Has the current housing bubble – which inflated such that it apparently now costs around $400k to purchase the average home – popped?

It seems to have – in my area, at least.

I keep track of the local real estate ebb and flow because it is a barometer of the other things, such as the changing demographics of my area, which (when I moved here back in 2003) was very rural and very affordable for exactly that reason. One could buy a house on several acres of land for less than $200k. Ordinary people, in other words, could afford to live in a single-family home on a few acres of land.

That changed – suddenly – during the (cough) “pandemic,” probably for several reasons – the most obvious reason being the mass exodus from the (blue) cities to (red) and rural areas, where (ironically) the “blues” sought refuge from the Hell they had created in their former areas. This exodus was facilitated by work-from-home arrangements that the “pandemic” enabled that specifically favored people whose work consisted of paperwork (done online) as opposed to going places and doing/making things. These people were being paid the same (high) salaries that they had been getting when they lived in the blue (expensive) urban and suburban areas but – thanks to the “pandemic” – they were now able to work (and live) where the cost of living was half as high. This – along with record low interest rates – created a boom in demand for existing houses and land that drove up the prices to surreal (for this area) heights.

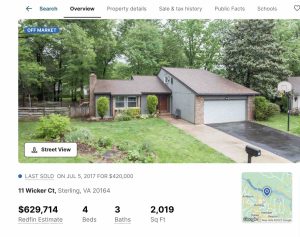

As an example:

There is a house not far down the road from where I live that sold for around $100k when it was built about the same time I moved here. It is actually a manufactured home – but it sits on an acre of land which – back in Northern Virginia, where I lived when this home was manufactured – would have cost around $100k just for the land. So it was a deal – for someone who wanted a home with some land.

That same house sold for $200k two years ago. It was just listed – a few weeks ago – for just shy of $220k. This week, the price has been reduced to just under $200k.

Probably because even at a relatively modest $200k, at 7.3 percent interest, a loan for this home would cost its putative owner around $1,500 per month, assuming the putative owner can swing a $20,000 cash (10 percent) down payment. How many people contemplating the purchase of a manufactured home have $20,000 in cash for a down payment?

A Northern Virginia government worker might have that. But he’d probably have to sell his house in Northern Virginia first. And a typical house in Northern Virginia sells for a great deal more than the $400k asking price of the average house. My old house in Northern Virginia is a $600k house now. When I bought it back in the ’90s, it was a $150k house.

And that’s why I was able to buy it.

It was – it is – a small house on a small lot in a not-so-great-neighborhood house. Yet it is now a more-than-half-a-million-dollar house. Such a house – today, at 7.3-something percent interest – would cost you just shy of $4k per month to buy. Assuming you could come up with 20 percent down in cash – which would amount to $120,000.

Even well-paid government workers – who are in the fine position of having the power to make us pay for their work – will probably have trouble swinging that. Maybe they can manage 10 percent down. That would only amount to $60,000 in cash needed to close. But then, they putative buyer would need to be able to swing a monthly mortgage payment of close to $4,500.

Not many can. So houses like my old one in Northern Va aren’t selling, either. Which means people wanting to live here are stuck there. Which is probably why the $200k manufactured home down the road from me may not sell – until the price gets reduced, again. Maybe all the way back to somewhere closer to what it’s actually worth, which is around $120k.

And then ordinary people may be able to afford a home with some land, again.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Keeeeeeev T shirt pictured below, you can find that and more at the EPautos store!

Nasdaq down another 2.27% today…so far…doesn’t look too healthy…

VIX up 3.94%

https://finviz.com/futures.ashx

[…] Guest Post by Eric Peters […]

Bubbles popping?

Nasdaq down 2.43%….

https://finviz.com/futures.ashx

Hmmm. Russell 2000 is down close to 18% since 7/31.

The Kobeissi Letter@KobeissiLetter

BREAKING: Google stock, $GOOGL, is now down by 10% posting its worst day since March 2020.

Nearly $200 billion in market cap has been erased today alone.

The 7 largest tech stocks in the S&P 500 have lost more than a combined $500 billion today.

This is the most widespread tech selloff in months which has resulted in a 5-month low for the S&P 500.

This is what happens when the few stocks that are holding up the entire market break.

Are tech stocks beginning to price-in a recession?

no bounce tonight yet……

https://finviz.com/futures.ashx

the hated bitcoin up 23% in 2 months….

https://finviz.com/crypto_charts.ashx?t=BTCUSD

bitcoin up 70% since march 2023….

What about collector cars?

