Crony capitalist electric car company Tesla announced this week its plan to raise about $1.5 billion in junk bon offerings to fund production of its newest electric sedan, the Model 3.

The debt offering marks Tesla’s debut in the junk-bond market and the company will start roadshows on Monday.

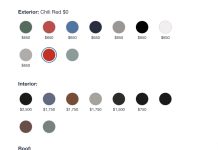

Tesla is counting on the Model 3, its least pricey car, to become a profitable, mass market manufacturer of electric cars.

Following the announcement, Standard & Poor’s reaffirmed its negative outlook for the automaker and assigned a “B-” rating for the bond issue – deep into junk credit territory. S&P also maintained its “B-” long-term corporate credit rating on Tesla.

The rating agency said the overall company’s “B2” rating was supported by the fact that if Tesla ends up in serious financial trouble, its brand name, products and physical assets would be of “considerable value” to other automakers.

Tesla shares fell 0.5 percent to close at $355.17.

At the launch event, CEO Elon Musk said the company would face “at least six months of manufacturing hell” as it increases production of the Model 3, which has a $35,000 base price.

Tesla’s cash burn, expected to top $2 billion this year, has prompted short-sellers like Greenlight Capital’s David Einhorn to bet against the company.

Musk said last week the company was considering debt to expand cash on hand.

Goldman Sachs, Morgan Stanley, Barclays, Bank of America Merrill Lynch, Citigroup, Deutsche Bank and RBC are the bookrunners on the bond offering, IFR reported.

Edits… words in all caps need to be changed in the actual article… yours truly, TL.

Crony capitalist electric car company Tesla announced this week its plan to raise about $1.5 billion in junk BOND offerings to fund production of its newest electric sedan, the Model 3.

As of right now, Tesla’s market cap is 7 billion higher than GM’s market cap. Let’s see how Uncle’s favorite two lemon stands fare in the crony agora going forward.

Is that Ivanka standing next to him?

If the company ultimately fails we’ll get to see just how much Toyota owns since they’ve been coy even admitting they have a dog in the hunt when it comes to Tesla.

He evidently didn’t offer “lawmakers ” a sweet enough deal to get that $4B bailout that had been presented to them.

He’s unaccustomed to greasing palms if the greasee isn’t of a certain fiscal class.

Just to show how dedicated EM suckers are though, the stock price only fell a half percent. Any other company would have taken at least a 10 percent hit if not more.

At least this is a free market way of doing things. I can respect issuing bonds and allowing the market to rate the risk and set the interest rate appropriately.