ABS can only do so much.

After going gangbusters for the past several years, new car sales are skidding all of a sudden – and the industry might just end up in the ditch, again.

The reason for the power slide is easy enough to grok – the rising the cost of money – which is upticking alarmingly, if you’re in the market for a car.

About 14 percent of people who took out a loan on a new car last month are paying more than 10 percent interest – and the average interest rate is now well over six percent.

Which is higher than it’s been since – interestingly enough – about ten years ago.

Which was the last Time of Troubles for the industry, back in ’08.

People talk about the bailout, but that’s not really what has kept the industry afloat since then.

Low (and no) interest financing has worked like the injectable plastic and make-up embalmers use to make a corpse look like it’s just sleeping. They make it possible for people to buy more car than they can afford – and for government to impose cost-adding mandates that people think they’re not paying for.

It works like withholding. If you don’t see it, you don’t feel it. Or so the theory goes.

If there were line-items on new car window stickers listing the cost of every federal fatwa – plus a profit margin for the car company, which is part of what you’re paying for, too – people would notice and perhaps object. But the costs are folded into the overall price of the car – and the cost of that price is hidden, in turn, by low (and no) interest financing.

Thus, the average price paid for a car is now $36,534 – a number which ought to scare the skin off anyone who is tied to the car business in any way whatsoever.

Because of the other number.

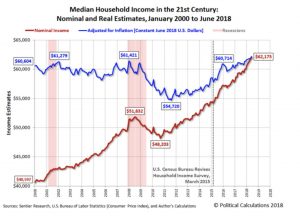

$61,891.

That is the current median household income in the United States. It is the gross – not after tax – median household income. And it is not after-mortgage/rent/utilities/food and Obamacare income, either.

Less federal and state taxes, mortgage/rent/utilities/food and Obamacare, the real median household income – the money available to spend on other things – is closer to $35 or $40k.

Even if half the people in the country were actually taking home $61,891 – and didn’t have to pay their mortgage/rent/utilities/food and Obamacare out of that sum – spending $36,534 on a car amounts to about 60 percent of their annual income.

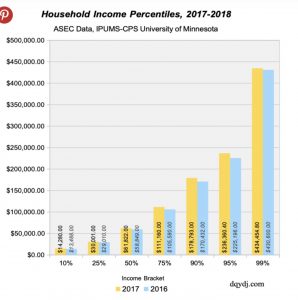

Much more for those making less-than-median income – which is half of the population, to the left of the median. The other half – to the right of median – makes more, of course.

But not enough more, as regards most of them.

Most home loans are kept to 28 percent or less of the borrower’s income. For car loans to be held to the same standard, the median household could not afford to buy a car priced higher than about $17,000.

Or – looked at another way – it would take an income of $130,000 to qualify for a car loan on a $36k purchase using the same standards mortgage issuers use for home loans. How many American households have incomes of $130,000 or more?

Fewer than 20 percent.

It is insanity – and it cannot be sustained – at least not without low (or no) interest financing – and that has apparently come to a screeching halt.

It has done so because of the inherently appliance-like nature of cars as opposed to homes and other things of enduring – or at least not axiomatically losing – value.

You stand a decent chance of building equity in a home. You are almost certain to lose the equity you put into a car. Put another way, the car loan not only leaves you with next to nothing to show for it at the end of it, you are now in the position of needing to take out a new loan.

And the new loan costs more now than the last one.

What will the next bailout be? Will Uncle “guarantee” – that is, subsidize/wealth-transfer – low (or no) interest rates on car loans, in order to prop up what has become an otherwise unsustainable business?

Perhaps owning a new car will become a “right,” like health care. The “logic” isn’t much different.

Doesn’t everyone, after all, deserve to have a car with eight air bags, automatic emergency braking, a direct-injected turbocharged engine and 10-speed transmission? Plus a 12-inch touchscreen and heated leather seats?

When the next crash comes – and you hear the sound of screeching tires and breaking glass – don’t blame the car industry. Blame Uncle – and people who can’t do elementary school arithmetic with regard to their personal finances.

. . .

Got a question about cars – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet (pictured below) in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a sticker – and also, provide an address, so we know where to mail the thing!)

My latest eBook is also available for your favorite price – free! Click here.

