The morality of it aside, Social Security was probably a good deal for the first two or three generations that were forced to pay into it, in the sense that most of them probably ended up collecting more than they were forced to “contribute” (it’s always worth air-fingers-quotation-marking words used to convey the opposite of what they normally mean).

Forcing people to buy car insurance hasn’t worked out the same way.

At least with Social Security, people eventually got something in return for what was taken from them. With car insurance, all you get is “coverage” – a thing of no tangible value if you never use it. This is a great deal for the insurance companies, of course. It is why they are among the most profitable businesses going. Much comes in, little (proportionately) goes out. It helps also to be able to force people to buy what you have to sell. The health insurance business saw what the car insurance business did and did the same. Both invested in government – and the returns have been spectacular.

Both have the power to summarily increase what they take in – mark the appropriateness of the italics – by increasing what they are in a position to force you to pay them in the event you ever actually use the “coverage” you’re forced to pay them for.

You may have been paying for 20 years or more without having filed a claim. But just a sure as the tide that went out is going to come back in, if you put them in the position of having to pay, they will make you pay for it.

Whether it’s your fault or not.

A deer leaps out of the woods and directly into the path of your car; there was nothing you did to cause this and nothing you could have done to avoid it. The incident is an accident and – supposedly – the chief reason for having coverage. Then you make the mistake of filing a claim, thinking – this is what I’ve been paying those premiums for all these years!

I am covered!

A little while later, discover how much more you’ll soon be paying. Your next post-claim premium has been “adjusted” – another of those air-fingers-quote-marks words – by a sum more than sufficient to recoup what was just paid out.

It is not uncommon for someone who was paying less than $1,000 annually for a full-coverage policy to find himself paying twice as much for the same coverage after having filed even a small claim, such as a cracked windshield.

Gallingly, it does not appear to matter whether the claim involved fault – i.e., something the policyholder could have avoided. A reader of these columns explains:

Recently, I ran over a truck tire in a rain storm and had to file a claim to get my front air spoiler repaired, which cost over $500. The insurance company decided that the rain storm and the truck driver’s blow out were my “fault” and raised my insurance rate from $750 a year to $2500 a year (for full coverage.)

This is sort of thing is common. And, commonly understood. From that understanding flows the realization that using the coverage one is forced to buy is foolish – because doing so will result in being forced to pay more for the coverage, going forward.

The sole point of car insurance is to make you pay – not to “cover” anything.

It is why insurance – when it is forced on you – is always a gyp. It cannot be otherwise when the “customer” (necessary air-fingers quotes marks, again) is obliged to buy whatever is being sold. The use of the term is a term of abuse in such a context. Customers have choices, most especially the choice to decline to be customers. If you are not allowed to say “no, thanks” and “not interested” to someone trying to sell you something – without repercussions – then you are as far from being their customer as Social Security is from being an annuity.

The best policy then, is to avoid using the coverage you’re forced to pay for. Consider it a write-off, the cost of doing business. Choose the least expensive policy you’re allowed to buy, with bare minimum coverage and put aside what you have saved. Then you can pay for incidental damages – if they should occur – out of pocket (once) rather than paying the insurance mafia to cover their loss, many times over.

Of course, this is just a stop-gap measure. It is probable that, soon, the cost of even the most basic coverage – for a driver who has never filed a claim – will become so exorbitant that the soundest policy will be simply to not pay for it, at all.

Yes, that’s illegal. So is making a right-on-red.

So what?

Yes, you can be punished for not doing what they say. Has anyone ever complied themselves out of tyranny? At what point will we say – enough!?

Insurance isn’t necessarily evil. But it becomes so when you cannot say no. When they can force you to say yes. It is precisely the difference between asking someone out on a date and forcing them to go on a “date” – in air fingers quotation marks for the same reasons as earlier, again.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

Eric,

Another EVIL trick these bastards use is hiking your rates after going years without an accident or claim! Their “reasoning” is that, the longer you go without an accident, the more likely you are to have one, because you beat their odds.

