While we’re awaiting the collapse of the dollar, let’s have a look at the collapse of crypto – aptly named because it’s so difficult to understand, the almost-axiomatic clue that a scam’s afoot.

The value of a Bitcoin has melted away like a mid-May frost. In fact, it has almost no value left anymore – relative to the value it had just a couple of weeks ago. The crash was on par with that of the Stock Market in 1929 and probably for the same or very similar reasons.

Both being the result of speculation and other variants of flim-flammery.

The actual value of Bitcoin was . . . what, exactly?

Here we had – in a purely abstract sense – a unit of money without physical existence, based on a fictitious “coin” that was divvied up into obscure denominations – e.g., “.00000345 Bitcoin” – whose value derived from the willingness of people to accept that it had value. People were told that, unlike the physical (and digital) money printed (or conjured) at will – i.e., dollars – the value of these Bitcoins was secure from inflation – that is, from devaluation – because the supply of them was strictly limited.

Supposedly, by “miners” who had a self-interest in ensuring too many weren’t “mined” – though in fact no one ever “mined” anything, in the way that word is generally understood. Nothing was dug up out of the earth, refined and minted. Various calculations – or some such – were performed.

It was all very . . . cryptic.

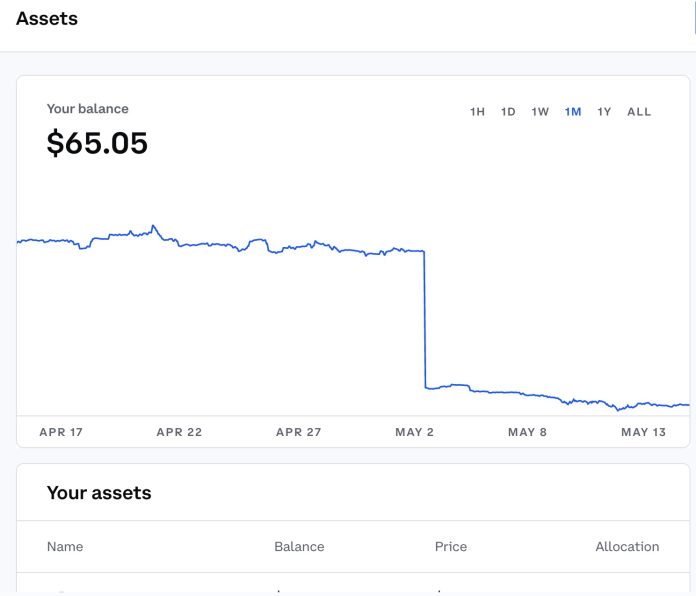

I had a small amount of Bitcoin – about $230 in dollar-equivalent. Well, I had it – about ten days ago. Now I have about $65. Where did the $165 in value I had about ten days ago go? Not even up in smoke.

It just disappeared.

For others – who had put more of their dollars into Bitcoins – the last couple of weeks have been catastrophic. They have lost thousands of dollar-equivalents. Some perhaps tens of thousands. If you didn’t put any dollars into Bitcoin, pat yourself on the back for not being tempted to do so. It was easy to give in to the temptation for the past several years, as the value of Bitcoin seemed to be on the rise and without end. Some people made a lot of dollars – if they converted them into dollars before Bitcoin crashed.

The same as back in ’29. The same as always – when doing an autopsy on a scam.

The initial buyers-in often make book; this encourages more to buy in. A frenzy of speculation ensues, driving the value of whatever it is even higher. It can be stocks in fundamentally worthless companies – e.g., the “dot.com bubble” of the early 2000s – or it can be houses whose value has been temporarily inflated far beyond what the market can bear, resulting in an inevitable crash of those ephemeral values.

Bitcoin is probably fundamentally no different. Its value – well, its former value – seems to have been purely a function of the perception that it was valuable. So long as more and more people believed it was so, the putative value of Bitcoin waxed, just as the putative value of a $500,000 1,300 square-foot house outside DC that was worth $230,000 in ’98 suddenly was by circa 2003.