Hagerty’s collector car indexes point to a coasting market…..

how do you hedge that market if you own these cars?

https://insider.hagerty.com/trends/hagerty-indexes/

from the comments

I think the biggest threat is the availability and price of gas as electric cars begin to surge. I see men that look to be in their 70s and 80s bidding huge and I just wish I was their son who inherits all!

I view classics now as works of art never to be made again so to park and maintain in a climate controlled garage the satisfaction has turned to just admiring than driving.

I have noticed some drastic drops in value for some. At least you can visit and admire instead of #s on a screen of a stock market portfolio!

At least you can visit and admire instead of #s on a screen of a stock market portfolio!…..

I agree….. I would rather have the collector cars to drive then money in stocks, etc….

but….people say why do you own those cars?….they see cars as just a liability and expense….

you have to love your cars…if not sell them….

JayEmm on Cars….on utube…loves cars…

what he says…..@11:52 in video…the mystical healing power of the automobile…..

https://www.youtube.com/watch?v=FxbOqpUqOvo

the mystical healing power of the automobile…..but….the marxist/globalist government wants to ban them….taking away the slave’s favorite thing….

Weird assed shit, mang: “I view classics now as works of art never to be made again so to park and maintain in a climate controlled garage the satisfaction has turned to just admiring than driving.”

Judge Dredd was supposed to be in the future.

Hi Aanon,

Yup. A car like my ’76 Trans-Am was a car a guy in his early 20s could afford to buy back in the early 90s. It is now a car that – for the most part – only middle-aged and older guys who have new car money can afford to buy. I could not afford it today. No wonder so many people in their young 20s today are angry. They can’t afford a cool car – or any car, for that matter. A house seems as out f the question for them as owning a private jet is for me.

Collector cars have been a better investment then real estate or stocks….

Hi Anon,

That’s true – but it’s also a shame in that they are also now beyond the means of most people, especially young people. That portends a bleak future for the collector car hobby when the Boomers and Gen Xers who were able to buy them when they were still affordable die off. At the car shows I go to, almost all the car owners are middle-aged and older.

At the car shows I go to, almost all the car owners are middle-aged and older.

Go to a Porsche club meeting….not many young people there….

At American muscle car meets…same thing…

At Euro car meets the same thing….

At JDM meets there is more younger people…

At VW meets…fewer old people….VW’s are cheaper then Porsche’s….

More young people could afford Golf’s or Civic’s….

How do you bet against the real estate market?….

One way is to short the banks…..it has worked this year so far….bank index DJUSBK….down about 15% this year……

The ultra rich hedge everything…..they don’t gamble…a form of insurance….if you are long the real estate market, you could hedge your bet this way….

RE: “How do you bet against the real estate market?….”

Buy gold, buy silver, have faith. ?

https://www.kitco.com/ind/schoon/july012010.html

Gold and silver is overrated. Not saying it doesn’t play a part in a balanced portfolio, it does. But it is a small part. At this point IMO, Platinum looks to be the most undervalued of the PMs. Looking back over the last decade, the best ROI I’ve received is on skills mastered, after that, I’d have to say the ammo I purchased in the early part of the century did pretty well.

Precious metals should not be looked at as investment, but as insurance.

For me it was always an investment in my piece of mind. Hope I get to gift it all in the years to come. Already started with the kids and grandkids.

The ultra rich hedge everything…..they don’t gamble…a form of insurance…

speaking of hedges….vix up…8.7% today…

someone said gold is the new vix…

https://finviz.com/futures.ashx

My house recently had its tax assessed value go up considerably –that way the county gets more money. But when I looked at an inflation calculator that delta was basically reflected the increase in debased FRNs. In other words, the amount went up but the value didn’t change.

Just to toss in a different perspective…. At least some (me) of the people fleeing blue cities (Detroit) for rural Southern America are not die hard liberals. We were the conservative outcasts amongst the lefty clowns and so very happy to have the corona-work-from-home shift which allowed us to once again move to a place where we fit in and can homestead in peace. Of course now prices here (in TN) have also skyrocketed and so we are glad to have moved in 2020 when we did.

QE…Quantitative easing……stocks and real estate go up…..Quantitative tightening… QT…which is happening now……stocks and real estate go down…CRE first…..real estate has finally started…stocks are next…..

Quantitative easing around the world: lessons from Japan, UK and US

In September 2019, the Federal Reserve began conducting its fourth quantitative easing operation since the 2008 financial crisis;

The Bank of England launched its QE programme in March 2009 with an initial spending target of £75bn over three months. At the same time it cut interest rates to a record low of 0.5%.