And did you read the latest, Mark? The diaper (and now cannot spell words) administration has decided that those people who have good credit will be (forced to pay) paying much more for a home, so that they can help subsidize and help pay for those with crappy credit, and who cannot afford a house to get one. Hmm, didn’t we do this once before?

I heard that. Conservative Treehouse says that there’s more to that than meets the eye. Basically, CT says that that’s a way to help the investors who bought up all those houses; the housing market is going down, so those institutional investors are feeling it. You can read more here: https://theconservativetreehouse.com/blog/2023/04/20/about-the-new-affordable-housing-fees-on-mortgages-that-punish-high-credit-borrowers/

Hi Mark,

Yup. That happened to me about two years ago. I had Geico (yeah, I know) and – despite decades of “safe” driving, no “points” (thank you, radar detector) or claims – they greasy Gecko summarily increased my premium by a significant amount. I called to ask why. The person on the phone said something like, “We’re doing this across the board because of rising costs.” I said: You’re not doing it to me. Either cancel the increase or cancel the policy. I was able to find a new one for less than I had been paying Geico, which is good – but I still resent the fuck out of paying because I might cause harm. I understand some people fear the possibility of being hit by an uninsured driver who cannot pay for the damage. Well, their fears ought not to be my obligation. The fact is I haven’t caused them damage and until I do, they have no right to cause me damage – as by using the government to force me to hand over money to “cover” damages I have not caused.

I’ve yet to have anyone explain to me – logically – how forcing people to pay for “might” is justified and (more to the point) how one could logically (coherently) oppose forcing people to pay for a litany of other such “mights,” ranging from their dog might bite someone to their dick might rape someone, if one supports forcing them to pay for insurance on the basis of the same “might.”

Maybe Greene will!

Thank you for the opportunity to post four words on this subject. Two follow up [osts with data and links were censored. That is a very leftist style strategy to eliminate debate. All contrary information is censored or published and ridiculed. All future comments automatically go into moderation, never to be seen again. The only way to be “right” on every subject is to reject contrary information.

This stems from allowing driving to be viewed as a privilege instead of a right

That was a big mistake on the part of very early car owners, that will be used against us in the plan to get us out of our personal cars. Up until personal cars, the right of passage was a right, not a privilege.

What happens if the Dems get their way and ICE vehicles go the way of the dinosaur by 2030? Presumably millions won’t be able to afford an EV and may end up relegated to riding bicycles, a’ la communist China. What then will the insurance mafia do for an encore since many will at least be off the hook for auto coverage?

The Dems will simply for us to pay an insurance premium for riding bicycles. Voila! Problem solved! It reminds me of Stevie Ray Vaughn’s version of “The Tax Man”. Where he says “…if you try to walk I’ll tax your feet”. Guess we’d better not give the greedy Feds any ideas.

Anyone else notice Flo from “Progressive” throwing the triple 6 hand sign in the pic above? Tells me all I need to know…

LOL. One of the biggest costs of my policy is for “uninsured motorist”. Why in hell am I paying for that? Yeah. I hate car insurance. It’s dumb.

Most state DMVs are quite efficient at enforcing mandatory insurance coverage. Once I let my motorcycle policy lapse, and within less than a month received a DMV letter threatening to cancel my registration.

So how is it that all these uninsured motorists allegedly are buzzing around, creating widespread havoc that requires heavy levies against insured drivers?

Or is the ‘uninsured motorist’ plague just a convenient slush fund for the insurance mafia, based on a myth that never goes away, and never gets fixed? I’d like to see some actual, audited data from the lying liars of the insurance industry and their captive ‘regulators.’

