There’s one simple – inarguable – fact about Bitcoin and crypto in general that ought to give everyone a moment’s pause. It is that no one can explain it intelligibly in less than 10 minutes – if at all.

Anything opaque that ought to be readily understandable is inherently suspect. Not necessarily bad – but suspect. Cryptic contracts filled with legalese which even intelligent people who can read and understand Shakespeare cannot understand, for instance. Time-share spiels. There are many such examples.

Money ought not to be among them.

Everyone understands that money is a medium of exchange because everyone understands that you can exchange money for something that isn’t money. That money has value precisely because other people are willing to accept it – whatever its form – in exchange for that which is not money.

In this sense, Bitcoin and crypto generally qualify as money since people are willing to accept them in exchange for things – goods and services – that are not money.

So far, so good.

People also accept Federal Reserve Notes in exchange for goods and services. They do so because they believe they are receiving money – which has value to them because they, in turn, can exchange it for goods and services as well.

Neither of these forms of money has any intrinsic value, however. Absent the willingness of people to accept Federal Reserve Notes in exchange for goods and services, all you’ve got are pieces of paper that have next to no value at all, in and of themselves.

With crypto, you haven’t even got that.

The problem – the danger – with both of these forms of money, then, seems to be that they only have value to the extent people are willing to accept them in exchange for things that do have intrinsic value; i.e., goods and services or any other tangible thing (such as land).

Both crypto and Federal Reserve Notes have another – dangerous – commonality that relates to their having no intrinsic value, as such. Both being created things of no intrinsic value of which a potentially limitless amount can be easily created – presto! – by those in a position to create them.

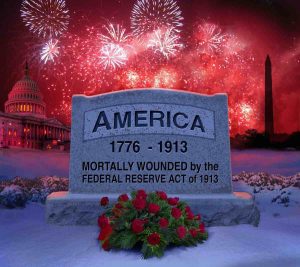

The Federal Reserve has a legal monopoly on the creation of Federal Reserve Notes – those pieces of paper that have no intrinsic value in and of themselves. And it has the ability to create as many as it likes.

The more of these “notes” the Fed creates – “issues” is the term the Fed prefers to use, to imply there is a fixed amount and that the “notes” are merely being . . . issued – the less the value of the “notes” already in circulation, since more of them are chasing fewer goods and services that do have intrinsic value, both because they are intrinsically valuable for whatever they are and because it is not possible to simply “print” more goods and services. The limited supply of goods and services imposes a kind of floor on the devaluation of these things whereas “notes” can be devalued to worthlessness via the simple act of making more of them, presto-style.

There is no legal monopoly on the issuance of crypto – but it does seem to be under the control of cryptic entities; enter the difficulty explaining where crypto comes from and who controls it.

Then there is this business of “mining” it – which is as understandable as quantum mechanics. How does one “mine” something that has no physicality? Who, exactly, is “mining” it – and how do we know that whatever-it-is that’s allegedly being “mined” actually is – or even exists, at all?

We go on say-so. So long as people say they are willing to accept crypto as money, then it functions as money.

But it is not at all clear how crypto is a sounder form of money than Federal Reserve Notes because it appears to be just as subject to devaluation by dint of printing (or “mining”) more of it. Some proponents say there is a set limit to the quantity of crypto that can be issued that correlates to the “mining” of it. But if you understand – or can explain – this, you are a smarter man than I am.

Perhaps the most worrisome thing about crypto, though, is precisely related to the thing which has made it so attractive to so many.

It is – so it is said – “decentralized” (i.e., not under the control of some centralized government-corporate nexus, such as the “Fed”) and thus represents a return of control to the average person over his financial affairs – as well as anonymity. Again, so it is said.

But it is, it actually?

Crypto is issued by . . . whom, exactly? Due diligence prompts the wanting of – the needing of – an understandable answer to this simple question. And anonymity?

Cash – even if fiat – is inherently anonymous because of its physicality. A dollar bill is one of trillions – literally – and not tied to any specific individual. So long as the individual can exchange a dollar bill for goods and services without having to also produce identification and have the exchange recorded, the exchange is completely anonymous. No one else knows you fed a dollar bill into a soda machine in exchange for a can of Coke.

And if you receive dollars in exchange for your goods and services – or as compensation for work – no one else knows the exchange has been transacted, absent any requirement that it be recorded and the parties to it identified.

Cash also has the intrinsic value of being the support of a black market in goods and services as well as the exchange of labor, etc. Put another way, physical cash is an effective way to keep the government out of your financial business – and the push to eliminate it in favor of some form of digital money speaks volumes about the government’s motives in that respect. If money becomes digital, it is no longer physical and so no longer anonymous. The Internet will know you bought a can of Coke – the moment you bought it. It will know everything about every exchange you and everyone else makes.

How, then, will the government not also know of it?

Which circles us back to crypto, which is necessarily digital. Which ought to give everyone a moment’s pause. Are we quite sure we want to trust in the assurance that it is “decentralized” and “anonymous.” That we want to buy into a medium of exchange that is inherently suited to eliminate anonymity?

Perhaps not. “Blockchains” and “wallets” and such. But I wish someone could explain how, exactly, this works – and in a way that anyone of average intelligence could easily understand.

Until then, I remain on guard – and prefer money I can hold in my hand and (ideally) which has intrinsic value, such as that based on (or which actually is) silver and gold, actually mined – and which cannot be mined in unlimited quantities by cryptic centralized “issuers” thereof.

. . .

Got a question about cars, bikes or anything else? Click on the “ask Eric” link and send ’em in! Or email me at EPeters952@yahoo.com if the @!** “ask Eric” button doesn’t work!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

Nice, but longish, article on why crypto and NFT are bad and will fail

https://antsstyle.medium.com/why-nfts-are-bad-the-long-version-2c16dae145e2

The article you posted makes zero sense.

Gold and silver coins do not — and will not ever — require a power grid nor a computer network to be useful.

No pro crypto person has ever been able to deal with the fact that no computer memory device can last on the scale of time simple silver or gold coins can. Furthermore these cyrpto currencies all have an effective end date as people die with their passwords and hardware fails. The coins are gone forever. Silver and gold, even if ‘lost’ are often found eventually.

The plans they weave:

“… Democrats, have introduced the “Electronic Currency And Secure Hardware Act” (ECASH Act) that does far more than just creating a digital currency. This Act cleverly strips the Federal Reserve of its authority to create the money. […]

There will be no centralized ledger or distributed ledger for it will be non-traceable thereby better than crypto. It is to utilize secured hardware software and it’s issued by the Treasury which eliminates the Federal reserve putting the creation of money in the hands of the White House. They are clever for this will be fully anonymous transactions just like paper money today rather than Blockchains that are designed to track every transaction, which means the government can therefore tie every transaction to the sender and receiver.” …

https://www.armstrongeconomics.com/world-news/taxes/ecash-bidens-attack-on-the-financial-markets/

I have computer programming experience and read alot about crypto… but I gave up at some point because I couldn’t easily find all the details… and I didn’t look at the computer code they run.

I think Eric is 100% spot on. It’s all about WHO CONTROLS the currency. That’s what defines a currency — it is an agreement among the people that use it, and it must be controlled by the people, otherwise it’s bad.