Quantitative easing has been largely undertaken by all major central banks world wide following the global financial crisis of 2007–08 and in response to the COVID-19

QE was effectively born in Japan, a country plagued in recent history by deflation and rolling recession. The phrase “quantitative easing” was coined to describe Japan’s efforts to kickstart growth and get prices rising again, starting in 2001 and lasting five years. That programme failed to rid the world’s third largest economy of its persistent deflation, a record that was repeatedly cited by QE’s critics as the policy was mooted in the UK and US at the onset of the global financial crisis.

The US Federal Reserve belatedly implemented policies similar to the recent quantitative easing during the Great Depression of the 1930s

Wolfstreet…..

My Take on What QT Has Done to Stocks, Bonds, Commercial Real Estate (Lots of Bloodletting) & What it’ll Do Going Forward

https://wolfstreet.com/2023/10/07/my-take-on-what-qt-has-done-to-stocks-bonds-commercial-real-estate-lots-of-bloodletting-what-it-will-do-going-forward/

My area, Northwest Indiana, is an escape valve for the Chicago area. Property taxes for example are much lower than Illinois, especially Crook County. Prices have finally slowed after rising faster then they ever have. They had never risen faster than 3% annually, never wildly rising (and falling) like a place like Florida. Well until now. My house probably went up about $100,000 (my folks paid about $109,000 in the early 1990’s). I would probably get about $325,000 for it now. One of my new neighbors will likely get hosed someday as they have way too much money into their house now (and they spent more on it after buying it too). I don’t think prices will drop much here, but won’t rise like that again soon.

Even though the prices have finally slowed, sales are still brisk in my own town. A production builder has opened a new phase of a subdivision in a town south of mine, and they are already building on many of the lots.

Real estate is highly localized. Here in Silicon Valley, due to the wealth of tech and biotech, and the government created housing shortage, prices have only been going up. I can no longer afford the house I live in, if I was buying today. It’s gone up by 120% in 10 years. This isn’t sustainable, that’s for sure.

>I can no longer afford the house I live in, if I was buying today.

Same here, OL, and I live in Riverside County, which is a “bargain” compared to the Bay Area, or Orange County. Just got my property tax bill today. Praise be to Howard Jarvis. Absent Prop 13, I would be run out of my home of 42 years, if property tax were based on current hyper inflated value.

Morning, Adi –

Same here. I could never afford the house I own today if I had to buy it today. This problem is a more serious problem, I think, for the under 30s today – who may never be able to afford a house. And that poses a serious societal problem in that when young people feel gypped – that the game is rigged – that they have no hope – they are easy meat for communist demagogues, who will whisper in their ears that their woes are all the fault of capitalists. That is to say, of anyone who has what they lack.

young vs old….More……get the slaves fighting with each other so they don’t co operate and take out the marxist control group….more push back against the control group is needed…like eric is doing….good work….

Excellent point. I would add this is deliberate and one can see how the renamed flu scam and wars were/are used as subterfuge to these ends. “Due to pandemic”, “Putin’s price hike”, etc. Yeah, right.

Hi, Eric,

Yes, I have friends who have left California because they concluded they would never be able to own property here. Known others who cashed out, “took the money and ran,” re-settled in a lower cost area. I considered the latter course of action, but concluded I didn’t quite have the equity to make it happen at the level of comfort I wanted.

I missed the “feeding frenzy” in Orange County by about one year. the house I own in western Riverside County would currently be valued about twice what it is, were it located in Orange County, or Pasadena, and I too would be a “millionaire on paper” with no place to go, as Mike in Boston put it.

Sux for the younger generation. I don’t know who is buying houses at these horrendously inflated prices, but I suspect it involves corporate interests who plan to rent them out.

BlackRock, State Street, and Vanguard. We have to hold onto what we have.

Same here in the Boston area; paid $33,000 for this house in 1974, mortgage rate back then was 7.5% and the monthly payment-including taxes- was about $350. Now the house is worth(?) over a million and the property taxes are $12k/year and only go higher every year. Great, I’m a millionaire on paper but being retired on a fixed income the ever increasing taxes, along with inflation driving up the price of everything, will eventually gimp our lifestyle. We’ve looked into “downsizing” but after almost fifty years we have the house and yard just the way we want so just going to ride it out till we croak.

The house we bought in Howard County, MD in 1988 for $145k is now selling for over $650k. Granted, there have been upgrades but, that’s quite an increase.

The house we bought in NC in 1990 for $70k is now appraised by GovCo at over $330k. I guess it all evens out…for the GovCo parasites.

Have you ever challenged the reassessment higher? I did that in my NC county in ‘20 and they met me halfway. Still went up a hundred or so but not as much. You find yourself saying “my home isn’t as valuable as you think”, which for some people is a bridge too far. Not me. LOL.