They don’t do that here (cancel) but I have read estimates where they say that up to 50% of drivers are uninsured. Of course, I reckon that depends on which metro area you’re in. One thing I do know, is that the cops don’t even need your registration and insurance cards. They already have that info and from what I gather, the plate readers they use do that automatically. It’s just another way of screwing with people. I very often even see people driving around with no plates and that most likely means no insurance. The cops don’t care about that. Something about squeezing blood from a turnip? I laugh when I recall the bad old days when I would rant to fellow employees about computers tracking everything you do and basically ruining your life. Most of them laughed.

Hi Teacher,

I put Farm Use tags on my truck for just that reason as well as others. I still carry insurance on it. But if they day comes that the cost increases substantially without my having given cause – I’m done. Me gusta! I will just stop playing ball, like the illegals never did.

I predict that insurance companies will try to morph into kaiser-Permanente style AMO’s (auto maintenance organizations), where drivers will pay a monthly fee for everything. They already have “preferred” shops for body and repair work anyway so it will just be an extension of that. Oil and fluid changes, scheduled maintenance, accident repairs, etc. At first it will be great, just to to your (in network) mechanic and all the routine stuff is covered. But then they’ll find out that some vehicles require more maintenance than others, and some drivers are better than others, and they’ll try to raise rates. Of course THAT’S NOT FAIR, so everyone’s rates will go up. Unless there’s some driving related activity that’s not politically popular, so the people doing that will get raked over the coals and extra time. In the end we’ll be right back to where we are now, except now there will be even more lock-in and paperwork. And proft for the insurance company.

Hi, RK,

>I predict that insurance companies will try to morph into Kaiser-Permanente style AMO’s

Some auto manufacturers (BMW, for one) already include the price of routine maintenance (oil changes, etc.) in the cost of a lease. That, coupled with 5 yr/50,000 mi warranty, leaves very slim pickings for the type of service you describe, at least for new cars. Used vehicles are, obviously, a different story.

Personally, I am not interested in “owning” (financing) any of the new vehicles, because they are too complicated, as well as too expensive. Lease is the only thing which makes sense to me, for a new car, if you are feeling flush. Me, I’ll stick with my 1989 F150. Paid cash in ’89, paid cash for all maintenance and repairs since then.

Another consideration is your auto insurance most likely won’t cover you outside the USA, including rentals. Rented a VW SUV in Germany and used my VISA card which included rental car coverage. Which was fortunate since I scraped the corner of the bumper pulling off the road for an emergency rig. That guardrail scrape was over $3K to fix since it also involved a sensor and a scuff on the edge of the fender. Called State Farm, sorry Sparkey no good overseas. Turned the claim into VISA, took months but they did pay it. KEEP ALL RECEIPTS/ RECORDS/ PICTURES!

hmmmmm

Wonder why it seems we (the ‘people’) are always screwed! I mean we are the envy of the world,,, right? We (used as no other word seems to fit) are the preeminent where those in government are employees working for us. And corporations know the customer is always right and would never team up with government to defraud the citizenry! I mean,,, it says so in the con-stitution!

So how can the country that sets the standard for the world for ‘self rule’ sell out their citizens so cheaply?

So, making a right -on -red isn’t illegal in Arizona unless a sign says otherwise. Is that different in virginia? Also, I believe you can go without insurance in Arizona if you have $25 Grand in the bank, or more. I have yet to test that.

Hi, BaDnOn,

>I believe you can go without insurance in Arizona if you have $25 Grand in the bank

At your peril, I suggest.

If you have ~$100,000 in liquid assets which are earning a good return, it *might* make sense to self insure, at least for property damage. That will pay for one very high end pickup, or luxury sedan, if you are lucky.

But what about the medical mafia? You can refuse medical treatment for yourself, but not for someone else. Based on my experience, *any* contact with the medical-industrial complex is likely to destroy your life. Are you willing to take that chance? I’m not.

You can also make a left on red, if you are on a one-way street and trying to turn onto a one-way street.

“It is not uncommon for someone who was paying less than $1,000 annually for a full-coverage policy to find himself paying twice as much for the same coverage after having filed even a small claim, such as a cracked windshield.”