But then came 2004 and – just like that – it was no more. That $500,000 house was suddenly worth $350,000 and perhaps not even that much. But at least it was still worth that – because it was, after all, still a house. It had value, as a house. Just not as much value as speculators and their dupes had added into the mix.

Bitcoin’s collapse is much worse than that because there is no value underlying it – beyond that people which people are willing to believe it has. Which it no longer has. Or at least, which it has very little of, remaining. You cannot eat a Bitcoin or live in it. It has no intrinsic value – or uses, as gold and silver have. You can’t even hold one in your hand, as you can a dollar – which also has intrinsic uses, even if all of its value as money is vitiated. It can still be used as wallpaper, for instance.

Or in the bathroom, for something else.

Of what use is a digital image, a pie-chart representation of a decimal point slice thereof on your computer screen? Can you do anything with it? Once other people are no longer willing to believe those digital representations have value, that is?

The same can and probably will happen to dollars, too. But – so far – the buying power of a dollar has only been devalued by about 15 percent, via the creation, out of thin air (and keystroke) of new dollars.

This makes a dollar look sound – relative to a Bitcoin.

But the latter does have some value – as a warning. “Money” that has no value beyond the willingness of people to believe it does is inherently dangerous. “Money” that can be devalued by the simple act of conjuring more of it into existence is worse. Dollars and Bitcoin share both flaws.

And Bitcoin has a further flaw – though it may not be regarded as such by those who’ve been touting it as the digital alternative to physical dollars. The former can be monitored, recorded and controlled in ways that are much less easy with physical currency, which can be exchanged anonymously. Bitcoin touters will claim that “blockchains” and “wallets” make Bitcoin untraceable. The fact that no one can clearly explain how makes this suspect. The fact that everything else that’s online is known makes believing Bitcoin doings aren’t seem naive, at best.

But we do know that Bitcoin isn’t worth much, all of a sudden.

Was it ever worth more than people’s willingness to believe it was worth anything?

. . .

Got a question about cars, bikes or anything else? Click on the “ask Eric” link and send ’em in! Or email me directly at EPeters952@yahoo.com if the @!** “ask Eric” button doesn’t work!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

Bitcoin is down to $21K now……

Hi Nunz,

Bitcoin has almost reached it actual value… zero!

I thought it had value because of all those “miners” doing all that “work” “mining” it….?

Hi Eric.

Bitcoin at this point is around $21,700. That’s rather far from zero. 🙂 I’ve got a few from the early days. It has FAR out preformed my gold and silver. 🙂 As I’ve mentioned, I’m more interested in the technical aspects of it. Also its social/economic/political implications.

Looking at our current situation with rampaging inflation eating away most peoples wealth,

whats fiat backed by? Ah, that’s right; “the full faith and credit of the US government”. In other words, the gang of thieves and murderers back it with their tax farm. Aided and abetted by the Usual Suspects central bank. With a debt that’s well over $30 trillion (not counting unfunded liabilities) its never going to be paid. But each time the Fed jacks up interest rates, the service on that debt grows ever larger.

I’d personally rather deal with a distributed, decentralized system. Sound money just doesn’t generate enough vig for the Usual Suspects. Given that they control so much of the worlds power systems, I’d not hold my breath waiting for sound money to make a come back.

Whats going to be fascinating is what happens, when Russia, China, India and their allies form their own trading block, and start sanctioning the Empire and its useful idiots in Europe and elsewhere. Its going to take years to re shore those critical industries, that the globalists sent to China and other places. Hell, we can’t even replace mission critical parts of our power grid, or just about anything else. Its all made in China. Couple that with the Greenies and their attack on our energy systems, and we have a bit more to be concerned about than the price of bitcoin.

