighting inflation for the rest of our lives, more money was created in the last 2 years than in the history of the nation. There will be no pivot, pivot is history, Powell is going to raise rates and keep raising rates like Paul Volcker did in 1980.

Link corrected:

https://i.imgflip.com/73a1bm.jpg

Used car prices will rise again! Demand will increase when buyers recognize how relatively undesirable new cars are becoming.

Fewer will put up with such annoyances as built in spyware, fragile, frivolous techno baubles, and the extreme cost associated with replacing hybrid or E V batteries….or twin turbocharger systems. The Status of driving a new car will be replaced by Stigma.

So don’t be stampeded into selling too soon by doom and gloom articles. Your 1995-2015 Toyota or Honda has a better upside than Apple stock.

Eric,

No need for that fossil fired car in the new 15 minute city “they” have planned for you.

https://iowaclimate.org/2022/12/03/oxford-2024-climate-lockdowns-start-you-will-be-tracked-and-trapped-in-your-suburb-and-happy-about-it/

Anon

Hi Anon,

Yup; saw this – Panem in process, again. I hope more people begin to see – and understand – what they have in store for us.

I’m wrapping up my late wife’s estate (such as it was). Kia Finance was horrible to deal with. The local Kia dealership was wonderful. I felt lucky to be offered the payoff amount –which was about the same as the KBB value. They needed inventory & I wanted rid of it, so it was win-win. The local dealer finance bubba said they’d make around $1500 on it; I asked if it was worth it. He said not really but they still needed used inventory so was willing to take the risk on a potential loss leader.

Too many have financed their lifestyle with debt for far too long, public and private. The interest is coming due. Debt, and the shuffling thereof, has become the primary product of the US. Financial “products” instead of real products. We’re living in a land of make believe. Trying not to let it show.

Ah, yes, it is true, Mr. Kable.

I’m so happy to have fled that rat race. No payments on vehicles, houses or any other property. Only service payments (internet/phone), and there are fewer of them. No more indentured servitude.

I only wish I would’ve arrived here sooner.

Also, I share your disdain of calling these financial shell-games “products”. Poppycock.

BaDnOn,

You left out taxes. But they pale compared to debt. As do your service fees.

And with the appreciation of used auto values, those who owned their autos and kept them got walloped on property taxes unless localities adjusted the rates. And even then, you still paid more than the year before! There should be a law that requires Vaseline packets to be included in every tax bill sent out!

Hi Allen,

Yes – and that’s exactly why I have kept my ’02 pickup and entertain thoughts of keeping it indefinitely. I could rebuild the whole thing on the “down low” and it would still be considered a 20-year-old truck. This latter is why – per my earlier column – I have thought about maybe putting a V6 in it, eventually – so as to be able to use it to pull a 5,000 or so pound trailer. I’d rather just buy a Taco – but I am done with paying these SOBs every time I pay for something.

A 3.3 V-6 like the one that would fit your truck goes for $4,344 on JEGS. Good investment and even has a warranty!

Hi Dr. –

When the times comes, I’m thinking more along the lines of a carbureted (or TBI’d) GM 3.8 V6. These are superb engines. Simple, strong and reliable.

Heh. I have two series three supercharged ones sitting in storage waiting for the right project. A very good choice. I think the 3.8 may even be a better engine than Ed Coles small block Chevy.

Eric,

Oh yeah? Think I could get one in my S-10 if the current 4-cyl goes? Probably won’t, though. I learned from a certain libertarian car-guy that that 2.2L is quite durable and long-lived.

Hi BaDnOn,

The 3.8 ought to be an easier fit in your S-10 (being a GM vehicle). It may even bolt in with the right mounts. It’s a pushrod engine, so not obnoxiously wide (an issue in a compact truck). And it’s easy to use a carb’d set-up with it, too as the engine dates back to the ’70s…

> The 3.8 ought to be an easier fit in your S-10

The 4.3 would be even easier, given that they were a factory option since 1988. I had one for a few years in an ’02 S-10, and my father still has one in an ’02 Blazer (and had another in an ’88 Blazer before that). Early ones were TBI, but you could probably find an aftermarket carb for it if you’re not handy at wrangling angry pixies.