I dread the day I need to replace my vehicle. Never mind that it is paid for. The cost for a vehicle that loses its value the minute I drive it off the lot is bad enough-but then to pay upwards of $40,000 bucks for it? I do not want to buy a car with all the saaaaafety stuff on it. I do not want automatic braking, steering that prevents me from doing what I want. There is a reason why we play “Frogger” on some of the roads in this neck of the woods: They are crappy as can be, and playing Frogger, and dodging the dips and holes save your struts and shocks. I do not want some saaaafety feature kicking in, and deciding what I am “allowed” to do~~in a car I paid for! Never mind the speed controls and other crap. Are there going to be any newer vehicles that do not have this junk in them? Probably not, I imagine. Sigh, leave it to the government to suck the fun out of everything in life.

Hi Joe,

I am with you, amigo. My 2002 Nissan will be the newest vehicle I ever own. When it reaches the end of its life, I will replace it with something even older – and freer. No air bags, even.

Assuming, of course, I am allowed to.

Great living in such a free country, isn’t it?

Unfortunately, Eric, that is a very difficult proposition for people living in areas with lots of winter road salt. It’s possible to prolong the life of a vehicle by oil-based undercoating, but it’s impossible to keep it running forever (like in Cuba!) if you have to drive in winter.

My gross is $180K a year with a million in the bank. I drive an inherited 2003 Mazda tribute every day to work. When it dies, I guess I’ll walk the 10 miles or just stay home before I ever pay 35K for an f’n new vehicle let alone whatever the h they want for an EV. How can someone making 60K a year even think of paying 35K for a vehicle? Is there any greater waste of money than a new vehicle? Have we gone batshit crazy? Brazos has it right, mandatory vaccinations today, mandatory EVs tomorrow. God help you if you’re storing nickels.

Hi Top,

Ditto. I’m not rich, but I’m not broke – because I have never bought a new car and never spent more than $8,000 on a car, period. It’s the best financial advice I have.

I like new cars. I get them the way I want them (factory orders) and I keep them for a long time. I’ve bought exactly two new cars in the last 22 years. Used cars I never seem to overcome what the previous owner(s) did. I don’t think stretched over a couple decades my premium is all that much per year for the privilege. It’s the people who can’t have something more than couple years old that destroy their finances.

However a lot of my choice has to do with the chicago environment and what it does to cars. If I lived someplace easier on cars I would probably do differently.

Hi Brent,

Extorted insurance is my second highest fixed expense after the taxes I am forced to pay to be allowed to live in the house I paid for 15 years ago. I resent both exactions tremendously since they are both varieties of theft.

I don’t “owe” anyone money for not causing harm – which is what forced insurance is. And I certainly don’t “owe” anyone money for living in the house I bought and paid for.

How about a refund for decades of not causing harm? I haven’t cost the insurance mafia a cent; it has stolen tens of thousands of dollars from me.

Yeah insurance is probably and distant number two to taxes for me now. I doubt insurance even amounts to ten percent of taxes given the fact that the medical insurance from my employer isn’t really insurance*.

*Like many companies over a certain size it’s a medical benefit paid for by the company managed by an insurance company. There’s a payroll deduction but not any ‘premium’ paid to an insurance company other than whatever they charge to manage the benefit.

I am in total agreement with you Eric.

Thanks, Ronald!

We’re making progress, too. This site averages around 60,000 page views per month; pretty good for one guy with a laptop and a few crackpot ideas about freedom!

LYFT stock price is eating dirt since its IPO. Mega-Debt laden Uber about to file IPO.

Both have horrible EBITDA. Uncle Sam bailout soon?

As long as a central bank determines the value of the currency we are taxed every second of every day for the privilege of holding onto dollars.

1971 a dollar equaled 1/35 of an ounce of gold.

Today? 1/1300.

It matters not who you elect, or what policies are in place, the central bank holds ALL the cards in the deck now. Just prepare for the crash, best any of us can do.

Hi A,

Interestingly, the private banking cartel which manipulates the country’s fiat currency has kept the main interest rate “low,” but interest on car loans is going up regardless.

Maybe they are keeping the interest rate up on where many of us might wind up living, assuming the repo men don’t wind up adding to what will be a gigantic glut in the holding lots. If I were buying a vehicle today, I would make sure, as I have in my last 3 purchases, to buy something I could live in, even if I weren’t already doing so, since 1984.