I think the RIGHT way to do a new currency would be to simply have a new bank system, and some kind of cash as soon as possible, but it could be digital-only at first just to get started, and the bank is owned by the people and the people vote on everything the bank does (besides day to day operations). This prevents all corruption.

They setup crypto like a stock market, so you could lose ~half the US Dollar value of your crypto in a matter of a few days, it’s very unstable. They COULD have set it up to be tied to the US Dollar 1-to1, so that you would never have to worry about holding crypto, and this would’ve made it easier for everyone to transition from US dollars to using crypto… but they didn’t. Why? I think because they wanted to make US Dollars on it, IMO they were greedy.

I think the whole “mining” thing, where the miners have to brute-force decrypt a hash/encryption file, is stupid — it wastes electricity etc, instead, they could just give each miner a fixed percent of the transactions based on how many they can process. And all the miners should be able to vote on all major changes to the algorithm/system, instead, as it is now, they have some kind of “developer board” — so it’s kind of a dictatorship which is bad.

IDK if the encryption they use is truly strong enough nowadays either, but whatever. And there’s too many ways for “hackers” [gooberment] to steal peoples’ money. It’s too insecure. Whereas a people-owned bank can simply replace your stolen money, so 100% of your deposited money is guaranteed safe, even if you have $billions in your account.

So I don’t like crypto at all personally, it’s all unnecessarily TOO COMPLICATED for no good reason, however “Monero” sounds like the only good crypto to me just because it is anonymous. Apparently ~none of the other crypto coins are anonymous.

Hi Eric, et al,

One thing about Bitcoin is that at its very core, it is a non-coercive medium of exchange. Such cannot be said of FRNs or any officially state sanctioned currency.

Next, very few things that have been used as money have intrinsic value, including gold. There’s a very relevant discussion of a related subject in Ammous’ book, The Bitcoin Standard. He relates that the only resource humans have, and a limited resource at that, is time. Individuals have allotted some finite amount of time that can be used to accomplish goals. Other things like gold, oil, etc. are simply raw materials or input to production. So, with enough effort, say, the stock of gold can be expanded or the stock of oil…..Bitcoin is fundamentally different….it, and not the other alt-crypto currencies, has a limit of 21 million coins by 2140…..that limit will never be exceeded. I’m no more intelligent than other readers in our community and I understand the potential of Bitcoin.

In the situation where we have no electricity and no internet, neither gold, nor FRNs, nor CBDCs or anything will have value. Ammunition, food, medicines and whiskey will have great value…..the trouble is, I have no interest in living in such a world.

The events unfolding right now are unprecedented in the history of the human race. If things go wrong, we are all toast. That’s what the sheep fail to understand. All the cancel culture in the world will not protect the sheep from what they have supported….the problem we all perish in the process.

P.S. – great column as always, and particularly a great community of commenters with thought provoking ideas….

Morning, Giuseppe!

I agree crypto isn’t coercive… yet. My worry – my fundamental dread – is that crypto has the potential to become the most coercive form of “money” ever devised. It would enable whoever controls it – and that’s not us – to utterly control our finances. Not one “dollar” escaping taxation. Every “dollar” subject to tracking. They – the issuers who control it – would know every last detail about every transaction made and would have the power to direct/restrict/eliminate our ability to transact.

I understand some say that Bitcoin is the way to prevent such – but I don’t see how given we don’t know who controls it and in any event, we certainly don’t!

I disagree with you regarding the value of silver and gold; these have always had value – and served as a medium of exchange – for all of recorded human history, in part because they have intrinsic value (other uses besides as a medium of exchange) and because everyone recognizes their value, which derives from their relative rarity as well as the extreme difficulty (and expense) involved in actually mining a substantial quantity of new gold/silver, which is a built-in check upon inflation.

I also don’t understand this:

“Bitcoin is fundamentally different….it, and not the other alt-crypto currencies, has a limit of 21 million coins by 2140…..that limit will never be exceeded. ”

How so? What is to prevent more Bitcoins from being created? They are after all just digital “widgets” with no physical reality and – unless I am missing something – more can just be keyboard-tapped into existence, just as I am typing more letters to complete this sentence. Isn’t the purported limit essentially a promise to limit?

Perhaps I am missing something?

The simple answer is that a bitcoin is a number. In order to be a bitcoin, that number has to have certain qualities. If, for example, the rule were that the number cannot contain zeroes, and the sum of the digits must equal 9, then there are a very limited number of “bitcoins” : 9, 18, 27, 36, 45, 54, etc., ending with 111111111.

The rules to be a real bitcoin are much more complicated, and the reason that the limit is expected to not be reached until around 2140 is that computers are not expected to be powerful enough to be able to solve for the last few until then. The whole point of this complexity is to make additional “bitcoin” be “found”, “mined”, “issued”, whatever term you like, at a slow, reasonably predictable rate, so, inherently stable.

You are correct that it will be a perfect ledger of every transaction. Once you are linked to your “wallet”, if they have one of those centers which have been trying to add transactions to the blockchain, they will be able to figure out every transaction you have ever engaged in. The same advances in computing that bitcoin is counting on will also work against securing the privacy. Your only security will be to not be worth them putting the effort into. So have a good social credit score, Citizen. If you have nothing to hide…

In short, the problem with bitcoin is not in the theory. The proponents are correct there. The problem is that they vastly underestimate the foe…

Exactly Steve. If you think the ptb haven’t thought of controlling your transactions in THEIR cyberspace, you’re not thinking. They haven’t spent years attempting control over the internet just to let a decentralized currency take over.

Think about google. It’s not hard to come up with an idea of how they control your transactions when the way to transact is 100% reliant on cyberspace.

100% internet dependence is the fatal flaw of bitcoin. Unless it’s no flaw at all. Hint, hint.

I was thinking about this: “because they have intrinsic value (other uses besides as a medium of exchange)”.

By that definition paper (cotton) U.S. Dollars and clad coins have an intrinsic value.

A person can use a paper U.S. Dollar to: wrap things up in; use as a note pad; used to help light up a fire; convey an object across a room between the wings of a folded paper airplane; formed into a funnel & used to control a flow of a liquid or small solids into a container; folded as a wedge or shim to prop things up or level them. A clad coin can be turned into a washer or tossed into a well for entertainment. There’s probably many other uses. The word ‘intrinsic’ seems unsuitable to define a difference between gold & U.S. Dollars.

Also, not everyone recognizes the value of gold, per the infamous Mark Dice video of offering a gold coin vs. a candy bar. So, the difference between gold & paper Dollars narrows further.

I posted a link discussing how extreme difficulty (and expense) involved in actually mining a substantial quantity of new gold/silver, does not, by itself, equal value, else a counterfeit gold coin would have value.

On the surface, this seems true: “actually mining a substantial quantity of new gold/silver, which is a built-in check upon inflation” it may be more of a limiter than a check. See for example what happened to prices when Spain managed to ship the bulk of Inca & Aztec gold to Spain.

Just some thoughts.

Digital E-money seems to be, “money unbacked by savings”. …

https://mises.org/wire/central-banks-have-broken-true-savings-lending-relationship

Perhaps, that is what differentiates gold from U.S. Dollars? Gold represents savings, and, per the link above, most U.S. Dollars do not represent savings, nor do E-dollars.