Average Americans should not have to take sometimes half a day out of their work to “protest” those High taxes. It sounds so 1970’s cornball. The fact is, we should want to burn down the building where the assholes work to take our money forcibly. Property taxes are a sick enterprise.

When they were taking less than 1k a year, it wasn’t bad, but things are ridiculous now.

There’s just one problem, FDS, ours is a 2k sq ft home with 2 car garage and new 1350 sq ft shop on 5.5 acres. A house 2 doors down, 1100 sq ft, no garage on 1/5 of an acre sold last fall for $220k.

I wouldn’t poke that bear either. Just for a little context on mine, the re-val was conducted in February 2020 just before it was off to the races with the renamed flu scam. Plus my house is like living in 1975 when it was built, which suits me fine but would be described as not updated. The comps all had been redone significantly in the last 5 years. The county actually came out to look and were like, yep, we (the pricing matrix, really) overshot.

If its coming down were I live it is just beginning too. I live in one wealthiest dumps the country. Unless you want to gut renovate, anything remotely descent starts at 1M. Lots of these brand new 1M town homes and other shiny boxes, were flying off the shelf but now have begun knocking off 2%.

I’m going to wait off for the foreclosures to come in. I think the little boom, especially were I live, was due to plandemic, and other assorted corrupt money.

20%

I am not tracking listing quantities, but prices don’t appear to be dropping much. If this was a consumer led market, the bottom would show signs of forming by now. We have a 25 year record in interest rates. We have an all time high in prices that have barely dropped that has continued for almost two years now.

By all measures, the bottom should be starting to show itself. Instead, prices remain stubbornly high. Affordability is at an all time low. Regular people aren’t affording homes of any type in any price range today.

To anyone with an ounce of critical thinking skill, its obvious that the regular consumer is not in charge of this market. Housing has become an openly traded commodity although it is though of as an illiquid asset. Perhaps online trades have sped the velocity of the money in this market.

I believe that other market forces are in control of real estate as they are of gold, platinum, silver and many other commodities.

We are in a new world and a new market, which is largely unpredictable.

It is hard to forecast what’s happening next.

That’s OK. Soon the global warming will turn the pedmont into a beautiful marshland, kind of like the Everglades but with fewer alligators. Then that property will be a beachfront home!

LOL.

Wow, a whole 9% reduction! The seller still gets a 5% profit at that price from the last purchase in 1/22. There were price reductions in the 7% range in ‘21 before that 1/22 sale, which closed only 3% higher, during the height of activity so not much “bubble” then, either. Unfortunately, the Zillow price history seems to start with a sale for $25K in 2021? Intrafamily sale perhaps. I don’t know when you moved there but if it’s been 23 years since this house was built to now, $100 to $200K is not a whole lot of price increase. Inflation alone did that. Might even be a tad below, especially in the last 3 years.

BTW, The overall supply of actual homes for sale, not land, is very low in your surrounding area.

Here’s my sketchy anecdote. In normal times near me there would be 5-6 pages of 10 homes for sale. For the past year or more there have been 4-5 homes for sale. A guy near me listed his well maintained but very little updated 3/2 40 year old home he paid $195K for in ‘15 at $529K. I almost choked. Second cheapest home in the area. No need to sell and looking to hit a homer, for sure. He just reduced $30K (5.6%) to $499K after 2 months. He’s going to have to settle for a 255% gain, I guess. LOL.

Housing by nature is an illiquid asset. No “price” is real until closing, except for certain HELOCs. Coming a few percent off all time highs isn’t a bubble popping. The market is frozen. Supply is extremely low, so transactions are few.

The notion that the Fed can reduce asset prices or produce deflation by raising interest rates while being an engine for inflation is a theory that has very little track record. An unintended consequence has been to lock people into existing low rate mortgages, which predominate since rates had been near 0 for 16 years, thus diminishing supply. The Fed is faced with either keeping rates high and/or continuing to raise rates and exacerbating the supply issue or cutting rates and risking a flood of buyers rushing in off the sidelines and driving up demand for the small supply. Either way, with inflation putting in a floor on intrinsic value of land, wood, metal, etc., stable to potentially even higher prices.

The national debt has increased by $30 trillion in 20 years. Our money has been devalued and will not be worth more in the future. Assets have re-priced. It’s like expecting the groceries and water heater “bubbles” to pop and prices return to some level from the past. Ain’t gonna happen.

Hi FDS: I think I’m in general agreement with you on your points, but inventory can change pretty quickly if buyers start to go away. Once values go negative it can then cause a negative feedback loop.