One dollar invested in an index fund in 1971 with dividends reinvested would now be worth $1833.63 which outperforms your gold by over $500.

Gold is not really an investment. It’s more of a hedge. Depends on how bad things get whether it will do you any good. In a really bad collapse nothing will have value but food, medicine, and bullets. (See “The Walking Dead”.) Historically though gold has always been worth something and that’s difficult to argue with.

As long as you can cash it in before the market crashes.

Few were that lucky in the Great Depression.

Those who had gold and silver used it as cash with no loss of value.

An investment is of little use if it becomes worthless before you can redeem it.

Hedges don’t have such problems.

Tried to make a deal on a 2019 Sienna LE for the wife, just to see how eager they are for sales. They wouldn’t go any lower than $31,500. I showed them a couple of used 2018s with 10,000 miles on them in the $25,000 range. They just looked at me like a cow at a new gate. Needless to say they didn’t make a sale that day and I have since pretty much decided I’ll never buy new again; prices are ridiculous.

Toyotas are #1 selling brand in the US for cars and cuvs. I’ve noticed the same unwillingness to negotiate on used siennas.

My daughter had a Sienna and it had terrible electrical problems and Toyota would not fix it.

Problem finally solved when it got totaled.

Possibly off-topic but about taxes/fees/etc — the taxes & fees for my landline phone costs MORE than what the phone company charges for the phone service. And the taxes & fees go up at least once every 4 months or so. Can you imagine the astronomical amount of money govt is raking in every single month just from this one thing alone? Since when is the govt a part owner of the phone company? Isn’t this the same thing as mobster-ism?

Hey Krazy Harry! “Isn’t this the same thing as mobster-ism?”

No, this is absolutely NOT the same thing. First, the Mob does not have a national flag. More importantly, the Mob does not tell you it is for your own good when they break your leg.

Amen, Jason!

I respect the mob; its members are honest about what they are up to. They want the money. They don’t try to lecture you about how they’re “keeping you safe.” And – even more laudable – they don’t bother you about your personal vices, or everyday activities – whereas Uncle micromanages everything.

My Sicilian Grandmother said one time “the Mob is no different than the IRS”. Except that the IRS operates under the cover of law.

Hi Joseph,

Your grandmother was right! And the Mob has more integrity than the busybodies and control freaks who are the government; they steal but pretend they are just advancing the “public good.”

Thank you for clarifying this to me. Just thought of another thing the mob doesn’t do — mind control the public via TV & all other media outlets.

Eric,

WRT inflation and fiat money, I hate to tell you that gold and silver are NOT the magic bullet to cure all this. History tells us so.

Back in Ancient Rome, copper was seen as a precious metal, much like gold and silver today. In fact, copper was the basis of their money, the As. After all their empire building and general profligacy, Rome was having a problem PAYING for everything. Someone got the brilliant idea to reduce the amount of copper in the As, and inflation ensued.

What does that have to do with gold and silver? Folks always tell us that, if we just went back to the gold standard, everything would be hunky-dory; all our problems would disappear. Such is not the case. Even if gold and/or silver backed our dollars, they could still be debauched by inflation. How? Simply do something similar to what the Ancient Romans did: reduce the amount of gold and silver backing our dollars. Just as the Ancient Romans reduced the copper in the As, our leaders could simply reduce the amount of money backing our money supply. See how that works? Therefore, I submit that returning to the gold standard would do nothing to cure our money problems; all it would do is force our leaders to resort to DIFFERENT TRICKS to accomplish their nefarious aims.

I tend to agree. The price of gold and silver hasn’t moved in 10 years despite 4% annual inflation which includes jacked up housing costs in the last 5. The problem in the car industry is far too much regulation and cars that offer way too many standard “features.” The easy car credit allowed these costs to be hidden from view. If you look at the price of your average car in 1970, it was about $3500. In todays money, that’s about $23k. The average transaction price of todays car is well over $30k. All of that difference is government regulation and consumer “preferences.”

Customer preferences DEFINITELY figure in to the cost of cars. When I was a kid, cars equipped with air conditioning, power windows, and power door locks were considered LUXURY cars. Hell, even the AM only radio was an option at one time! Now, cars come with power everything and the factory stereo system is good. Then, count in the mandatory airbags, ABS, etc., and it’s easy to see why cars cost so much more now…

Like health insurance, every car is a Cadillac.