Hi Helot,

It’s true, certainly, that paper has some value. Just not much. A silver ounce, on the other hand, has more value than about 30 dollar bills. And an ounce of gold, more value than 2,000 of them. That value is much more intrinsic – because while you can mine/smelt more silver and gold, it is very difficult to do so, because silver and gold are difficult to find and cannot be created. Anyone can find or even make paper, fairly easily – and paper will rarely be worth more than its value as throw-away material.

Silver and gold have great value – universally accepted – as precious metals as well as stores of value/as money.

RE: “A silver ounce, on the other hand, has more value than about 30 dollar bills. And an ounce of gold, more value than 2,000 of them.”

Those are subjective values, that’s why some people choose the candy bar over the gold coin in the Mark Dice video.

Currently, I value 30 Dollars & 2000 Dollars more than I value a silver or gold coin, I would use those Dollars to buy other things, such as roofing material, which I currently subjectively value higher than the Dollars.

The pesky differences of, ‘the spot price’ + or – ~30% when selling or buying P.M.’s is worth mentioning.

When I read, “as stores of value” perhaps instead the phrase, ‘stores of savings’ is the better term? Stores of value works too though, subjective values.

Is paper easier to make than mining gold? I think about what it takes to make a pencil & I don’t know.

“WE, PENCILSOur Family Tree, as Told to Gary North” …

https://www.lewrockwell.com/2011/08/gary-north/only-liberty-can-produce-a-pencil/

Yeahhhhh, without power and electricity you can bet your ass gold and silver will have value. I mean what?… is everyone going to live like solo-free-for-all-savages forever? “These are my squirrel chunks, devil-woman!” *BANG BANG* dead… really?

In any survival situation, you team up and form communities. The larger the better. And with the knowledge we have now, why couldn’t we conduct electricity at some level? Silver sure does a good job with that. I would absolutely help someone, or hire someone, to help pick off cabbage worms off of my broccoli plants for a mercury dime a day.

We aren’t going to be surviving without working, building, harvesting… and we aren’t going to do it for free. If we do it for free, someone will work less and pass the work off to someone else. If I do more work, and get more silver or copper (or berries-as in bartering), then I’m motivated to do more work and do a better job at it. But the problem with bartering, is a berry isn’t always a berry. One might be moldy, or too unripened. “But it’s a berry, take it!” Not a reliable medium…

Silver and gold are necessary in any economic stage. Probably never more so when civilization collapses… And no one has ever found a better medium of exchange than silver and gold. It’s been around for a VERY long time for a reason. And to spit on our ancestors and deny this is foolish.

Just today, I saw this article about the NFL and crypto/blockchain.

https://www.cnbc.com/2022/03/22/nfl-lets-teams-blockchain-sponsorships-crypto-ban.html

The whole thing is impenetrable, even the nature of the controversies. My one takeaway, though, is that there is a lot of activity and big money moving around in this space. Being that sportsball Inc. is so heavily involved doesn’t give me the “it’s a store of wealth” or “decentralized libertarian currency” vibe. More like how can we milk more money out of brain dead losers who consume our products.

I think a lot of the appeal, and necessity perhaps, relates to the “virtual” worlds these folks are moving towards. A way to spend real money on fake shit in “cyber space” and try to address some of the obvious fraudulent rip off aspects. Seems completely insane to me…

The anonymity is not really a thing. It’s always the weakest link that gives away the game. Since it is a ledger going back to the moment it was “mined”, anyone who has ever had it in his “wallet” is a point of attack to trace that “coin”. If he has declared his capital gains, and he is within a few hops of you, you are as good as made. If the guy you bought something from spends it at Starbucks, you are probably made. The longer the bitcoin has been in existence, and the more widespread the crypto becomes, the worse, in no small part because as it gets broken into smaller and smaller denominations, your transaction may involve the transfer of dozens of “coins”, any of which could compromise you.

I’m with Raider Girl here. Those centers scream Feds to me. I strongly suspect the reason is to get the inside scoop on as many transactions as they can. Since you know when each coin was exchanged, you know how much capital gains should have been declared…

Hi Steve,

We have never met, but you are a brilliant man. 🙂

Here is why I question the authenticity and decentralization of crypto. It wasn’t so long ago that the Colonial Pipeline paid ransomware (in Bitcoins) to those crazy Russian hackers …guess who got it back? Shocker! The Feds! Amazing that the very people that designed the system could so easily manipulate it.

https://www.cnn.com/2021/06/07/politics/colonial-pipeline-ransomware-recovered/index.html

There’s no such thing as “intrinsic value”. Every value is subjective. The definition of intrinsic value the accountant types use is more properly called, ‘ objective market-exchange value ‘ which in turn is only determined by the subjective value.

https://mises.org/library/subjective-value-and-market-prices

See also, “an old photograph of Jill’s grandmother, and ask Jill, “Do you value this object?” …

https://mises.org/library/subjective-value-and-market-prices

Also, “it is wrong to think of value in terms of what labor has been put into a good.”…

https://mises.org/library/artwork-and-subjective-theory-value

A bit about fiat currency, “it is not possible that money could have emerged as a result of a government decree. For the decree cannot bestow purchasing power upon a thing that the government proclaims will become the medium of the exchange.” …

https://mises.org/wire/money-created-government-decree

Consider, “Gold formed the basis for the value of today’s fiat money. […]

Bitcoin is not a new form of money that replaces previous forms, but rather a new way of employing existent money in transactions. Because Bitcoin is not real money but merely a different way of employing existent fiat money, obviously it cannot replace it.” …

https://mises.org/library/bitcoin-money-myth

Electronic money will not replace fiat paper money. The belief that it can stems from a failure to understand the nature and function of money and how it emerges on the market. […]

One could argue that a government decree could enforce electronic money and displace the current paper standard. This would not work, however. Electronic money is merely a device of storing information concerning debits and credits. It cannot acquire any independent purchasing power; it cannot become money itself. It functions in the same way as checks, which cannot acquire an independent purchasing power from money.” …

https://mises.org/library/electronic-money-myth

One related thing I found interesting was, Goldbacks.

https://goldback.com/

I don’t agree with James Wesley Rawles’ views entirely, here’s what he had to say about it:

“This is a new private currency that is literally infused with fractional amounts of gold. The basic premise is sound, but for the Goldback to work, it needs several things:

Great promotion.

A budget to provide staying power, during a long ramp-up.

Consistency of the gold content of the currency, for each denomination.

A government that doesn’t see the Goldback as competition.

Eventual widespread acceptance and use.

Anti-counterfeiting protection features that the Chinese fakers cannot beat.

Any of the aforementioned could conceivably derail this project. Thusfar, aside from some delamination problems, the company seems to be doing a great job. My estimate on their chances of success? Probably only around 25%. Time will tell. But I wish them the best.”

Hope that was useful. Windy rainy day.

“There’s no such thing as “intrinsic value”. Every value is subjective”

Gold and Silver DO have intrinsic value because they both have significantly high value OUTSIDE of their use as money. That value becomes objective by market wide demand for them, as product, not money.