It is my understanding that claims paid by your comprehensive coverage generally won’t result in a premium increase. If the windshield gets broken in a wreck, however, the collision coverage pays and your rate is likely to go up. Running over a truck tire would qualify as a “collision with another vehicle or an object.” My wife once straddled a big rock that was lying in the road, and it poked a hole in the oil pan. That was deemed a collision.

The “Sage of Omaha” isn’t so much a sage as a looting parasite who has made great investments buying politicians so he could steal from the ‘forced insured’.

Trying to avoid Buffet’s companies and avoid St Farm (due to their poor performance in previous claims) narrows the auto insurance field to a very few.

I’m forced to pay for insurance, and have similar anecdotes.

My wife was driving on the highway, in fairly dense traffic, when a truck lost a load – a big log. It landed right in front of her and was unavoidable. The insurance raised our premiums because, per the laws they helped write, hitting anything on the road is the driver’s fault, it doesn’t matter that it flew off the back of a truck at high speed, she was supposed to dodge it. They didn’t “raise rates”, which isn’t allowed in this case, what they did was remove the good driver discounts, and no-accident discounts from our policy, for both her and ME! End result, insurance goes up 40% for five years, that’s many $thousands.

Someone was texting while driving down my street, and ran into the back of my parked car. They ran off, and I had an $6,000 repair, and this falls under the uninsured coverage. My rates were raised permanently by reclassifying my address as risky.

What these damn companies do is often in breach of various regulations, but regulations don’t enforce themselves, and so you have to sue them for breach of fiduciary duty to a customer. It’s an expensive process, and your legal fees will exceed whatever you hope to claw out of them, and they count on this. Attorney generals aren’t interested in forcing them to follow the law because of insurance contributes a lot to campaigns.

When I bought my first car, in Rhode Island at the time, a use piece of junk at that, my premiums were $5,000/year (I drove without). RI insurance costs were exploitative, so they passed this “no fault” law, that everyone’s insurance covers their own car in an accident, fault is not established. This was going to make it all cheaper. What happened? Prices double overnight. If you’re curious, go type in your car details in a RI insurance estimator and see what it’ll be.

‘so you have to sue them’ — OppositeLock

Every state has a criminal statute punishing insurance fraud. If an insurance company suspects you of inventing or padding a claim, they can refer your case for criminal prosecution by the state, with the potential for jail time.

But no corresponding ‘insurer fraud’ statute exists. As OppositeLock said, you are on your own to sue them. Public prosecutors will not attempt criminal charges against cheating, pilfering insurers. They get a free pass, even when there’s a pattern of misbehavior.

It’s just another ugly example of corporatist hijacking of laws, to engage the state as their agent in oppressing and looting the public.

I have noticed an especially raw deal with health insurance.

My employer pays literally tens of thousands of dollars on me, every single year.

But on the rare occasions when I ask for a measly $800 for an MRI, or even $10 to cover a prescription they say is “preventative” and covered, it’s like pulling teeth.

I can get whatever healthcare I need/want, until I hit my deductible, which I rarely do, and then it’s a fight to get anything.

And the price difference for the low deductible plan is significantly higher than the difference in deductibles.

It’s a ripoff.

At least it’s “free” (to me) and I have it.

You “urrned” it (thank the late John Housemann) just the same. The bulk of your healthcare premiums are paid BY you, with pre-tax, imputed earnings. That distinction was in the Internal Revenue Code almost from the get-go, but came more into play during WWII, when wages, and in THEORY, prices, were frozen (causing shortages of almost all consumer goods, which justified the extensive rationing the wartime Government imposed, i.e. “points” system, think about that one…). It was ok, in order to retain employees that weren’t already joining the Armed Forces, or better paying work, like in defense plants, to substantially increase medical and/or dental insurance plans, as well as employer-paid life insurance and contributions to pension funds.

No, Publius, NONE of it is “free”, you’ve paid for it with your own efforts.