If you said ‘stripped model’ to someone under 40, they might not know what you’re talking about…

Just tell them to lookup “Studebaker Scotsman” on their dumbassphones.

Yesterday I read a 24 page thread on a jeep forum on basically “to Rubicon or not to Rubicon.”

It turns you can buy a JLU Sport with manual transmission, crank windows, and plain key locks for about $33K (not exactly cheap, but keep reading …).

So then someone counters with essentially “I’m buying the $50K Rubicon because even though I will never go off road I know that I can and besides I like the look of the Rubicon and it comes with a bunch of cool gadgets.”

Except when the coinage is debased that way people quickly hoard the older good coins. People learn to tell the difference between them.

I have checked my change for silver US coins since I was about 10 years old. Still haven’t found one that way. No problem finding the first year without silver, even now I’ll occasionally get one of those, but never the year before.

Got one (a silver quarter) as change out of a Coke machine last year. I heard the sound and knew immediately what it was! Real money is distinctive.

The look on the face and edging is different too, it even feels different in your hand. That high frequency ping will make your head turn when you hear it versus the dull thud if nickel zinc.

Hey: I collected coins as a boy and still do now to some extent. Big change was 1965, when the silver coins (dimes, quarters, halves) were replaced by copper clad coinage. So, you’re right, all the 1964 coins vanished. Boy, I wish I was around in 1964…. Same thing for copper pennies in 1981. By 1982, they went from 95% copper/5% zince to the other way around! (2.5% copper/97.5% zince) Check the pennies in your pocket. Ones older than 1981 still pop up, but are scarce. Melt value of a pre-1982 penny is just under two cents. There have been stories about people who have hoarded these pennies on an industrial scale. They are waiting for the laws to change which precludes them from melting them down. (Or exporting them for meltdown, as well.) At industrial scales, that would be a tidy sum.

So, you might be thinking, “Gee, I wish it was 1964, or 1981 again!” Well, you’re in luck b/c *it is*: as far as nickels are concerned. Their melt value, with 75% copper/15% nickel is about 4.1 cents, or about 81% of face value. All the other US coins have about 16% melt value, relative to face value. (Dollar coins excluded, which are at about 6%). There have been calls to change the nickels composition. (To make it more “profitable” to mint.) I’ve also read things that say it costs the Gov’t like 7.5 cents to produce and distribute nickels, and 3 cents for pennies.

So, it is 1964 as far as nickels are concerned. I have a few coffee cans full of them stashed away for my coin collection. I have read preppers sites that talk about having bags and bags of them. I see the appeal (since the nickel is cheap from a “precious metal” standpoint), but have not bought into that line of thinking. I just want to have a small stash for my coin collection. (that I’ll pass on to kids/grandkids)

Hello fellow Nickel hoarder. The $100 boxes from the bank are easy to collect.

I have a good many copper pennies and I hoarded some nickels when they were talking about changing the composition.

Nickels are the coins unchanged in composition since before the fed. Well except for those silver war nickels. But there’s no sense in complaining about those. They can be purchased cheaply at times because its not a desirable form of silver coin.

Nickels for awhile were worth more in metal than face. Almost double for awhile.

The problem is not using the actual gold and silver as money. If you do that instead of the paper substitutes created by the state then they can’t devalue your gold/silver. Lots of ways out there now to use the actual gold and silver instead of paper proxies. Transactions would then be done in verified weights and purity of real gold and silver instead of fiat dollars or digital entries in a computer system. You can’t have an honest economic system when the basis of all transactions is a fraud controlled by the elitist scum at the top.

It really has never been easier for a gold or metallic based currency to exist. Imagine we store money at our banks. I wish to purchase something from you, so I swipe my card in a machine that authorizes my bank to exchange this many milligrams of gold from my account to you. Your bank accepts the exchange. Done. No gold ever needs to leave a vault, it’s just known that “this many” mg of gold in my bank’s vault are now are yours. Your bank has a reciprocal storage agreement with my bank, paid for out of monthly storage fees paid by the depositor. Rolling audits keep everyone honest. Another option would be a blockchain register for the vaults. Not as efficient, but much more open and easier to audit.

Hi RK,

The thing I like most about hard currency is that it is under our control. Paper currency is under the control of whomever controls the printing presses.