That aside, both are especially useful as money precisely because supply is physically limited. As an economy grows, and production increases, the value of gold and silver money automatically increases. Both of which are of course infinitely devisable. Which could result in the end of “interest”. The money you borrow is worth less than that which you pay back, and the money you lend will be paid back with money worth more.

The bottom line is there is no real down side to pegging money to Gold and Silver, unless you want to make a living off interest rates. It can’t get away from you, because it is physically limited. The very thing the Ivy League MMT economists demean it for. In spite of their delusion that because money can be printed, wealth can be as well.

Like beauty, value is in the eye of the beholder. A.k.a. value is subjective.

You’ve like heard the expression, “Your money’s no good here” which is similar to, “… You see, if you were thrown in the middle of the desert, a pile of money wouldn’t do you any good.” …

https://mises.org/library/inflation-and-value-gold-explained

“… Rothbard’s approach can work for any type of good or service. It doesn’t matter whether the horses were bred for sale or whether they were discovered the day before “for free.” The subjectivist approach can therefore explain the price of Picassos as well as the price of peanut butter.” …

https://mises.org/library/subjective-value-theory

“… the value an individual attaches to a given sum of money or to any kind of good is based on a subjective judgment and is without physical dimensions. As such the value of money varies from moment to moment and between different individuals. The price paid for a good in a concrete act of exchange does not measure the good’s value; rather it expresses the fact that the buyer and the seller value the money and the price paid in inverse order.” …

https://mises.org/library/myth-unchanging-value-gold-0

What can you use Bitcoin for, besides as a medium of exchange?

That’s right, nothing.

What can you use gold or silver for, besides as a medium of exchange? These substances have like a dozen actual industrial uses each, which go well beyond mere “decoration.” And decoration isn’t such a bad thing anyway–humans consistently like, appreciate, and value shiny things. This is true across basically all of time and throughout basically all cultures. It may be subjective, but it’s also pretty constant.

Can you polish up a bitcoin so it sparkles and looks pretty when it catches the light? Didn’t think so. Not interested.

Hi Publius,

Gold and silver have reality to recommend them. An ounce of silver is an ounce of silver. It exists physically. It cannot be inflated. It cannot be “cancelled.” So long as you possess it, you have it and no one else does. Everyone recognizes its value, independent of some centralized entity (such as the Fed or the Internet). This may increase or decrease but it is unlikely to ever experience the swings that paper/digital currency are susceptible to and is extremely unlikely to ever become worthless, which paper money always has, in time – and digital likely to as well.

It’s also anonymous as such – and so a guarantor of privacy. Americans – people generally – would be so much freer if their financial affairs were as opaque to the government as crypto is to most of us!

Great article aEric:

I believe I understand the argument for crypocurrency is that its value is controlled by the fact that there are a finite number of solutions (coins) available. This makes it more valuable that Fiat currency (which can be created in infinite amounts).

I get that part. What I don’t get, is what makes one cryptocurrency better than another?

OK – so Bitcoin has a finite number of coins that can be created – or mined. Great. The number of competing cyrptocurrencies that can be issued is infinite. So why is one more valuable than another?

Why is Bitcoin better than any other crypto? Is it name recognition alone? What is to stop other competing currencies from taking market share away from bitcoin?

Until someone can explain this – I just don’t get it.

RE: “So why is one more valuable than another?”

Like anything else, it’s simply a matter of subjective value.

I still have a checkbook account. My checks have an image of a tropical beach on them. The checks my neighbors have are just blank with text. As with ‘Jill’s photo’ in the link above, my checks are of course more valuable than my neighbors because they are pretty,… right? See where that’s goin’?

Our money is based on debt. Therefore, it is based on servitude towards that debt. Your children were born into slavery same as the Matrix. Just as in the Matrix, we live in a dream world of imaginary wealth borrowed from the human energy/effort of others…future others who will have to pay the piper.

Bite-me expanded the money supply 40X+ since February 2021. Yep, Trump never saw a deficit he didn’t like, Obama more than doubled the national debt so did GW. Money is printed right now by the Fed by buying the government bonds created out of thin air. Stop the borrowing equals stopping the printing of money. Will congress live within the tax revenue collected…never. Fed can also stop buying bonds and other securities on the open market, raise interest at the discount window equals less loans due to price increases. Means recession. However, if we had a recession that was short and corrected things from cheap money chasing endeavors that should never had started like HUD funding, then it might be worth it. But it wont.

The dollar was fragile. Bite-me just crashed it into a light pole by decree of using it as a tool against the guy who stole the 2016 election from them by declining petro-dollars to Russia. There will be other means of exchange created easily around the dollar then comes another recession.

Bitcoin was interesting when it was trading at $100. Once the Chinese speculators blew it up it became this mythical thing.

I compare the blockchain to something like Western Union or a money order. When you transfer money via Western Union they don’t actually move money from the 7-11 in Carbondale to Guadalajara, they just recorded that you gave them some cash, and that someone you designate will pick up the equivalent amount that is kept in Mexico. Both sides have to trust that Western Union will honor the transaction. If Western Union screws up and loses the record of the transaction in Carbondale you’ve got a paper receipt. As long as you don’t lose the receipt you can file a complaint or even bring in a third party (the police, etc).

The difference between cryptocurrency and Western Union is that anyone can confirm the transaction took place because the record is available publicly. Your “wallet” holds the receipt of the transaction, as does the other party. As long as you have the wallet, which is a very long string of numbers that equates to an address, you can recreate the transaction as proof. That transaction is coded forever in the blockchain.

Really pretty boring stuff, except that people decided to make it a bubble.

RE: “I compare the blockchain to something like Western Union or a money order.”

Very good. In other words, just a check.

Let me give the quick explanation a try, since I work with cryptography a lot.

Cryptocurrency is a database which tracks all transactions that have ever happened since its creation. This database is called the “block chain”. It’s different from a normal database, in that it’s not controlled by any one entity, but by all the miners who try to make a buck by “mining” it. Mining involves some fancy math which secures the database from fake transactions, to keep bad miners from cheating.

I’m a big believer in cryptocurrencies. Bitcoin is now solid, ETH can be half trusted, and the rest are all, without exception, complete garbage. Both BTC and ETH are useless for transactions, they’re just good for storing wealth. One day, BTC will power inter-bank reserve exchange, and there will be banks willing to let you spend BTC quickly and easily, but this is way off.

Hi OL,

OK, but who is behind the database? It has to be someone – or some thing. Who or what, exactly, remains very opaque – which bothers me. It echoes of the equally opaque origins of Facebook. Especially in view of the fact that – clearly – there is a push to eliminate physical money in favor of digital. By making this seem “cool” and “with it,” it makes the idea more appealing, especially to the youth. Per Sam Adams, I smell a rat.

And this “mining” business? How does one “make a buck” by “mining” transactions on the “blockchain”?

It all sounds very scammy to me. Like one of those multi-level marketing schemes.

We’ll get into more details then.