I’d take no insurance if they’d put the money in my paycheck instead. But that’s not really an option.

The dirty secret of employer medical insurance is that it often isn’t insurance at all.

Employers over some size, not exactly sure where the line is, can’t afford insurance for employees. Instead they contract an insurance company to do the administration work, get the better prices, and so forth. The bills are simply paid by the employer. The bills are less than the insurance coverage.

On average that should be true.

I have to get an ultrasound completed next week. I have no insurance so I am “self pay” as they like to describe us bums with no healthcare. 🙂 Just went online to look at pricing. Insurance quoted a price of around $1071 for ultrasound and radiology. Not that is what most would end up paying, but what they would charge insurance.

Self pay…$275. I pay cash, don’t have to worry about a bill or a fight with insurance companies and still plenty of money left over for the premiums I don’t have to send each month. Sounds like a no brainer.

Has anyone here ever gotten offers from their insurance company to get a discount on premiums in exchange for having what could only be described as a spy plugged into their vehicle’s OBD port? I’ve gotten such offers before but never subscribed to it.

Yes, John B.

My recent ‘accident’ is the example Eric mentioned in the article. When I posted that experience, I posted the additional observation that in searching for a replacement insurer I was ‘offered discounts’ for such a spy device on my car.

I decided that I wouldn’t accept the bribe to give up the freedom to drive my car as I decide is best and what speed is ‘safe’ for the conditions.

I’m certain that my style of driving would not result in any discounts.

Sure, and I would plug the unit into a 12 Volt power supply and leave it in the garage. Screw them. Therefore, it’s always on, but going nowhere.

Hi Swamp,

Amen!

PS: Did you get my email? If not, shoot me one (I may have your old one) and I’ll send it again…

Everybody is required to have liability insurance, but then why do I need un/derinsured driver coverage? The cars become more expensive to repair, so regardless collision premiums continue to grow. The only car insurance that is a “good” deal is comprehensive. That can at least be had with a low deductible for a negligible rate.

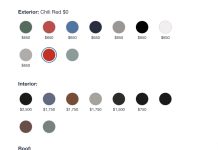

Because the required minimums are a joke. California only requires $5K for minimum property damage; that’ll barely cover a junker. I carry $100K, and it actually doesn’t cost all that much; that way, I’m covered if I take out a Cowboy Cadillac or a Mercedes.

People should be able to make free market decisions with respect to insurance coverage.

Here’s a catch-22 in Taxachusetts, not sure if other states have something similar: auto insurance is compulsory for everyone and there are a few separate categories with compulsory minimums. One of them is “coverage for an accident caused by an uninsured driver”. Well duuuh! So the insurance is mandatory but you also are forced to pay just in case it isn’t! One of the reasons why I drink.

Hi Mike!

Yup. They tell us insurance must be made mandatory so that everyone will be “covered.” Then they admit that there are people who don’t buy the mandated “coverage” – and we who do must pay higher premiums to offset that.

It’s like “gun control.” Pass the law so that criminals won’t have guns and we’ll all be saaaaaaaaafe.

And they ask us why we drink.

Or, the mandated “coverage” is like the work pants that keep slipping off (“crack kills”)…the coveralls don’t “cover” ALL. And truth be known, the insurance companies would rather NOT cover everyone, because that increases the overall risk…to THEM. They want to issue coverage to folks that likely won’t need it, obviously.

Last time I hit a deer, it busted up the front of my car really bad, and the deer got punched through someone’s mailbox. Since it hit someone else’s property I felt I should get a police report, and did. Cop confirmed dead deer on the front lawn.

When I called it in to the insurance company they asked “do you have a police report of hitting the deer?” Yes I do. If I remember it was $3-4K to fix and I was paying around $800/yr at the time.

They said, my rates wouldn’t go up over hitting a deer but that I had to prove it.

This was a while ago, so I don’t know if anything has changed.