There’s no doubt the Fed created trillions of dollars out of thin air, but my understanding is that the money supply has been negative for some time now (https://mises.org/wire/credit-tightens-money-supply-falls-ten-months-row). It would have a long way to go before getting back to the money supply of 2019, but it does look like housing might get cheaper soon.

That’s a good article, though it doesn’t mention the unintended low rate lock diminishing the supply of homes for sale. This caught my eye:

Since 2009, the TMS money supply is now up by nearly 185 percent. (M2 has grown by 142 percent in that period.) Out of the current money supply of $18.8 trillion, $4.6 trillion—or 24 percent—of that has been created since January 2020. Since 2009, $12.2 trillion of the current money supply has been created. In other words, nearly two-thirds of the total existing money supply have been created just in the past thirteen years.

And this:

If the Fed reverses course now, and embraces a new flood of new money, prices will only spiral upward.

I would agree, but more inflation too soon could crash the dollar as the world reserve currency. I also think the Fed may be purposefully crashing the economy so that the elites can buy at a discount before they reflood the market with money (to increase the value of the newly-acquired assets they will have just bought on sale).

The printing was just so unprecedented. I think a downturn will come (so long as the Fed doesn’t “pivot”), but it will take some time.

Then again, what the hell do I know?

Thus why we hear about moar war and rumors of moar war. Aid packages. Munition deals. There is something to the exporting of inflation and retention of dollar strength (flight to safety!) via these devices. First by inflation then by war.

a blog following real estate…..

realtors in this nation are in recession. Or depression. Sales have crashed. Inventory is piling up. Many agents have had zero sales in 2023. That means no income, just expenses. And while most people mistakenly hate real estate shills, blaming them for high prices, few among us would take a job that involves no regular pay, no pension, no benefits and a massive attrition rate. You eat what you kill. No safety net.

Two weeks from now the latest stats will show a spurt in listings and a dearth of deals. Buyers have retrenched. There’s no autumn market this year. Now it seems would-be sellers have awoken to the reality things could get worse, while many condo investors scramble to get out before they have to refinance or close.

The imbalance between supply and demand is growing, making a mockery of the ‘we don’t have enough houses’ argument every politician clings to. We’re entering one of the most significant buyers’ market in a dog’s age.

https://www.greaterfool.ca

from comments….

Replace realtors with a $1 app as I see it. First, easiest and most ethical thing to do when faced with a historic housing crisis.

They can sell RV’s, used cars or vacuums or such. The alternative is to leave them eagerly humping up RE with their spin.

Libertarian car guy writes the most succinct article on the government-distorted housing bubble and why it has likely popped.

It’s all NOVA to rural SW VA gov’t teleworkers using market jurisdiction arbitrage and formerly low loan rates colored by his own experience 20 years ago. No mention of the ginormous government spending and expansion of the money supply and how this is, for the most part, nationwide. Nor is there any mention of the extreme across the board inflation both in the bag and ongoing and why the cost of many, many things has doubled in just the past 3 years. Just bubble.

“Which is probably why the $200k manufactured home down the road from me may not sell – until the price gets reduced, again. Maybe all the way back to somewhere closer to what it’s actually worth, which is around $120k.

And then ordinary people may be able to afford a home with some land, again.”

—

Why is this house “worth” only $120K? Seems really random to me. Why not $60K or maybe $10 gold dollars? Who’s an “ordinary” person? The aim should be squarely on the government and what they’ve done to our money.

Well, there was discussion about down payments, monthly payments and lack of affordability. Definitely a succinct article that identifies the issues, albeit on a regional basis.

Serious question to you or anyone. Say you wanted to buy a certain house and had money for a down payment and qualified for a conventional loan at 8%, knowing that you could probably get a small concession now on price and refinance later if rates go lower. Would you go for it or would you wait?

Hi Funk,

I’d wait – because I think it’s likely prices are going to plummet. This will make up for the high cost of money.

Depends on what happens in the cities. If the mayors realize what the O’Biden administration is doing to them, what the “refugees” (don’t) bring to the table, and why the taxpayers are running away… then maybe the trend will reverse. But the overall demographics say otherwise.

10,000 people a day are turning 65. Many of them put up with the city because they could earn a decent living and convinced themselves that city/inner-ring suburbs was great despite never really taking advantage of it (such is the screen culture). Until COVID they thought they’d live forever and keep working, but now they’ve seen death and don’t like where they are. Maybe they stick around just to keep the house so their kids have a crashpad, but if they’re empty nesters they’re going to bolt. And as long as Blackrock’s buying, they’ll make money.