Hi BJ,

I don’t take issue with any of your criticisms of fiat currency. But I regard digital “money” as even worse because it is digital. This business of habituating people to using digital is catastrophic insofar as financial privacy and thus to our ability to control our money. This alone is reason to shun crypto. Another reason is that we do not physically control it. That means it is not under our control, in the way that a piece of physical currency is – even if it is fiat.

Also, I suspect crypto is far from “decentralized.” I believe it is the mechanism for establishing a form of centralized “money” such as has never before existed in human history. I believe it is like “social media” and not organic, an outgrowth of Just Folks but rather of the same apparat that gave us Facebook and Twitter.

Finally – as I have said previously – I do not have faith in “money” whose source of value is opaque and which almost no one seems able to understand or (so far as I have been able to determine) to coherently explain. At least fiat can be explained and understood by most people of average intelligence.

I do understand that it is a speculative mechanism, because that’s what people do when they invest in it. One doesn’t invest in money; one uses it as a medium of exchange and a store of value. This “investing” business is a clue to crypto’s fundamental nature.

Hi Eric.

I totally agree with aspects of your position. I’m all for a system of sound money. I also have no faith in either fiat or digital. I can also see the horrific potential danger of digital programmable, centralized systems. Not to mention the danger of ever more centralized power.

That having been said, I also see the potential for a series of distributed decentralized systems. It has been said that knowledge is power. I’d amend that to say knowledge is an aspect of power.

Power has three basic aspects. Its base is physical. That is the most brutal, obvious aspect of power. One sees that in the clubs/spears/swords/guns of the ruling gangs enforcers.

Above that is wealth. Wealth allows one to hire the services of the enforcers, and to properly equip them.

Above that is knowledge. Remember the OLD saying; “Good soldiers can always get you gold. But gold can’t always get you good soldiers”? Simply having wealth isn’t enough. You have to understand how to use it effectively. This ties in to the many reasons that the Empire has lost every war its been in since WWII.

How does this tie into distributed, decentralized systems? Look at the common elements that have resulted in the Empires losses. Lind has laid out in precise detail why they have lost, and will continue to lose.

If you combine Lind’s teachings with knowledge of cryptology, distributed network theory, mesh networks and insights from some of Tesla’s original work, you start to get an idea of the potential for a much better way forward. That is why I’m still hopeful, even in the face of the merchants of despair howling that all is lost.

By the way, you may find this of interest for the Crusade.

https://brownstone.org/articles/more-bad-news-for-the-mask-cult/

Bitcoin is a better option than fiat money, said Mexico’s third richest man, Ricardo Salinas, in an interview. Bitcoin, Salinas said, is unseizable (this is very important there will probably be a bailin soon, they will confiscate your bank account and every other asset), and bitcoin can be transferred instantly worldwide, contrary to fiat and the gold standard.

Bitcoin’s peer-to-peer nature makes the digital currency much harder to be banned or controlled as transferring value through the network doesn’t involve an intermediary that could be subpoenaed by the government.

This property, paired with its supply limit of 21 million coins, enables bitcoin holders to preserve wealth for the long term in a more sovereign way than what is possible with fiat currencies or even gold.

“Everything we have in fiat is 100% seizable by the government,” Salinas added. “It’s not in the government’s interest to make it easy for people to use bitcoin.”

https://bitcoinmagazine.com/culture/mexican-billionaire-says-bitcoin-is-a-better-option-than-fiat-money

Hi Anon,

This assertion that Bitcoin is not seizable make no sense to me as Bitcoin is online and digital. All digital money is inherently seizable by the people who control the Internet – who aren’t us. And even leaving that aside, what good is a currency you cannot use to buy things with? Only a few retailers accept Bitcoin and once/if the government decrees such acceptance/transactions illegal, they no longer will. Bitcoin is fundamentally a speculative thing; a means by which some make more (or less) Bitcoin. It’s not that different in this aspect than “investing” in a multilevel marketing scheme.

Gold and silver would have to be physically seized – a far more difficult thing to do. People also readily accept either as money – because they are.

