Lots of advice online and everywhere else for teens and young people about buying a car. Here’s mine, which might be worth something:

Only buy a car if you can afford to pay for it.

Note the italics, which are there for a reason.

One of the worst mistakes you can make when you’re just starting out is getting into debt – for a car or anything else (including a college education). It isn’t accidental that just-graduated-from-high-school 18-year-olds are offered credit cards almost as soon as they set foot on college campuses. The idea being to chain them to debt as soon as possible and thereby forge a chain around their necks that can be yanked at any time. The kid sees the credit card as his ticket to buy stuff – which it is. He doesn’t see that he’s just sold himself in a way that isn’t materially different from the indentures people without means to pay for their passage to the New World signed 300 years ago – except for the fact that the indentured understood they’d agreed to be enslaved. They had literally signed the papers.

So have today’s indentured. Only they didn’t read the fine print.

It’s the same with cars as it is with other forms of debt. The lure being that which the borrower cannot otherwise afford. Which, of course, is evidence that he cannot afford it.

Cash – and debit cards, which are essentially the same things – serve as a way to avoid financing what you cannot afford. When you have $100 in your wallet – or left in your debit account – you know that is all you have available to spend and so you spend accordingly.

The best advice I can offer a person in their teens or young 20s who is thinking about their first car is to base their decision similarly. The car you can afford is the one you can afford to pay for – when you buy it. If that means a $1,500 car then that is the right car to buy.

It will, first of all, be entirely your car. At least insofar as that is possible in what’s no longer a free country (notice that phrase is never said by anyone anymore). You will still be forced to pay for the state’s various permission slips, including what are styled license plates (i.e., ear tags, just like the kind cattle are forced to wear) as well as registration and inspection. But you will not have to pay a lender. You will not be paying interest on a loan, either. That means you will be paying yourself – plus interest – each month that you do not make a payment to a lender.

As a thought experiment, add up what you would have if you were not obliged to pay say $300 per month every month for a car payment over the course of just one year. You would have paid yourself $3,600.

Even in our times, that’s still not small change.

Now multiply that by say six years – the duration of the average new car loan. You will have paid yourself $21,600 – a sum sufficient to pay your living expenses for a year, without having to earn a cent. That’s a nice cushion to have, isn’t it?

You will also not have had to pay full-ticket insurance on a vehicle you’re making payments on – which the lender has every right to require you to comprehensively cover, since the lender will be the one who loses if you total the car you’re still making payments on. The difference in payments there – for the full coverage policy vs. a bare-minimum (liability-only) policy on a car that has almost no value – except to you, its owner – can commonly be another $100 per month you won’t be paying someone else.

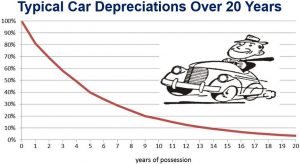

And you won’t be paying for depreciation, either. A $1,500 car you buy today will likely still be worth $1,500 in three years, assuming it’s still in driving condition – which it probably will be. A $30,000 new car financed today will be worth maybe $20,000 three years from now.

That cost you $10,000.

Will there be expenses to pay – as for repairs and needed maintenance? Yes, of course. It comes with the cheap car territory. But there is a crucially important difference. Those payments are irregular – and since you haven’t been paying regularly every month for the car, you will (if you were smart and saved what you did not pay) be able to pay for them. In cash.

Don’t allow yourself to be controlled by the fear of risk. It is part of life. And it should not be the central organizing principle of life. When it becomes that, you spend your life fearing risk and paying an extremely high price. One that is measured in much more than just money.

They – the people who do not have your best interests at heart – want you to be afraid, of everything. Of a car problem that will almost never be more of a problem than being in perpetual hock, to them. Of getting sick – even when you are young and healthy and it’s unlikely to be anything you’ll need “health insurance” to “cover.” Of people who ask questions – and expect answers.

When the thing you really ought to be afraid of is the people who want you to be afraid.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Keeeeeeev T shirt pictured below, you can find that and more at the EPautos store!

I helped my youngest son buy a used car. We found a dealer who sells used police cars.

These are usually built with heavy duty cooling systems, Hi-performance brakes and engines with no engine governor. This was a 2013 Chevy Impala with 35,000 miles capable of 150 mph and acceleration of 6.1 sec to 60 MPH. These are sparsely equipped cars as the seats are made of plastic and there is no carpeting on the floor. This one was bought about 6 years ago for about $13,000. A little pricey I admit but it is Hi-performance with gas mileage of 18 city and 28 highway using regular gas.

The only suggestions I have is to make sure you don’t get the patrol type vs the administrative type vehicle as the patrol cars may have a lot of engine idle time.

The first used car was a 2007 Chevy police car that was totaled while parked. Some drunk mexican about 2:30 in the morning crossed over the median and caused about $8,000 damage. He had no insurance and the car was his uncles. The Police arrested him because he was drunk and dazed after the crash and unable to fully recover and run away. Oh well that’s life in the big city. At first the insurance wasn’t going to pay because my son only had liability and Comp and not collision. But they finally gave in and gave him about $4,000.