There is a lot of old people in large houses….but….they can’t afford the maintenance on the house….maintenance is a big expense on a house…plus property tax…utilities…expensive to heat…yard maintenance..lawns etc….

roof leaks….just stick a bucket under it….

if this group dumps their houses….prices will drop…good for young people….

I get that. But is the cost of money really high? My first mortgage in ‘01 was 7.25%. We thought that was super low, a deal. Yes, prices were lower but for everything. Food, cars, screws, you name it. 20 years and $30 trillion later how much “plummet” is left? 185% increase in the money supply since ‘09? Hello. 16 years of rate repression has distorted a lot of folks’ perception of what money should cost. It’s boomeranging on the Fed in unanticipated ways. Serves them right.

That may be true FDS, for your experience in 01, but what that experience is missing is the ginormous inflation (debasement of money) that has ensued since 2001. 7.25% on, say, a $150k mortgage is a WHOLE LOT LESS than that same rate on the $500k mortgage you would now need. I believe that is Eric’s point about his old house in NoVA.

I’ve been talking non stop about inflation so not sure how I missed it. Although I didn’t say it, I was thinking about 8% mortgage in the context of the $200k house Eric used as an example. After all those years at or near 0%, there is sort of a sense of entitlement about that. It wasn’t always so and yet houses transacted. That was my point.

Hi FDS,

Our mortgage rate in 1974 was 7.5%, up to then rates had been in the 5% range for years. I think at one point in the ‘80’s it got as high as 12%, but of course house prices weren’t as outrageous as they are now. How the hell would someone come up with $200k as a down payment, even if they could afford the monthly payment on a million dollar house?

$900,000 mortgage about $6000 month

income to qualify….about $234,000 year….lol

The house that Eric used as an example, which is listed for $200K was what I am using as an example. That’s a $20K down payment conventional loan. Still seems like an entry level opportunity to me even at 8% mortgage.

My first house was in ‘01 in the NYC suburbs in Short Hills, NJ. I was in finance at the time, a lot of which goes on in Boston as you know, crazily driving up prices, and my wife was an attorney. Our first house cost $485K, we got it with an 80/15/5 loan. So, 5% down ($23,250) with a conventional 80% at 7.25% and a 15% HELOC at 8.5%. A “gift letter” from my folks was required by the lender regarding the down payment. LOL. We shoe horned into it. Put in about $150K in updates and sold it ‘09 for $739K, per Zillow last transacted in ‘16 at $1.2mil. A 3 bed 3 bath ranch house from 1940 on a third of an acre on a main thoroughfare.

The Fed money spigot is how people in those places still buy million dollar homes. If you’re not attached to it, you’ll need to go somewhere where RE is cheaper if you want to buy a home.

I think I would wait. The key metric for me right now is the disparity between the monthly costs of owning vs. renting. It’s never been out of whack like it is right now. I think rents have hit a ceiling right now and to cost to buy will drop closing that gap.

But once again, what the hell do I know?

FDS, you have to agree that the higher cost of borrowing money necessarily causes downward pressure on pricing, right?

We haven’t seen that in any material sense in the data yet and we’re at 8%. At what rate does that “rule” kick in? 9%? 12%? 20%? There’s an “affordability” crisis now. What’s to say supply doesn’t constrict further should rates go any higher? Then say the Fed cuts rates. I’m not anticipating that, btw, but do you think that’s gonna lower prices? I’m speaking for myself in a purely theoretical way here but I’d get in now slightly off all time highs because, barring some mass unemployment scenario, the notion of plummeting prices in the face of the money supply situation discussed above seems to me remote at best. Akin to my groceries, which I pay cash for, plummeting in price. I want this but don’t think it’s possible under the circumstances.

Rates may have at least suppressed price increases. Give it some more time. I think eventually prices will fall some.

Not trying to insult anyone and I think people should be free to contract however they wish but IMHO, renting is a loser financially long term in almost every circumstance. You’re basically paying someone else’s mortgage or just paying them. If you can pay a mortgage, you’ll be better off over time even if it costs more, within reason, of course. Plus, you can refinance should rates drop, which likely won’t lower your home’s value. Apples and oranges.

FDS: I would agree with you on that point. Renting, but carrying a mortgage means you are gambling on the price of the house going up. You can also depreciate it year over year for your income tax purposes. However, if you do not have positive cash flow, renting is pretty dicey. (This is coming from someone who does not own any rental property, btw, so take what I say for what it’s worth…) I had a guy once tell me that renting only makes sense if there is no mortgage.

Doing some rough, public math (which is always dangerous) Say you have a house you bought $350k for cash. Furthermore, assume you can rent it out for $2200/mo. Over the year, you will collect rent that produces a 7.5% yield. (Assuming no expenses, for simplicity.)