One form of insurance that we’ve been MANDATED to buy nationally was health insurance thanks to the passage (and subsequent signing by then President Barack Obama) of Obamacare back in 2010. The Speaker of the House at the time, Nancy Pelosi, had a now infamous saying “We have to pass it to find out what’s in it.” Unfortunately, we found out just what was in it good and hard, from health care becoming MORE expensive to the IRS fining you if you didn’t have health insurance. Heck, I wouldn’t be surprised if the federal government even used something in Obamacare to try to FORCE Americans to take an experimental pharma product that, over time, turned out NOT to be what it was sold as to the public. If Donald Trump becomes President again, he should make good on his original promise to REPEAL Obamacare.

200 dollars per month to insure your car to prevent loss if you have an accident is what I pay to the insurance company.

100 million insured drivers/car owners that pay 2400 USD per year in insurance premiums totals 240,000,000,000 USD. Every year, after ten years, there are 2.4 trillion dollars collected in premiums, the money is there in case there is an accident and you are covered.

Must be some left over to distribute to employees of insurance companies.

Warren Buffet has 128 billion in cash, so Progressive must be making some money.

And the government edicts that have led to modern cars without old fashioned bumpers makes repair costs astronomical. The lady who cuts what’s left of my hair was rear ended a few weeks ago. The whole plastic ass end of her Camry is gone. Guessing it’ll be multiple thousands to repair. In another life a non-life-threatening fender bender like the one she was in would’ve resulted in a few scuffs on the chrome bumper.

Indeed, Mike –

I have a perfect case in point. I used to own a ’98 Nissan Frontier – essentially identical to my current (2002) model. Except the ’98 had an exposed metal bumper and a pair of sealed beam headlights. The ’02 has a plastic “fascia” and a pair of plastic headlight “assemblies.”

I hit a deer with the ’98, glancing blow, driver’s side. It pushed the bumper out of whack and smashed the driver’s side headlight. I was able to use come along and a big tree to pull the bumper back out and into place. The replacement sealed beam headlight cost abut $25.

Hit a deer a few years later while driving the ’02 (the god-damned hooved rats are everywhere). It ripped the “fascia” off the truck and cracked the plastic headlight. About $2,000 in damage.

Oh but Eric think of the fuel savings! Your metal bumper and glass headlight added literal pounds of material. And the various gaps and lack of optimized aerodynamics meant you might use an extra gallon of fuel per month moving from point A to Z.

Also, shouldn’t the state of Virginia be liable? I’m pretty sure if you shoot a deer without a permit it’s “poaching,” going back to the days of when the monarch/sovereign owed all the wildlife. So if the king’s animal damages your property rights, why do you have to pay?

From Apple’s Dictionary:

poach’ | pöCH | verb [with object]

1 illegally hunt or catch (game or fish) on land that is not one’s own or in contravention of official protection…

“With car insurance, all you get is “coverage” – a thing of no tangible value if you never use it. This is a great deal for the insurance companies, of course. It is why they are among the most profitable businesses going:

That statement is false <a href="http://“>

Richard,

The statement is entirely true; insurance is a hugely profitable extortion regime. That happens when you are able to force people to pay you.

And as far as no tangible value. Perhaps you will show me what value I have received over the past 30 years for all the payments I have made? As far as I can tell, I am simply relieved of money – lots of it.

Richard. I am an attorney with many years of experience dealing with all kinds of insurance coverage issues. The business consists of 3 things #1 collecting premiums, #2 Advertising and PR, #3 NOT paying claims. Some do get paid, but look closely at your policy. If I were to add up all the premiums I have paid for Home and Auto in 30 years. Home 30×1000= 30,000.00. Claims None. Auto 30x 4500.00=135,000.00. 3 accidents in that time one a deer in a rental in Washington State 15K the new Focus was toast. 2 others were ballpark 10K total. Several windows under the comprehensive, I am a loser the house always wins. The homeowners was much cheaper (also if the house burns we are talking real money), and it’s still sorta voluntary only have to have it if you have a mortgage. The Auto, mandatory, much more expensive for less “coverage” in quotes as Eric would say. I am also in Michigan as you said you are. What do you think of our Governor’s latest plans to impoverish us?