At least you can do that in your rural county in VA. If the original engine is getting tired, Eric, I’d pull that trigger sooner than later. What you don’t have control over is the smog requirements, and aren’t you a tad close to Roanoke? If the EPA expands the “smog attainment area”, it could take in your home, and you’re out of luck to drop in whatever plant you want.

In the once-great state of Cali(porn)ia, it doesn’t matter where you live, even if you were, say, in sight of Mount Lassen in the rather sparsely-populated areas north of Tahoe. You COULD, in theory, do an engine swap for a different plant, but you’re subject entirely to the whims of the inspector in so doing. My #1 son and I have run into this in restoring a 1966 Plymouth Fury, while eventually the 318 Poly “boat anchor” will get a complete rebuild, for now, we’d make do with a 360 LA engine liberated out of an ’85 Ramcharger. Since a related engine (the 273) was available on 1966 Dodges and Plymouth (not the full-sized models, though), we’ve been able to make the case that it’s enough like what the ’66 would have featured. However, it’s taken quite a bit of wrangling to convince the smog inspector that the ’85 engine should not have to have EGR, OSAC, and not be equipped with a “Lean Burn” carb (it’s getting an Edelbrock aftermarket), but at least, by yanking it out of that Ramcharger, which was NOT required to have “cats”, we don’t have to retrofit them to a vehicle produced ten years prior to the first ones! Never mind that the USED 360 engine (it’s quite strong) with a fresh carb is CLEANER on emissions than the original ’66 ever could be!

I wonder if the existing trans is the same for the 4-cyl and V6? if so, would be pretty easy swap. Might get lucky and find one in a boneyard?

And you probably could get all the mounting hardware right from Nissan. Of course, all the cabling, could be an issue.

OR maybe you get lucky and trade the whole truck with someone who has a V6 for your 4-cyl., ya never know.

Hi Chris,

I think, in the end, swapping a GM 3.8 would be easier because it could be done without any computer crap. Just gut the existing stuff and run the 3.8 conventionally, with a carb or a stand alone TBI. I think the 3.8 has the BOP bellhousing, too – and so a non-computer-controlled GM TH350/TH2004R would bolt right up. I think this engine was also offered with a manual, too –

that engine is one of my favorites. I had many, and a couple supercharged versions as well.

Hopefully you can make it work. Best of luck.

Wish I was closer, would be fun to help you with it.

I think if you lay your hands on a vintage Buick 225 V6 (more of them went into Willys Jeeps than Buicks) you’ll find that the bellhousing will bolt right up. Still plenty of performance parts for that particular engine.

Allen,

And perhaps a battery operated conveyance to insert them?

Vaseline is not healthy in body orifices, but there are a plethora of safe personal lubricants. Not that the Psychopaths In Charge are concerned with such trivial matters.

‘This is very bad news for people who bought into a lease – or bought a new vehicle – over the past year or so.’ — eric

Charlie Bilello of compoundadvisors.com, in his free weekly newsletter, echoes Eric’s comment, as it pertains to Tesla:

Tesla Flipping Is Over

Rising interest rates, increased production, and the contraction in the money supply is bringing to an end one of the strangest things we’ve ever seen in markets: car flipping.

You read that correctly. The demand for cars, particularly hot EVs like Tesla, exceeded supply by such a large extent that people were literally able to flip their new/used cars for a profit.

“Tesla owners are flipping their cars like houses” — LA Times, June 30, 2022

This was a reversal of the age-old principle in which a car was said to lose a certain % of its value the minute you drove it off a dealer’s lot.

We now seem to be reverting back to the old normal, and at a rapid pace.

The average price of a used Tesla is down nearly 15% over the last 90 days, $11.5k lower than the peak in July. Chart:

https://ibb.co/xJKJB7M

Oh, the bovinity!

Now look at them yo-yo’s that’s the way you do it

You flip the profit on your new EeeVeeeee

That ain’t workin’ that’s the way you do it

Money for nothin’ and your cars for free

— Dire Straits, Money for Nothing