The database is distributed. Every single miner has a copy of the entire database – millions of copies. Governments can remove some, but not all, of these. Mining ensures that the database copies at each miner agree with each other, so that one miner can’t steal cryptocurrency. Mining involves solving a very difficult math problem which can’t be cheated, and all the miners compete to be the first one to solve this problem and “sign” a block of transactions. Once they submit a proposed solution, every miner checks it. If the math doesn’t add up, that miner is ignored, so that’s the incentive not to cheat. Miners spend a lot of money on power and equipment to do this math, so they need to be paid, and that’s via rewards and transaction fees. When a miner solves the math puzzle, they’re allowed to give themselves some cryptocoins from thin air (block rewards), this is how coins are created. More stable cryptos, like Bitcoin, now have very low rewards and they’ll completely drop off. So, lacking rewards, you must include a transaction fee in your payments, “I want to pay $10 to Eric, so here’s $10.50”. The miner who includes your transaction in the block sends you $10, and keeps the $0.50. It’s up to the sender to give a transaction fee, and miners will pick transactions to include in the database which maximize their profit. Cheap transactions can take months to settle, those with big fees settle quickly.

The whole system is as strong as the number of miners that are working to secure it. If someone can mine fast enough, to be faster than all miners put together, they can take control of the database and modify it however they want, this is called a “51% attack”. At this point, Bitcoin and maybe Ethereum are immune from this attack due to the number of miners, but nothing else is.

It’s not scammy, but it’s a young technology and bugs will happen. So far, the only cryptocurrency which has not done shenanigans with transactions is Bitcoin, which is why it’s so valuable – it’s well established now. If you have the time, read this article, it really is an excellent analysis from a solid Austrian economics perspective.

https://vijayboyapati.medium.com/the-bullish-case-for-bitcoin-6ecc8bdecc1

That is a long article. I scanned through it, I didn’t see how this point was disproven:

“[Electronic money] cannot acquire an independent purchasing power from money.” …

https://mises.org/library/electronic-money-myth

“The database is distributed.”

Where and how?

“Every single miner has a copy of the entire database”

Who are the “miners” and how is it a good thing that they possess all of a user’s financial data?

“Governments can remove some, but not all, of these.”

Why would Government “remove” them rather than exploit them?

“Mining ensures that the database copies at each miner agree with each other,”

How? And who are the “miners” again?

“so that one miner can’t steal cryptocurrency.”

Why “steal” it when they can just generate more out of phase-space?

“Mining involves solving a very difficult math problem which can’t be cheated,”

Okay, I’m just going to have to call 100% bullshit on this bullshit. You’re spouting idiotic junk techno-babble. MOVE!

“…and all the miners compete to be the first one to solve this problem and “sign” a block of transactions.”

Pure bullshit. Dumb bullshit. Idiocy. Just stop with this nonsense. Stop.

“Once they submit a proposed solution, every miner checks it.”

WHAT ON GOD’S GREEN EARTH ARE YOU BLATHERING ABOUT?

“If the math doesn’t add up, that miner is ignored, so that’s the incentive not to cheat. Miners spend a lot of money on power and equipment to do this …”

WHO ARE THE “MINERS”? Please do tell before going on any further about your cyber-punk fantasy nonsense.

“When a miner solves the math puzzle, they’re allowed to give themselves some cryptocoins from thin air (block rewards), this is how coins are created.”

Who devises the “puzzles”? Who “grades” the “answers” by the “miners”? This is all such insufferable bullshit.

“The whole system is as strong as the number of miners that are working to secure it.”

Who are the “miners”? Who are they and why do you trust them?

” If someone can mine fast enough, to be faster than all miners put together, they can take control of the database and modify it however they want, this is called a “51% attack”.”

Hahhahaha. I’m done. LOL. Just, LOL.

“At this point, Bitcoin and maybe Ethereum are immune from this attack due to the number of miners, but nothing else is.”

I don’t believe you and I think you are a liar. See how that works?

“It’s not scammy…”

You’re wrong about that. It’s not just “scammy,” but is One. Hundred. Percent. Bullshit. Bullshit.

“but it’s a young technology and bugs will happen.”

Color me shocked.

“So far, the only cryptocurrency which has not done shenanigans with transactions is Bitcoin…”

Bitcoin IS shenanigans.

“…which is why it’s so valuable…”

It’s worth nothing. Zero. No value.

“…it’s well established now.”

So you’re saying we missed the “ground floor”?????? NOOOOOO!

“If you have the time, read this article, it really is an excellent analysis from a solid Austrian economics perspective.”

Not a fucking chance.

Damn Counselor I wouldn’t want to get in an argument with you. You seem to have a real knack for it. I take back what I said about all lawyers and the ocean. I was obviously wrong.

…they’re just good for storing wealth.

Just pray you always have electricity and internet (the government can shut this down during an “emergency”) The two things that will undoubtedly be compromised when SHTF. I’ll stick with gold and silver as a store of wealth. It has a track records of thousands of years.

“Fiat” of course means “by decree.” Characterizing Bitcoin and other cryptocurrencies as fiat serves only to exacerbate the confusion. There is no coercion. All parties are acting voluntarily.

Several years ago, while on a business trip in the Philippines, I bought a few bitcoins from a graduate student whose pipedream at that time was to start an off-grid self-sufficient homesteading community in the mountains with their own non-government currency.

We agreed not to share our real-world names, and we did not use an exchange. The system took about five minutes to complete the transfer from his wallet to mine. Admittedly neither he nor I would have been able to explain the mathematics involved. But It was peer-to-peer, anonymous, and voluntary.

Bitcoin’s value as a medium of exchange for me as a traveler was being able to cross international borders without having to worry about TSA shake-downs, having to declare monetary instruments in excess of $10 K, or civil asset seizures.

For long-term store of value with less volatility, the precious metals are superior, of course.

Thanks for the correction, Mack – I adjusted the wording accordingly!

It seems to me that Bitcoin/cryptocurrencies are INTANGIBLE but not necessarily FIAT, “fiat” meaning “command,” that is, “FORCED” into existence through “legal tender” laws. A fiat, or “commanded into existence” unit of account can manifest as either physical paper notes/base-metal tokens or “digital” form, as entries in a bank’s ledger.

A cryptocurrency is of NECESSITY intangible, but not necessarily FIAT. “Fiat” and “intangible” shouldn’t be conflated or confused.

Language is the means by which humans parse reality – precision in the definitions of words enables clear thought on this or any other topic. Tyrants routinely hide behind vague language.

I wonder if the powers that be will allow us to exchange “our” CBDCs for various PM’s made from Au, Ag, Pb, Fe and wondrous concoctions of Cu and Zn? It looks like it’s time to learn to barter to save what little privacy we have left.

OT but Ivermectin Joe is now thankful for the career bureaucrats and spooks a.k.a. The Deep State for keeping us safe from Senile Joe.

https://www.mediaite.com/podcasts/joe-rogan-defends-deep-state-do-you-know-how-fcked-we-would-be-without-them/

I think cryptocurrencies are gov’t originated and currently in a beta test phase. They let them “float” against current fiat. It’s like gambling. You might make “profits”, which they tax. Next step is to illegalize all competitors to the central bank digital currency, which then become worthless. Then they go cashless and utilize blockchain tech to implement social credit scores. The WEF and every country, including Russia, are all in on this.