Eric, just because something is digital doesn’t always mean it can be seized. This is a very complex subject, that deals with many over lapping domains of knowledge and power. There are various “layers” of the internet. Some of those can’t even be discovered, if you don’t have the proper encrypted key/token/app. Think of it as different “layers” of access.

The data ocean is so gigantic that even our “buddies” at No Such Agency are drowning in it. That is why they are so desperate to get more advanced AI search systems. Spying on a planetary population generates an insane amount of data.

“Control” of the internet is also much more complicated than most people imagine. Certainly the Empire, and the other mega gangs of thieves and murderers (which is all governments are) can seize anything physical that’s in their power, or that of their vassals. But to do that they have to know where it is. There are quite a number of ways of making that difficult. Keep in mind that the vast majority of those working for the gangs are there for the pay check. Not to mention the impact that diversity hires have had. The very best technical minds simply will not work for the gangs for any amount of money. Why? Because thats not what motivates them. Its also bad for ones reputation in certain circles.

As for government decrees, it seems that the Empire and its vassals (toadies/servants…) are out of luck when it comes to Russian commodities. That may soon expand to China/India and various other countries. The days of the petrodollar are drawing to a close.

A governments decrees are only useful, if they have the power, knowledge and will to enforce them. Fear is their main weapon. But fear has inherent limitations. Once a government loses the illusions/delusions that underpin its “authority” it is left with only fear and brute force. Look at the Empire as only one example. There are very good reasons why it has lost every war its been in since world war II. The same applies to technical wars.

Don’t buy into the myth of the all powerful and/or all knowing state. Just like any human system it has its strengths and glaring weaknesses.

Hi BJ,

The problem with what you say is that not everyone is like Neo in the Matrix; i.e., a whiz kid hacker type who can use the system to avoid the system. Ordinary people need something comprehensible, usable and physical. Hard money fits that bill. It is impervious to being “hacked” or seized or just “turned off.” Nothing online is impervious to that, even if you are Neo. As others have observed, if the Internet goes offline, so does everything you hold in “assets” online. Hard money in your hand doesn’t. You still possess it – and it will always posses value.

Gold and silver operate independently of government, of the Internet. Real money, of real value.

Placing faith in digital money is dangerous, for all the reasons I’ve already laid out. It is why gold and silver were removed as money by the powers that be – and that alone ought to tell you something about the kind of money they don’t want us to have.

Eric, perhaps we have a miscommunication going here. I’m no real advocate for crypto. My main interest is in the technology and its implications. As I’ve mentioned, I look at gold/silver and lead as insurance that I hope I never need. But don’t get too fixated on gold/silver. They are one of the most manipulated markets in the world. The Masters of the Universe™ are very well aware of the implications of rising gold/silver. That’s why they have hammered it down for generations. Just because you can hold it in your hand, doesn’t mean others will place as much value in it, or that the gangs can’t take it from you. As for faith, I reserve that for people who have earned my trust and God.

PS One need not be Neo to know more about how the technology of the internet functions, than most of those in the various gangs.

The truckers had bank accounts seized, no bitcoin or crypto accounts were seized, it is very difficult to do.

NOTE: It is not online for the smart people, don’t store it in the cloud.

keep it on a memory stick in your pocket, same as cash or gold….

If you store it online that is stupid….keep it on a memory stick in your pocket…how do they steal it?

You can print out bitcoin info on paper and bury it in your back yard, it can be stored on a hard drive, take the hard drive out and bury it, memory sticks are easier, to store bitcoin.

I can have bitcoin on my computer, or device and transfer it to your computer in a parking lot, no bank or anyone else involved, no bank, no central bank, no regulations are involved, free enterprise.

Bitcoin’s peer-to-peer nature makes the digital currency much harder to be banned or controlled as transferring value through the network doesn’t involve an intermediary that could be subpoenaed by the government.