That is not too bad. Can you find a stock/basket of stocks that yields 7.5%? Maybe. Annuity? Maybe. Bonds? Ha!

I was referring to buying vs. renting personally. You’re talking about buying and renting it out. Different considerations altogether but I agree with all of your points, except that you are gambling on the value going up. If you have a mortgage and your rental income covers the mortgage nut you agreed to, you’re good. It’s when that isn’t the case you’re in trouble. If you own it outright, the rental income is all gravy. Much less risk/stress. Short term rentals being the best form of this business.

If interest rates very low or are dropping and houses are going up in price and the mortgage payment is similar to renting…buy….

If interest rates are rising and houses are going down in price and the mortgage payment is higher then renting….rent…

plus if you have a down payment you can get 5% return on cash now in the money market…while renting….

another viewpoint…

if you can rent money for near 0% and get 15%…plus the huge leverage… return on house appreciation or 7% in stocks…it makes sense…buy them…

the huge leverage… return on house …it works against you when prices drop too….$200,000 down payment…house drops $300,000…equals 150% loss….

The notion that the roof over your head is fungible with financial investments misses out on a lot of the intangibles of owning a home but then again you’ve been a proponent of van life so those may not matter to you. Furthermore, if you don’t need to sell a home there is never any unrealized loss. The only risk to consider is being unable to pay the payment due to job loss or some other issue and then being forced to sell.

Yes. There is always opportunity cost in any investing.

Of course, when buying a residence (as opposed to an investment property) there are also other considerations beside whether its purchase is the highest and best use of your money and resources. Some might consider planting roots to be worth the added cost over renting.

Leveraged debt indeed amplifies results (whether they be gains or loosed).

You guys are walking on the crazy line.

Outside of the warmongers love & the covidians blindness, This is THE Absolute bat-shit craziest comment I’ve ever read:

“The notion that the roof over your head is fungible with financial investments misses out on a lot of the intangibles of owning a home but then again you’ve been a proponent of van life so those may not matter to you. Furthermore, if you don’t need to sell a home there is never any unrealized loss. The only risk to consider is being unable to pay the payment due to job loss or some other issue and then being forced to sell.”

…There’s just no reasoning with that.

‘Buyers Are No Longer Willing To Pay Those High Prices And Offers Are Coming In Below The Asking Prices’

http://housingbubble.blog/

“…We’re at a permanently high plateau”? Psft.

Try sleeping in a T-bill.

I should not have said, “THE Absolute bat-shit craziest comment” it was not. Nor said you guys were walking the crazy line, that was not civil.

You guys being Freedomistas, I hope you all have a great day.

See also:

“Many errors in discussions of utility stem from an assumption that it is some sort of quantity, measurable at least in principle.” …

https://mises.org/wire/subjective-value-not-arbitrary-value

Also,X2, in the background: WWIII, and all which springs from that.

I’d be curious to know what you think that all means specifically in the context of these comments.

I would make the purchase decision based on actual need, not the cost of money. You can always refinance later if lending rates decline.

When I bought my house in 1981, I had to pay 16% (+ 1/4% PMI) for mortgage money, which was a “bargain” at that time. The payment on a $60,000 note was $810.

The decision to purchase was the best one I have ever made, financially. Based on my experience, when the cost of money declines, the cost of property increases. You can renegotiate the financing, but not the purchase price.

Agreed Mr. Adi! I worked with a guy once who described just what you wrote. He bought his house in the early 80’s with sky high interest rates, and refinanced a number of times. Dont know how many times, but his words were, “Every time the rates went down, I refinanced.” Around ’05, when we had this conversation, his house was north of $1M.

There’s another wildcard: Property tax rates. Houses in NY are priced cheaper than here in VA, but the property taxes are suffocatingly high in NY, as everyone here knows. So, in looking at a house purchase: three big factors are 1) purchase price, 2) interest rate/financing, 3) taxes

I think the country is making too big of a deal on the interest rates and the unaffordability of American homes.

Sure, some areas of the country are priced ridiculous, but the big difference is many kids today don’t want to move forward. Mom and Dad’s house is comfy…three square meals a day, the lights are always on, and Mom and Dad don’t charge rent.

My nephew is making 2x more than my husband and I were making when we bought our house 20 + years ago. The houses are twice as much. The same goes in reverse in regards to our parents. We were making twice as much as they were and houses were 50% less.

My nephew and his girlfriend are in their mid 20s and they are “content”. She wants to work 15 hours a week and he is fine putting in his 40 hours.