Anon,

I’m with you; the gov’t HAS to take out crypto! Why? Because if it’s as anonymous and decentralized as its devotees claim, then it undermines too many gov’t objectives, mainly that of monitoring and controlling us. China’s already gone after BTC, and the US gov’t is making serious noises about doing the same. Sen. Elizabeth “Fauxcahontas” Warren, who chairs the Senate Finance Committee, has already made serious noises about going after crypto. It’s only a matter of WHEN, not if, the US gov’t follows China’s example.

Morning, Mark!

Given what we know – and don’t – about crypto and FRNs – I think the soundest policy is to transmogrify as much of our money into hard money or things which have tangible value, under our control.

Trusting anything that isn’t under your control when it comes to assets strikes me as foolish.

Indeed, if you can’t reach out and physically touch it, you don’t own it.

You should check out some of the videos/stories out there about these virtual worlds like Metaverse. People are spending real money to buy stuff in cyber space. Via cryptocurrency. Seems cra cra to me, too…

I agree, Eric. I need to move my funds in to things under my control. JK is right; if you can’t physically touch it, you don’t own it.

I was on the fence about crypto until recently.

The good:

You don’t need a bank

Doesn’t run through the fed, swift, or any other “controlled” system

It can be anonymous if you have your own wallet or multiple wallets & buy in certain ways

Extremely difficult to lock out an individual or even a network (ala Canadian bank accounts & Russia)

Limited total amount

The bad:

Needs electricity & connectivity

can be lost if not careful

Can be traced with enough resources

Slow-ish

Not as convenient as cash

It is ultimately fiat

Ultimately, I don’t trust the govt to not pull a Trudeau, even for something you typed years ago.

I am in the process of emptying my bank account and turning it into cash, metals, crypto, and anything else of value.

Crypto is confusing. This may be due to the overly nerdiness of it & govt/media ignoring it.

This has also proven to be a strength as adoption has increased without govt interference.

Read a story of a person in need of car repairs in the worst way, a friend offered to help by spending a Bitcoin to pay for the cost of the repairs. The mechanic accepted the payment, which was worth about 3500 USD at the time. Somebody made some money.

The friend probably had more than one bitcoin than the one offered.

Cryptocurrencies are traded on the exchanges, they’re an equity. A financial website will have them listed, go for the one dollar cryptocurrency ticker.

“Getting the story on a company is a lot easier if you understand the basic business. That’s why I’d rather invest in panty hose than in communications satellites, or in motel chains than in fiber optics. The simpler it is, the better I like it. When somebody says, “Any idiot could run this joint,” that’s a plus as far as I’m concerned, because sooner or later any idiot probably is going to be running it.” – Peter Lynch

https://quoteinvestigator.com/2010/05/31/any-idiot-can-run/

Invest in metals, no-brainer there. A corporation like Rio Tinto would be a good investment, not cryptocurrencies.

Any idiot with a lick of sense can see that metals trump cryptocurrencies.

Steel, copper, lead, specie silver coin, junk gold, some. Nickels galore, 95 percent copper pennies, save those. You know, money that is real, you can see it, it’s there.

Plenty of cryptocurrencies out there.

Isn’t a share of a stock about the same? You have a piece of paper that says you own xyz shares of Engulf and Devour, Inc. If Engulf and Devour, Inc go through bankruptcy then receivership, you’ll cry.

Venmo could possibly tie up all of the money in the world, you can’t get cash with venmo, everything is traced, you receive a receipt in your email.

The banks would freak if everybody had a Venmo card/account and deposited all of their money into Venmo accounts. Just transfer enough to a bank account to get cash, otherwise, all the money can be in Venmo accounts. Maybe far-fetched, don’t know if it could happen, but it might.

Venmo then becomes a cryptocurrency.

The closest thing to crypto in the real world is Berkshire Hathaway BRKa. You can buy one share today for the asking price of 447,000 USD, one chart says 525,000 today, who knows.

Says everything about hyperinflation.

Only 1.5 million shares outstanding, something like that. Has never split.

You could buy one share back in 1991 for 8,000 dollars.

If the power goes out, you’re out of luck. Maybe have a solar array to charge your phone battery, no global internet by then. Too bad, sucker. All your digital coin to us belong.

Confiscation of goods and it looks like nothing happened, a swindle nonetheless.

No matter what it is, better have it all down in writing.

Plunk down a gold double-eagle next to 19 one hundred dollar bills, your choice.

Which one do you accept as legal tender? Obviously, you pick up both the gold and the clownbux, another no-brainer. har

“…crypto, which is necessarily digital.” -Eric

Recently when oat milk boy over there in Canada began freezing citizen’s bank accounts, one of the MSM talking heads hosted a “crypto expert.”

Said expert held up his Google device (aka “phone”) and rattled off some dot coms’ apps that would handle all the crypto for the uninitiated. Dump your bank, do the crypto!

No matter your hardware, your cell provider and/or your ISP a can shut you down or take over your account or turn it over to law enforcement, overtly or covertly. Google or Apple would be glad to help out.

Some authority having coercive power, legal or criminal, could hand a note to Göran Marby and say, “Delete this Top Level Domain” which just may be the dot com business servicing a crypto “phone” app.

And all that is just the tip of the iceberg.

That’s my take as well, Haakon –

I want my things under my control – including my money.

Just as an aside,

It seems that people without an understanding of Bitcoin are dumping on it from an ignorant PoV. The nice thing about being non-coercive, unlike the proposed Central Bank Digital Currencies (CBDCs), is that you don’t have to participate. Also, those people who have kept their Bitcoin on exchanges using exchange wallets are subject to government intervention….those who, intelligently IMO, use a hardware wallet for cold storage have total control of their assets….even governments cannot touch them. Now, as to whether Bitcoin, the only one I have an interest in, can be used to buy stuff, that’s another story. That depends on non-coerced market participants taking it in exchange for goods. It’s already happening. The flip side is if the CBDCs do take over and assert that nothing can be purchased in any other commodity, then the black market will step in and the people who abide by tyrannical dictates will be slaves. One further thing, the code for the implementation of Bitcoin mining is out there for anybody to inspect. I don’t recommend either way for investments. That’s up to individual choice. But those of you who declare Bitcoin to be a government plot need to investigate further. IMO, it’s really a fascinating solution to a fairly intractable problem up to now. That said, I admit to being a nuts and bolts programmer type. As always, YMMV and OALA, EHOATAS…

Morning, Giuseppe!

Is questioning Bitcoin “dumping” on it? I agree, it’s not coercive. But digital money carries with it the very real possibility of this – and I am alarmed by Bitcoin for this reason, but indirectly. I see a possibility that Bitcoin is the vehicle for conditioning people to feel comfortable with digital money. And given that digital money is implicitly far more amenable to coercive control, that worries me.

I don’t say Bitcoin is a government plot. I point out that it is opaque. I’m not the smartest guy in the room but when I can’t understand something that ought to be straightforward I’m immediately leery of it. Financial stuff is full of flim-flam. Byzantine details and impenetrable language designed to serve as a kind of “inside baseball” language to enable “experts” to mulct the marks. When I encounter anything that smacks of that, I assume it’s a con. Crypto is in this class. Anything this complicated that ought not to be is suspect on the face of it. One cannot simplify quantum theory. I get that. Even engineering can be hard to follow, sometimes. But money? This ought to be such a simple, readily comprehensible thing. Indeed, I submit it must be that to be honest and trusted as such by the average person.