Who are they going to subpoena?…hahaha….bit coin is decentralized, no ceo, cio, head office, who do you phone? no head office address, no address lol….it is not a public or private company or limited partnership, it is not regulated…

They could shut the whole internet down….that isn’t too likely.

The worst thing you can do is use communist fiat electronic payment, use cash only if you use fiat, it is private, if you don’t we will lose that too.

you can use gold or silver (the best money…only money)to purchase a car to avoid fiat, don’t use fiat,

non compliance is the answer, this is the same as the globalist/communist masks, lockdowns and extermination injections mandates, don’t enable the beast…avoid fiat..

bitcoin can be used to buy real estate, university tuition, cars, etc., some employers pay in bitcoin.

What Can You Actually Buy With Bitcoin In 2022?

https://netcoins.ca/blog/what-can-buy-with-crypto/

What Can You Buy With Bitcoin?

https://www.investopedia.com/what-can-you-buy-with-bitcoin-5179592

What Can You Buy with Bitcoin? 10 Things You Can Actually Purchase

https://www.moneylion.com/learn/what-can-you-buy-with-bitcoin/

there is only one bitcoin…the other coins are shitcoins, ethereum is ok, it is an infrastructure play, a different animal.

bitcoin isn’t just created with a keystroke like fiat is, fiat requires no work to create it, bitcoin is mined, it requires work, electricity, equipment and a huge amount of calculations, number crunching. (mining is processing the transactions on the network). this is all done by private individuals, no government or bank involved, real free enterprise.

bitcoin mining

https://bitcoinmagazine.com/guides/bitcoin-mining

Eric when your computer is just sitting there, put it to use, use it for mining bitcoin, make some extra income, free enterprise….simple easy, runs by itself….

If they really wanted crypto to be used by everyone, they would get rid of the ‘price’ aspect — they would make 1 crypto coin equal to $1 dollar. Then people could actually hold onto the crypto without worrying about it losing half it’s dollar-value overnight.

Bitcoin is a millennial thing, they saw they couldn’t make any money in the boomer’s old financial system, it was already over priced way out of reach, (houses, stocks), so they created a new financial system, starting with bitcoin. Lots of old people don’t understand it…..

Do the millennials realize this? They are fighting against communist/marxist/leftists…

you might not like bitcoin but anybody working against the globalist/communist/satanists should be supported….that is why I like bitcoin…..fighting against marxist fiat….

using/owning fiat = communist/globalist/marxist….supporter enabler

using fiat = supporting the globalists/leftist/satanists

bitcoin owners = same as anti maskers, also anti marxist/communist fiat currency

With more than 30 million Americans and 300 million citizens globally HODL-ing, Bitcoiners are already a political constituency.

There’s even a Bitcoin backed SuperPAC now whose stated aim is to rid the government of anti-Bitcoin politicians like Brad Sherman and Elizabeth Warren

Anti-bitcoin = in bed with Brad Sherman and Elizabeth Warren

Don’t use communist/marxist fiat….

This is why:

Using Fiat currency = the 5th plank of the communist manifesto

5. Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.

The Federal Reserve System, created by the Federal Reserve Act of Congress in 1913, is indeed such a “national bank” and it politically manipulates interest rates and holds a monopoly on legal counterfeiting in the United States. This is exactly what Marx had in mind and completely fulfills this plank, another major socialist objective. Yet, most Americans naively believe the U.S. of A. is far from a Marxist or socialist nation.

This is what the communist/marxist bastards have done….with their marxist central bank….

20 U.S. dollars bought one ounce of gold in 1900

In 2022 it takes 1800 U.S. dollars to buy one ounce of gold

That means the U.S. dollar is worth $0.01 now….. that is one cent, it dropped 99%.

A car costs $50,000 now, a crappy small house someplaces costs one million dollars, a gallon of gas is $6.00, now you know the real reason.

They ran the printing presses and destroyed your money. On a gold standard that can’t happen.