Hi Ugg,

Dealing with Clovers (i.e., people like Richard) gets tiring sometimes. I also once added up what I have paid to “cover” just my old truck. And it amounts to appx. $4,500 – a sum equivalent to what the truck is worth today. What have I to show for what I have spent? Whereas had I not been forced to spend it, I could have bought multiple sets of new tires, replaced the clutch, rebuilt the front end and still had enough left over to pay for gas for a year, at least.

Which do you suppose I’d have bought if I’d had the choice.

Meanwhile, every other commercial on TV is peddling “coverage” of some kind. I wonder where they got the money to pay for all that… ?

Home insurance? They want even more – around $1,700 annually. But luckily, I am not yet obliged to pay this and so have a little change left in my pocket.

Great article Eric.

Insurance “coverage” mandated at gunpoint is why I made the decision to sell my beloved 2004 2WD 2.4L Frontier.

I have a 2011 4WD Frontier that I drive in Winter. I drive (or drove anyway) the 2004 in the summer. The 04 get much better gas mileage – and is just generally a much simpler machine (no TPMS / power anything / cruise / etc).

Since I’ve been working from home – I only rack up about 1,200 miles per year now This means the insurance / registration cost alone for keeping the second vehicle is more than a dollar a mile. Talk about a gyp. I will never save that much in gas or depreciation – even assuming gas at $10 a gallon.

So the insurance mafia’s mandated “protection” is pushing me to sell my dear beloved truck.

Anybody interested around SE Michigan can check it out here:

https://www.facebook.com/marketplace/item/1355527548630886/?ref=search&referral_code=null&referral_story_type=post&tracking=browse_serp%3A9e2356ff-f9f3-40d1-b495-92838e08fb20

Thanks, Blake!

Your truck is the twin of mine, right down to the color. Very sad that you have to sell it. If I could, I would buy it. These little pick-ups are exactly what trucks ought to be all about.

Why not just park it. You are in Michigan, no personal property tax on cars, Probably a better investment than the roulette wheel, I mean stock market?

I would keep it too. No real good reason to sell it to be honest. Just keep it in running condition and put it out of the way for now.

‘insurance – when it is forced on you – is always a gyp.’ — eric

A majority of states allow vehicle owners to post cash or a surety bond — typically in the $50,000 range — in lieu of liability insurance. Here is the list:

https://www.nerdwallet.com/article/insurance/states-not-require-car-insurance

Thus it is possible to cut the blood-sucking parasites out of the picture, though not too many do so.

Hi Jim,

Yes, but who has $50k they can set aside as “surety”? I grant that it’s not hard these days to incur $50k in damages. Yet, I still take umbrage at being told I must be “held responsible” a priori – for harms I’ve not caused, but might. It’s a dangerous road to go down, for if I must post a $50k bond to be allowed to drive then why not the same or similar to be allowed to own a gun or a dog or any other thing that might cause harm?

I have this weird affliction of the mind that causes me to resent such. To feel obliged to pay only if I owe – which I don’t unless I have actually caused harm.

It’s strange, I realize…

“Both invested in government – and the returns have been spectacular.”

In my early twenties, I was working for a very successful mechanical contractor. The owner of the business was for some reason talking to this kid, and said the best investment he ever made was a $5k donation to the dominant political party.

Every government is founded upon its assumption of authority to kill you if you disobey. Nothing like gaining that power to collect fees from your customers.

“You have to buy it or we will kill you.”

Fuck ‘Em! If your vehicle is over 30 years old or you purchase one new from a Dealer, register it in Mexico. Insurance is good in the States, cheaper and your rates don’t go up if you get a ticket or have an accident. You’re going to get the same shitty treatment but it will cost you a whole lot less.

And as an added benefit, your license plates will cost you about $25 a year