It is not possible to print more gold or silver. It thus end-runs the banking cartel and returns it to its proper role as a place where money is stored rather than created ex nihilo!

Eric,

As the example of Ancient Rome shows, so-called hard currency can be debauched; only the METHODS are different. When Rome devalued the As, they simply reduced the copper content; they diluted the coins with other metals. With gold or silver based money, all one would have to do is the same thing, i.e. reduce the gold or silver content of the money; all they’d have to do is emulate the Roman example.

Hi Mark,

Yes, but that is easily remedied by eliminating a “national currency.” Instead, gold and silver as such, valued according to their weight. That can be frauded too, of course – but not officially/legally.

I don’t see the elimination of national currencies any time soon though. Plus, that begs the question: HOW will gold and silver be valued? What will be the standard of value? IOW, how will it be determined that an ounce of silver is worth ‘X’? What IS ‘X’? Is it in dollars? Is it in British pounds? Is it in Euros?

I guess my point was that, regardless of what money we use, it can be debauched; it can be made worthless. The only question is HOW, not IF. Ergo, what matter is the INTEGRITY of those administering the currency system in question.

Gold and silver have always been valued by those using them in transactions. The value of gold and silver is generally based on the price paid for either of them in whatever fiat currency is being used to buy them, just as it is now. The official price of gold is $35, but I doubt you’ll find anyone selling or buying it for that, because it is well below the cost of production.

You have to look at the deprecating dollar as well. For a real life example,,, In 1985 I earned a meager $40,000. Bought a new 1984 Olds Cutlass Supreme for $10000 @ 12% interest. That’a about 25% of gross. Today’s $62,000 median Income and a new car at $37,000 comes to about 61%. Course I didn’t get heated steering wheel, seats and,,, no precious, can’t do without, must have digital so I can text my pals rolling down the road. I could also work on this car even with the primitive ECU’s and it got me to work.

As an aside,,, I (we) lost earnings from then (1985) till now due to massive inflation. To earn the same buying power I would have of earn $97,000 today. I lost over $25,000 in earnings as my wages was about $72,000. So I lost 26% in wages and car prices doubled to 50% of my income. Which is why I am keeping my 98 Regal.

Those are not good numbers. We are being taken to the cleaners every day,,, yet not a peep from MSM. They rob you in taxes, fees, fines and inflation… and the numbers I showed are from their data which to put it nicely is probably skewed. (Nawwww) Today they laughingly say <2% inflation. From my digging I come closer to 10%. Eric is spot on saying we simply can no longer afford these machines even at 0%.

The Cutlass looked nice but with the smaller engine I called it my gutless cutlass.

Isn’t this why trump won. At least Trump pointed out the fact that the everyday us citizen is getting screwed with inflation, taxes, regulations and lower waged jobs.

Trump was a Hail Mary by the People…. It didn’t work. They fouled out…..

As opposed to your Hail Hillary?

Hi Bobster,

I don’t think that’s what he meant. I think he meant that populist anger against the political class was thrown toward Trump, which got him elected, and he failed to deliver. Ken, if I’m wrong, let me know.

Jeremy

That’s how I interpreted the ‘hail Mary’ statement too. How anyone could come up with a different interpretation escapes me…

And considering his whole empire was built on borrowing and praying for inflation to bail him out (and loose bankruptcy laws), no wonder we got a pig in a poke.

Hey ken! “I lost over $25,000 in earnings as my wages was about $72,000. So I lost 26% in wages and car prices doubled to 50% of my income.”

Which is exactly how the system is designed to work. In an interview some decades back, F.A. Hyek recounted a conversation he had with John Keynes, the architect of today’s monetary theory. Keynes explained that during World War One the combination of a British labor shortage and removal of the gold standard had combined to force a rise in the ratio of common wages as compared to levels of income for the elite. After the war, the elites (and Keynes himself was a British Lord) demanded that they once again have their traditional much larger slice of the economic pie. Kaynes developed his theories as a plausible but deceptive way to justify creation of inflation to drive up prices (and income to the elite) while wages (being nonelastic) would stagnate.

Feel like the top dogs are getting all the benefits of increasing technology and efficiency? Feel like all the fresh, new money is going to the 1% with political connections? Feel like you are working more and being paid less? You are right! The system is functioning exactly as planned.