There is another huge benefit to using bitcoin only, it is a giant ledger, you can see all the transactions, nothing is hidden, this would be a big problem for the corrupt politicians that steal 5% to 100% of the money the government handles.

You would see where every cent of tax dollars are spent. Plus their crooked central bank couldn’t run the printing press 24/7 365.

The globalists would never use bitcoin….this is why…it is a giant ledger, you can see all the transactions, nothing is hidden, this would be a big problem for the corrupt politicians that steal 5% to 100% of the money the government handles. it would be great for taxpayers..

this why they are bringing out their own centrally controlled CBDC crypto, digital currency, then they can hide their theft, but see every one of your transactions, these are evil bastard thieves….

Hi Anon,

In re: “The globalists would never use bitcoin….”

No, but they want to force people to use essentially the same thing – digital currency. Why? Because digital is controllable in ways that hard money (and even paper dollars) is not. Anything purchased via digital money is recorded and know to Sauron. Any funds received/sent, too. To say Bitcoin is “different” (because Blockchains or whatever) is a species of absurdity right up there with the DMV’s assertion that you are its “customer.”

Ding! Ding! Ding! Eric, I wouldn’t doubt if it turns out that Bitcoin was ultimately created by some CIA or other government program as a means to get people onboard with and used to the idea of digital currency, for the day when the official state-issued terlit paper goes digital. What better way to get the wary and the rebels onboard as early adopters than to make them think they are somehow fighting the system….and to get to relieve them of some of their wealth at the same time? Sounds like the same kind of evil genius which created the Social Security Ponzi scheme!

Exactly, Nunz!

I submit that no one who is interested in resurrecting sound, stable money – and privacy in financial affairs – ought to support any form of digital currency. Down that road lies the end of any prospect of them not knowing your business and controlling it.

Well-said, Eric! And even on the simplest level- of what value is a ‘currency’ which can and has lost two-thirds of it’s value in the course of a few months on multiple occasions? That type of instability and volatility makes FRN’s, the Stock Market, Enron, and Herbalife look good by comparison…. Hell, it makes Monopoly money look good (At least you can have and hold Monopoly money in your hand, and drive around that metal top-hat…and maybe even get a Get Out Of Jail Free card!) (I always picked the top hat!)

You just don’t understand how it works, BOOMER.

And neither do I honestly. I like the idea. There needs to be a way to send money without the controlled apparatus. Monero is my favorite currently.

But a wise boomer once told me to not invest in things I don’t understand. I haven’t yet.

Brandon, I still maintain that the only stable investment (despite me not understanding them) are pogs! And I’ve yet to hear of any pogs ever being seized! (Although a few have accidentally been used as coasters….). To my knowledge, pogs have only depreciated once, and have remained stable ever since, ’cause it’d be hard for them to go any lower- although I suppose if one’s hoard is musty and booger-smeared, it could happen.

O-K, so the good thing about crypto is that it can facilitate avoiding the banking cartel and prying eyes….(Although all of the other metrics of a remote sale can still be tracked- like shipping….) -now if it just didn’t have all of the other negative traits as mentioned above and below, it’d be awesome…..dude. [<- See? I speak your lingo! Well,. I think that's your lingo, since you're from the east. If I were from California, it'd be my lingo….and I'd be a douche and not posting here, but rather discussing the awesomeness of being in the Gender Of The Week Club on a forum devoted to L. Ron Hubbard).

Hey, remember the TOR browser and the Dark Web? That was like crypto for the internaet. How'd that work out?! The internet was like crypto in comparison to landline telephones….but any privacy and freedom (well..most) is down the terlit there too- and no surprise there, since it was created under the guidance of the military through their moles at MIT. So ultimately, anything that uses the internet is not to be trusted; 'specially when the arbitrary rules invented by the lords of the cryptos are shrouded in mystery, and are…after all, arbitrary.