A silver ounce is a definite and objective weight/measure of a precious metal. Its value can be easily understood and is difficult to manipulate. It has physicality; i.e., it is real. You literally hold it in your hand. It cannot be created out of thin air – or via keystroke. It cannot be disappeared by keystroke, either. Its value will vary, of course, but that variance has a an easy-to-understand basis in the scarcity-supply of the metal itself. It may increase or decrease in value but it is unlikely to ever have no value – unlike, say, digital “currency.”

Axiom: Anything online is suspect because everything online is compromised.

O come now, eric, really, what’s so complicated about a “51% attack” by a consortium millions of “electro-miners” each of whom “has a copy of the entire database” who squabble at the speed of light about hyper-difficult “math problems” for the rights to “give themselves some cryptocoins from thin air (block rewards)”, for which “you must include a transaction fee in your payments” but the “miners will pick transactions to include in the database which maximize their profit” and those “transactions can take months to settle”?

You just “need to investigate further”.

Hi FP –

Yup; the inscrutability of crypto (just the right word) ought to be a red flag. Anytime you’re asked to invest in something you do not understand and which the party wanting you to invest in cannot clearly, succinctly explain – you should probably not invest in it.

More broadly – and to reiterate – anything that’s online is under the control of parties over which you have no control. A transaction is allowed at the sufferance of the online entity. It has the power to “cancel” you at any time and there is essentially nothing you can do about it. What happens if your $5k in Bitcoin just disappears – for whatever reason. Whom do you call? Good luck with that…

My position is that we’re not going to get any meaningful freedom – or privacy, an aspect of freedom – back until we wrest back control over assets, including money. This means physical currency that cannot be arbitrarily created – nor easily taken, without actually physically seizing it. It means cutting out the government – and corporations – from our financial affairs entirely. No more “taxes” on our earnings or our assets, such as our homes and land.

Crypto is only “money” for so long as those who issue it say it is. And worth as much as they arbitrarily say it is. It is also something over which opaque entities you have no control over have total control of.

I understand that people have made money with crypto; some people make money in Ponzi schemes, too. Maybe this isn’t one – but it feels like one. Or rather, some kind of speculation thing which has no real soundness behind it.

I’ll stick with real money.

Hi Giuseppe,

I will be the first one to raise my hand and state it is a government plot. Does that make my point of view ignorant? To some..maybe.

The IRS enforced guidelines on this beginning in 2014. How many people were investing in Bitcoin or any other digital currency at that time? Do you believe it was enough that the IRS already had regulations in place? That same year the gaming community began accepting Bitcoin for some transactions (e.g., Microsoft in 2014 for some Xbox games and Dell in July). Let’s think about that – government regulations already established, and the gaming community steps up to accept it. Thinks that make you go umm.

We are supposed to believe that Bitcoin was established by some Japanese fellow by the name of Satoshi Nakamoto. Nobody knows who this person is, but yes, let’s invest and hope for the best! Call me a coward, but I am apprehensive about investing into a system who was engineered by a man with the same anonymity as D.B. Cooper.

The data centers that are “mining” this crypto are being built into redneck farmlands surrounded by chain link fences and hidden among trees. Why? Is Bitcoin and other digital currencies are on the up and up why not “mine” them in downtown NYC or Chicago? Plenty of empty commercial buildings available for their use. Even Wall Street doesn’t have the secretiveness that is built upon the cryptocurrency fad…and they are about as underhanded and corrupt as one can get.

I have to back Ol’ Warren Buffet on this one who called Bitcoin a “mirage” in 2015. I believe he is absolutely correct. Mirage seems to be an optimal term to describe cryptocurrency. It looks like one has money, but if you look around the smoking mirrors – tada – it is gone!

It’s worse than you may think.

Blockchain technology has an immutable record of transactions built into the currency directly. It is not at all private nor is it untraceable. The next iteration of crypto-currency is going to be ***programmable*** crypto-currency issued by governments and possibly large corporations. Programmable crypto-currency allows the ***issuer*** or possibly even your ***employer*** to program the currency in such a way that it can be used on certain classes of merchandise/services or it can be used in some businesses but not other businesses. A simple example is that if you work at say Target, your employer could program your paycheck in such a way that you couldn’t spend any of it at Wal-Mart and a certain percentage of it could only be spent on housing or utilities. Add this to some sort of implantable chip or biometric recording device and you have something right out of the Apocalypse of John.

You can think of it this way. You are using “electronic money” whenever you use your debit or credit card to pay for something. Crypto is just a specific form of “electronic money” that tracks its own transactions instead of having a separate database at the bank to track transactions. Programmable crypto is crypto that also enforces its own “approved” uses. Governments everywhere (but most especially China, UK, and USA) are orgasming over the control this “digital currency” can give them and are working hard to iron out the details as quickly as possible.

This is already in the works and many of the aspects of it are already being publicized by multiple organizations and financial bloggers:

https://www.federalreserve.gov/econres/notes/feds-notes/what-is-programmable-money-20210623.htm

http://www.ronpaulinstitute.org/archives/featured-articles/2021/october/05/programmable-digital-currency-the-next-stage-of-the-new-normal/

https://stevesammartino.com/2021/10/01/programmable-currency-is-coming/

https://www.bankofengland.co.uk/news/2021/april/bank-of-england-statement-on-central-bank-digital-currency

https://www.nasdaq.com/articles/programmable-digital-currencies-are-coming-heres-what-that-means-2020-08-18

If you want a solution, produce something locally, then sell it for cash only or barter it for something else you want from another local producer. Do this often enough with enough different people and you’ve built yourself a small, local economy that doesn’t rely on any official “big government” currency.

Welcome to the company store. Some things never change. If you are to be free be prepared for great evil.

I’ll succinctly summarize “crypto”, or really “the blockchain” technology on which it is based:

It is information.

In its simplest form, it is information regarding transactions of fiat tokens that is iteratively processed by a network of computers. It is essentially a ledger. The utility and the true substance of cryptocurrency is this. The tokens are just an idea, given value, as was said in this article, by those who would use it as a method of exchange.

The blockchain has been put to use for many other purposes in which a long running ledger might be used, such as “smart contracts”.

“Mining” is the processing of the transactions that become part of the blockchain. This can theoretically be done by anyone, but it is a competitive process, and one generally needs a fast, dedicated computer to participate. Mining usually yields to the miner some value of the cryptocurrency being processed as a reward.

I think crypto is the Trojan Horse for govco control of your money, just like Tesla/EV’s are for controlling your movement. Some day Uncle will require all transactions to be digital so Big Brother can monitor everything you do, along with blocking certain transactions, such as buying ammo. It already got a trial run in Canada with the truckers, so coming soon to your life – social credit scores and “no soup for you”!