Yes: The first ones in line for the money are the banks that are in the Federal Reserve cartel. (Cost to them = $0.00, face value $1.00) the further removed you are from the source the more the cost goes up to you. By the time it gets into the hands of the consumer that isn’t part of the Gov’t-Banking-Military Industrial Complex (GBMIC), the debasement of that currency has taken full effect. So the cost to you is $1.10 with face value of $1.00. The $1.10 is the true cost of inflation then, not the 2% that is always said to be the norm. Check out ShadowStats or Charles Hugh Smith’s “Burrito Index” to see what the real inflation is.

Nobody deprecates the dollar more than its issuer. Depreciation is another matter.

“Less federal and state taxes, mortgage/rent/utilities/food and Obamacare, the real median household income – the money available to spend on other things – is closer to $35 or $40k.”

That can’t be correct. That means only ~30-45% of income for the basics and taxes. That’s the big taxes alone in much of the country. The housing and food on top of that.

I just got pre approved for a 20k loan for a used car. We are looking at buying a low mileage awd toyota sienna. I emailed a guy about a 2015 model that had everything i wanted but it was listed for 24k. I low balled an offer to 20k seeing where we can meet and the guy flat out said no. I said stay in touch and he told me it was sold 3 days later. I never checked the listing to see if he was lying or not. I thought sales are down but these sales guys are acting like there is a line of people at the dealership begging to buy a minivan. I know i won’t be heading back to that dealership. I cant wait until the market crashes more. I think the used car market is still suffering from cash for clunkers. I’ve seen my same old van a 05 odyssey listed for 3500 on craigslist with 200k miles. I think it would 3500 just to make these things really road worthy. I know mine needs a new ac compressor, new shocks and struts, new brakes, calipers, and disc. I could do it but rust is having its way in mn as well.

Used car sales are “brisk” for the above article’s reasons.

1) Some used vehicles do not need to be marketed down.

a) not distressed merchandise.

b) not a “fire sale”.

c) supply and demand, with desirable vehicles being in low supply, and larger demand.

2) The used car market’s mark up on trades/suction buys are miniscule compared to yester-year. Why? The INTERNET. This is the single reason used car prices are kept in check.. Also, the net margins will not allow a $4000 “haggling”. Average mark up is $2000 net. Difference of $3000 with $1000 for reconditioning and repairs. Franchise lots must have used cars pass a “safety” inspection. B Lots do not – let the buyer beware.

Hope this helps explain things…

I know the internet keeps car prices pretty accurate and consistent but i believe they get the most money on their used car sales. Average newer/used car trade in is for store credit. Sales guy can accept the trade and then not tell the customer about regional factory rebates. It happens all the time. So they pocket the rebate and discount at a higher sticker price for the trade in and also throw in the dealer financing interest profit. There’s wiggle room for the used car market. They aren’t giving full market value for trade ins.

And most buyers aren’t making a down payment of any consequence. So to get those incentives and get them into a new vehicle they play with the trade in value, knowing that they can get it on the used market.

If Ram beats Silverado in sales a second quarter in a row or truck sales fall off double digits again yoy for Merry-Berry, heads will roll. Was at a Nissan dealer over the weekend doing a test drive on an Armada, 2019. Way too expensive new, but the dealer was offering $10k off EVERYONE OF THEM no matter the package. I brought up that the Q1 sales were down for everything but Armada and Rogue and if they would have incentives later this year. The salesman was like, oh that is only for this month man you have to take it now. No, I think not, you will be a lot hungrier later this year and will discount further as sales crash. We are secretly planning on buying used anyways, if even a new car is in our future as that reality grows dimmer each day. If no one is buying a traditional ICE with juiced loans NOW, who teh furk is going to buy an even more overpriced EV SUV monstrosity later? Vaccines are mandatory in New Yahk this week, maybe EV’s will be mandatory tomorrow.

All the Mfr rebates and Banks rates are month to month. He is correct. He has NO IDA what the two institutions will do next month let alone later in the year… Franchise Dealerships are contracted and beholden to Mfr rules. Without rebates and reimbursements, the dealers don’t have much of a say of mark up anymore..

Thats some sales bs. They don’t know what the next regional sales strategy will be by the manufacturer. Always trying to push you into buying right now.