But yeah…for the short term, to facilitate a quick transaction…..crypto could be useful…..but remember, just buying that crypto IS NOT anonymous….and may well set off alarms (Not that'd we'd be doing anything nefarious….but it does kinda defeat the very purpose for which we would be taking the trouble….)

At least we can still buy pogs anonymously, in-person! (Hey, might as well impute value to pogs…it's no more absurd than imputing it to a string of numbers created by a bunch of computers working to compute some equations and Al-Gore-rhythms, eh?)

Hi Brandon,

I think Bitcoin is a trap. People are desperate for a way to avoid the central bank cartel – and government. But is a digital widget “currency” the answer – or something worse? I think the latter because (again) it is digital. Digital money is fundamentally perfect for the kind of panopticon control grid wanted by the people who gave us fiat dollars in the first place and by the people who want to end any type of anonymous, “cash” transactions.

There is all of that – and then there is the problem of understanding it and knowing who is behind it. Since no one seems to, I’ll pass.

Hi Eric

They want their own CBDC then they can see/control/ban your transactions, but they will hide their’s.

The globalists would never use bitcoin….this is why…it is a giant ledger, you can see all the transactions, nothing is hidden, this would be a big problem for the corrupt politicians that steal 5% to 100% of the money the government handles.

it would be great for taxpayers..

it is not the same thing CBDC is centralized, they control it, bitcoin is decentralized, they don’t control it, it freaks them out, plus central bankers don’t/can’t charge interest on creating it, and then charge you income tax to pay the interest….hahaha

Hi Anon,

Yes- but you beg the question: Who controls Bitcoin? Who exactly? Please don’t tell me the “miners” do. That is a non sequitur. I want to know who, specifically, controls it.

Eric, once again Bitcoin has no central committee. It is a distributed, decentralized system. That would be like asking who the leader of Anonymous is. Now the following may or may not have happened, but its funny. After the third time that the FBI claimed to have captured the “leader” of Anonymous, the head of the NSA spoke to the head of the FBI and told them that Anonymous has no leaders, and that they should stop making those announcements, because they are making all of us look bad. 🙂

As I’ve mentioned, the vast majority of people do not know who controls the dollar (and who controls those who control it). But that doesn’t prevent many millions from using the dollar everyday. Its a matter of utility. If a sufficient number of people find utility in crypto, it will become more and more acceptable. In a free market system, thats how things should work. But we’ve not had a free market for a very long time.

Hi Anon,

You say that “you might not like bitcoin but anybody working against the globalist/communist/satanists should be supported….that is why I like bitcoin…..fighting against marxist fiat….”

But is it true that Bitcoin is working against the above? How do you know? How could you know? No one knows who is behind Bitcoin – and it alarms me that it is habituating people to be comfortable with digital currency. This is a hideously dangerous notion that ought to be fought tooth and nail for it is infinitely more a threat to our liberty than mere fiat currency.

Anyone using bitcoin is one less person using fiat, fiat is the number one problem, it is the 5th plank of the communist manifesto, the people running the fiat system don’t like it, they will/have tried to ban it….why did they try and ban it, trash it at every opportunity? maybe the main reason is capital flight, money leaves the country in one second, that is why china just banned it….

remember the enemy of your enemy (the communist central bank printing), is your friend.

Using Fiat currency = the 5th plank of the communist manifesto

5. Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.

The Federal Reserve System, created by the Federal Reserve Act of Congress in 1913, is indeed such a “national bank” and it politically manipulates interest rates and holds a monopoly on legal counterfeiting in the United States. This is exactly what Marx had in mind and completely fulfills this plank, another major socialist objective. Yet, most Americans naively believe the U.S. of A. is far from a Marxist or socialist nation.

This is what the communist/marxist bastards have done….with their marxist central bank….

20 U.S. dollars bought one ounce of gold in 1900

In 2022 it takes 1800 U.S. dollars to buy one ounce of gold

That means the U.S. dollar is worth $0.01 now….. that is one cent, it dropped 99%.