I have said it before…I don’t trust Bitcoin or any other type of cryptocurrency. I realize it is becoming more prevalent and more of my clients are investing in it, hence the amount of capital gains that I am reporting on Schedule D on an annual basis. My problem is I don’t believe the decentralization concept. When I receive a transcript of gains/losses from a cryptocurrency company showing the various types of crypto being sold, date purchased, number of shares, etc. it doesn’t seem all that disseminated from any other investment gain or loss. Who is reporting this? Not my client. They received the statement from XYZ Company.

I came across this article the other day in regard to the emergence of data centers for crypto “mining”. Appalachia (Tennesse, Georgia, Western VA) seem to be their go to places for these new buildings. Apparently, the noise (why would there be noise for something digital) is causing local residents much distress and many are regretting their positions for allowing the sites to move in.

https://www.inquirer.com/business/technology/crypto-mining-data-loud-sound-bitcoin-20220321.html

Also, the economic growth and jobs that these companies portray as their reasons for wanting to move in are absolute BS. The states and counties allow them to erect these eyesores because of the amount of taxes that they can collect on the tangible personal property. Build the hideous monstrosity, it creates little to no jobs, therefore one does not have to build roads or expand schools and tons of taxes to collect on the gazillion computers inside the data center. Win-win for any local jurisdiction, well unless, you are the poor soul having to look at this horror at your back door.

The gain/loss reports would be true if your customers are using & keeping their crypto on centralized exchanges (coinbase). Most of these all fall under KYC.

I’m also a gold and silver type of guy. It’s always been money, well, at least for most of recorded history. And it doesn’t depend on the power staying on and internet servers being online for you to redeem it for goods and services.

What’s that you say? The power to the whole world would have to go out before your crypto became worthless? Bullshit. All that needs to happen is that the power goes out to your city, and you no longer have access to your crypto. It might as well be worthless at that point if you can’t access it. But the gold and silver coins still jingle in my pocket, and the bills issued based on them, heck even the fiat bills, still crinkle when I handle them.

Interesting as the crypto space might be, I don’t buy it.

Hi Jim,

Not only is the internet a must for these things to “mine”, but God forbid if one invests in the wrong digital currency. If the crypto hits zero it becomes “delisted”. It reminds me too much of the Stock Market. Another intangible item where you can wake up one morning and everything be evaporated overnight.

I am just curious who is behind the money on these large data centers? All of a sudden Ethereum as the moolah to erect these things? Why weren’t data centers not needed before? Anytime I see large buildings, surrounded by fence and wire, in the middle of nowhere, I automatically think “government.” If it isn’t government, why are they hiding them? There are plenty of empty commercial buildings throughout this land – let’s recycle their use if “climate change” is such an issue. Taking away perfectly good farmland to hide God knows what behind a passel of bushes and fencing that makes Fort Knox look unsecured should be questioned by one and all.

Hey Jim, I’m a Au Ag guy as well. Our son got us into some crypto and we have it on a cold laptop. Cant be shut off if it isn’t on. Hopefully we never need it in say another country or wherever. It can be a good hedge for a tiny part 2-5% of your liquid assets.

I don’t consider it an investment, it would suck as such. I consider it a speculative hedge. The dollar debasement is now in the open and ole’ Dollah Bill is starting to gasp for breath.

Remember Ron Paul asking Bernake “is gold money?” Classic.

I’m still wondering how having a gold coin or one ounce ingot will get me toilet paper or a bag of lentil beans when things go economic dystopia. I’m thinking a can of beer would do. Stockpile those cartons!

Hey Haakon,

Tenth once American gold eagles are best, even with the premium. I don’t know what it is now but used to run about 10% over spot. Once once US, Canadian, And Mexican Libertad silver coins will probably be the new 100 dollar bill.

As things go up and down against each other, some things with little value now will reach parody with things of high value now. I’m thinking a can of beans or glass of clean water vis a vi a piece of high quality tail.

Jeez ounce, not once. Twice not once. Need to curtail my imbibing at night.

Canadian Gold Maple Leafs, and Silver Leafs, are cheaper and have higher purity, and I have no loyalty to US mints. Silver is useful as pocket money. I have some fractional Gold coins, but stopped buying them because of the exorbitant mark up on them over 1oz coins.

Hi John, I like the maples and libertads for silver. You never know when or where you might end up. Locals in Canada or Mexico would probably be more accepting of their own coins. Although if they’re like Americans they might not have a clue.

I love the Mark Dice where he offers people a gold or silver coin, or a candy bar. 99% choose the candy bar. I’ve been picking up a few 1 ounce Platinum British or Americans. If Russia wins this battle by some long shot, the price of Platinum should go up nicely.

Canadian Gold Maple Leafs, and Silver Leafs, are cheaper and have higher purity, and I have no loyalty to US mints. Silver is useful as pocket money. I have some fractional Gold coins, but stopped buying them because of the exorbitant mark up on them over 1oz coins.

Considering the state of affairs over in Europe right now, I’d say that Russian vodka will become the next Cuban cigars. Probably would be worth more than beer.

I bought a couple cases of Stoli a few years back. Don’t know where the value is headed but I know it was a helluva lot cheaper then than it is now.

These people pouring good Russian vodka into the streets are probably triple vexed and super boosted idiots.

I am stocking up on Russian vodka. It is one of the main ingredients in making tinctures. If the bark and berries doesn’t work the vodka usually does. 😉 Let the idiots throw away perfectly good alcohol. In a few years they will be crying because it will no longer be available to them.

This whole spiel on blaming the Russian people for what their government does is absolutely absurd. Cancel culture has created this madness. When we are kicking out sopranos from the Met Opera because they have Russian roots, we are supposed to despise all hockey players that immigrated from the USSR and are pouring perfectly fine booze down the kitchen sink we have lost our ever-loving minds. It reminds me of several times in the past where we blamed people of certain ethnic backgrounds for things beyond their control – like their nationality, religion, or race.

Karma’s a bitch and I guarantee she finds us.

Hi RG, Surprisingly, Hi test beverages haven’t risen in price as much as many other things. The long term prospects of Vodka, whiskey, and Scotch still seem sound, even if just for trading/bartering.

This whole thing of loyalty tests based on hatred of all things Russian is confusing. I find I have much more in common with Russians than the myriad of turd worlders they constantly fill my country with.

When I was recently in Alaska, Many places we went, I heard people speaking Russian. All I could think was no Russian ever called me a racist, homophobe, sexist, Nazi. Many times I’ve been called that by people who clam to be my countrymen. The upside is I’m now immune to their opinion.

They will not buy much in the immediate aftermath. As commerce increases, money will be needed, and there is none more sound than Gold and Silver.

Beer would be good money, if it would keep, which it won’t. It does spoil, faster if not refrigerated.

Guns are good. Ammo is good. Clothing is good. Playing a fiddle is good. Entertainment will become high value if the power is down for extended time.

I think Warren Buffets advice would be be best here, which is never invest in something you don’t understand. I sure as hell don’t understand Bitcoin or any of the rest of them. One of the problems I see with it is that people are “buying” it as an investment instead of using it as a medium of exchange, which should be the only purpose of “money” in the first place. Sure, you can purchase a few big ticket items with it, but as far as I know, crypto doesn’t work at the grocery store or gas station or anywhere else I shop. Maybe things will change, after all, everything in the world is going digital. I’m sure money will get there eventually too, but right now, doesn’t make sense to me.