One doesn’t move ahead staying complacent. How many of us even thought of a “work/like balance”. There was no such thing. When you are young one has the energy and time. You work hard now so once you hit your 50s and 60s you can slow down and enjoy the benefits of what you accomplished.

It all comes down to priorities.

> When you are young one has the energy and time. You work hard now so once you hit your [70s] and [80s] you can slow down and enjoy the benefits of what you accomplished.

Yup. 🙂

propping the bubble….

Just recently brandon told the banks to approve all loans…mortgages for the migrants…so the migrant gets a $500,000 mortgage to buy a house….if they don`t pay they will leave them in there….free housing…lol….the migrant could also take out a $500,000 loan to start a restaurant or other business….if they default….nothing will happen…it would be racist…lol….

meanwhile the white middle class has become the poor….and the white poor are on the street in tents….

migrants are traitor slaves…they co operate with the control group..bribed….this divides the slaves to prevent a slave uprising….

higher population = lower wages for slaves…this helps the .00001% owned huge corporations …….more tax and debt slaves….and more trust accounts to confiscate when the slave dies….win win….

Is the manufactured home in the listing from Clayton Homes?

Another Capo Gecko racket.

This morning, with the entire Treasury yield curve from 3 months to 30 years pushing disastrously above 5 percent, stocks opened with a thud and looked ready to crash.

Then Bill Ackman, a hedge fund CEO, posted this on X:

‘We covered our bond short.

The economy is slowing faster than recent data suggests.’

Scylla and Charybdis, bitchez: first you get toasted by runaway interest rates. Then rates fall back cuz the economy cratered into depression.

A lotta guys try to catch her

But she leads them on a wild goose chase now

And she’ll have fun fun fun

‘Til her daddy takes the T-bond away

— Beach Boys, Fun, Fun, Fun

‘Has the current housing bubble popped?’ — eric

To help answer this question, cast your eyes (if you dare) on this stomach-lurching chart of the yield on a 10-year US Treasury note:

https://tinyurl.com/499puffk

Over the 2006-2023 period shown, the 10-year yield sank from 5.0% in 2007 to 0.6% in 2020. Then in a mere three years, it slammed all the way back to 5.0% again.

Mortgages, even for 30 years, key off the 10-year Treasury yield. (The average mortgage gets paid off in seven years or so.) Mortgage rates run 2 to 3 percentage points above the current Treasury yield. They’re at 8 percent now.

By some measures — an octupling of the Treasury yield, a halving of the long Treasury bond’s price — this is the worst interest rate shock in US history.

Like the victim of a severe infrared burn, the US economy is still walking around, chatting, and seems okay. But soon enough, its skin will begin to peel — without which, it cannot survive.

Nobody is in charge. The Uniparty’s priority is to fight proxy wars in Ukraine and the middle east. As their housing equity plunges, the hapless middle class is being looted to pay for these reckless foreign crimes. This is how empires die: gradually at first, then suddenly.

I stand with the Klingons: take our evil rulers out. We’ve had enough. 🙁

The Woods may have received a bit of a reprieve when the plans to expand the express toll lanes on I77 north out of Charlotte to the VA border were dialed back about three years ago by NC DOT and Transurban. The lanes will still happen eventually, but on a much longer time table.

Two hours to Downtown Charlotte would make The Woods an exurb and attractive to people who only have to be in the office 2-3 days a week.

I hope so, Roscoe –

I’ll move if it becomes necessary. I hope it doesn’t. I’d like to remain where I am untilI croak – and then they can bury me out in my field.

The $8000 first time home buyer tax credit (actually a loan) of ~ 10 years ago combined with 3% down mortgages common at the time put a hard floor of $240k under detached single family homes in most markets. That will be a very tough floor to break through since so many Americans’ net worth is tied up in their primary residence, and sinking home values will be politically unpopular.

Here in Texas, the RINOs in charge negotiated a deal with Dems in the Legislature to kick the housing bubble can down the road another two years by spending the state’s current budget surplus on property tax “reform”, temporarily increasing the homestead exemption and reducing tax rates to get everyone through the next election cycle with their jobs in Austin secure until the 2026 trim notices get mailed out.

Yes. This will keep values inflated until 2026. I bet they kick it again. Housing prices in Texas are going to remain elevated. That property tax deform is horrendous. I can’t wait to vote against it.

The “reforms” will pass. Many people don’t understand the implications of the propositions on the November ballot, and turnout will be light.

The really outrageous one IMHO is Prop. 7, which is essentially a giveaway to Capo Gecko to further his efforts to involve his other rackets in the all EV future as well as his ongoing dream to take control of the Texas energy market.