Buy something older that is analog, simple and easy to work on, get something you can work on yourself….and buy a vehicle that you can still get parts for, or there is a source of used parts, if millions of a vehicles were sold, there is a chance there is used parts somewhere still available, make sure there is a mechanic nearby that can fix the things you can’t fix. Get something that has a good track record for reliability…

I like the older VW’s.

Sometimes you can buy cheap cars from towing companies….they end up owning cars because people can’t pay the towing and storage fees….

A few years ago I’d agree. Now, look around – the country is being looted, illegals are invading… I’d advise the young to splurge and enjoy life before the dollar and the US collapse.

Hi Ben,

Sadly, there may be something to what you say. Being responsible in an irresponsible time is almost a kind of self-flagellation. I sometimes wonder why I get out of bed at 4 and work every day when I could just go get an EBT card and some lobster sushi, then hit the medical marijuana shop and get some gummies for “free” using my “disability” check and go watch a few hours of YouTube videos…

Excellent advice.

Also, find a good independent mechanic. It’s astonishing to me how ridiculous some of the repair shops are. I took my wife’s VW to a place in the neighborhood (not the German independent that I usually use). The came back with thousands of dollars of things that the car “needed”. The next time I brought the car to my guy I specifically asked him to check several of the “critical” items. I’ll bet y’all can guess what happened.

Sad to say, it’s not just young people who need this advice.

The most insidious example is the Rent-A-Center model.

The interest = principal x rate x time formula does not register with young & old alike. Having not understood this simple formula, they end up paying 2x, 3x, etc for a freaking appliance or pressboard furniture.

I get it, Rent-A-Center fills a market need for people with bad credit and who are at high risk of not paying their bills. But it perpetuates the enslavement vis-a-vis credit based economies.

My advice to first time drivers is to to buy a cheap car because it’s highly possible that you will crash it, break it or do something else stupid to it. This way you learn a valuable lesson for say $3000.00 instead of $35,000.00.

Once you buy it go with the severe maintenance schedule as oil and fluid changes are a lot cheaper than engine, tranny and differential repairs or replacements.

Also never forget that “A penny saved is a penny earned multiplied by taxes paid”, that penny might have involved 25% taxes to save!

Hi Eric,

Good advice. This applies not just to cars, but to everything else, too. Don’t go into debt, period. Otherwise, you lose your freedom.

Thanks, Yuri!

Also, see today’s latest about the EV retreat. Time to finish the job, now. As the Confederates ought to have at first Bull Run.

I agree with that but we are sooner or later gonna be displaced by people who system favors aka people with debt. Until the system is completely broken they can pick winners and loosers. Before it didn’t matter unless you wanted to be recognized and have all the right gadgets but now they are going for basic stuff like housing and land. They dont let you buy land or they dont let you build on it they own the money printer. They make basic necessities more costly and illegal / hard to produce yourself so their money has more power.

This is wise advice. Do not go into debt for depreciating assets.

My first car loan, for $7000, was in 1983 at 10.5% interest and resulted in $250/mo car payments for three years. My rent payment was $285/mo. I had only $25 per week for “entertainment”. Made dating difficult.

‘the thing you really ought to be afraid of is the people who want you to be afraid.’ — eric

Biden’s EPA wants us to cower in fear from greenhouse gases. Red guard Michael Regan has mandated a total transformation of vehicles by 2032 to reduce those dread gases. The auto industry’s response: ‘YASSUH, Massa Regan, suh!‘

Here’s an email I sent ten minutes ago to the Alliance for Automotive Innovation, which said in a press release that Regan’s rules are a ‘stretch,’ but agrees that ‘the future is electric’:

To: info@autosinnovate.org

Portions of John Bozella’s statement in the March 20 press release are quoted in a New York Times article today, titled “Inside the Republican Attacks on Electric Vehicles.”

What a contrast between full-throttle Republican denunciation of the EPA’s new rules, versus Mr Bozella’s obsequious groveling in response to the EPA’s sweeping ukase.

If I hear “the future is electric” one more time, I’m going to smash something. Listen up, John: “the future is bankruptcy” for a good portion of your members. And it will be well deserved, as they meekly comply with the EPA’s regulatory overreach rather than fighting back.

Tune in to some automotive blogs, as lifelong car buffs ridicule “EeeVee Mary” Barra and Jim “Lightning” Farley for their “commitment to the EV transition.”

EeeVee Fever is over, John. Now it’s just a matter of picking up the pieces from the lost billions; the white elephant battery plants — and waiting for voters to lash out in fury against the pig-in-a-poke you’re trying to cram down their throats.

Your Alliance for Automotive Innovation is the enemy of the American people.

Jim H,

The future is electric…as in electric fence…electric chair…you get the idea. Those pushing the EV madness are environmentalists of the most wicked order. At the core enviros hate humanity. This has been known for decades since Dave Forman founded EARTH FIRST! and David M. Graber (GovCo biologist) stated that humanity should be wiped out by a virus.

Today on my facebook feed and enviro group post showed up. In only three pics they stated the core tenet of the movement, the destruction of humanity.

Here’s the link: https://www.facebook.com/photo/?fbid=744765854453862&set=a.585807933682989