A car costs $50,000 now, a crappy small house someplaces costs one million dollars, a gallon of gas is $6.00, now you know the real reason.

They ran the printing presses and destroyed your money. On a gold standard that can’t happen.

CBDC (central bank digital currency), which is coming very soon, is centralized crypto controlled by the government. centralized is bad….government will copy/bastardize/corrupt it.

Bitcoin is decentralized, no head office, no central control, no head of the snake, no CEO, CIO, it is individuals cooperating on a network, hard to kill shutdown…many times safer then a bank account.

Bitcoin is a millennial thing, they saw they couldn’t make any money in the boomer’s old financial system, it was already over priced way out of reach, (houses, stocks), so they created a new financial system, starting with bitcoin.

Lots of old people don’t understand it…..maybe because they are used to analog things, millenials were born with this computerized world, are more comfortable with the new tech.

Not understanding it in one sentence/minute isn’t bad, it is a difficult concept to get your head around, which is good, your brain likes a challenge, go and do a bunch of research it is fun…

there is a job opportunity, colleges need people to teach about crypto, but very few people have the knowledge…

I personally like gold and silver or the gold standard, but anything taking power from central bank fiat is ok with me…cash is also great, no records….but it feeds the globalists/central bank….

bitcoin is better then a bank account, (remember bailins are coming…this fall?). it is far, far harder to confiscate, it is also the easiest, quickest, safest way to get your money out of the country, more benefits….

On the dark, negative side some say bitcoin’s purpose is to divert money from going into gold, which is the biggest enemy of communist/marxist fiat.

Another problem it is dependent on technology…..

I forgot the biggest, best benefit of the bitcoin/block chain, libertarians should like…..

There is another huge benefit to using bitcoin only, it is a giant ledger, you can see all the transactions, nothing is hidden, this would be a big problem for the corrupt politicians that steal 5% to 100% of the money the government handles.

You would see where every cent of tax dollars are spent. Plus their crooked central bank couldn’t run the printing press 24/7 365.

Catherine Austin Fitts developed a browser you could use to search/hunt through government data banks, you could search and see where every cent of your money went, it never took off for obvious reasons…everything is hidden, buried, deleted, not accessible, opaque because they steal….

**”Anyone using bitcoin is one less person using fiat”**

Bitcoin IS just another form of fiat- just created by different people using different arbitrary rules. No intrinsic value; it’s creation is dictated by arbitrary rules that can be changed at any time; it fluctuates even more than government paper fiat, which means it is even less stable and not a reliable store of wealth; and…it’s less portable and non-tangible.

Nunz, I’m not defending Craptocurrency here, but it isn’t fair to call it “fiat”. Fiat means “by decree”—in other words, by official threat of force. Supposedly, Bitcoin can act as simply a voluntarily-agreed convention, like sand dollars or butter. Nobody is forced to use Bitcoin. However, as a practical matter, nobody DOES use Bitcoin (as a means of exchange as intended). And that’s the real response to Anon’s statement of “Every time someone uses Bitcoin an angel gets its wings.” Yeah, that’s why heaven is empty, and all the fallen angels are here (to butcher Shakespeare). This “rebellious” virtue-signal supposedly served by using Bitcoin is a myth. A fiction.

Another response to Anon’s glittering statement is that because Bitcoin does not and really cannot serve as a useful means of exchange, it thereby has become only a proxy fiat currency. It is a derivative, second-order expression of the same old nasty fednotes. But again, it is not, itself a fiat currency, but is at best merely a second-order “IOU” for guvbucks.

Hi FP

People have a hard time understanding the basis of the globalist/satanists power is their central bank printing fiat without limit…

If everybody quit using it their source of power would be cut off. using fiat is helping evil.

Using fiat is the same as wearing masks and getting poisonous injections, you are enabling the globalist/satanists.

Use anything else, barter, gold or silver, bitcoin, anything but the globalist central bank fiat.

Bitcoin doesn’t come from a globalist/leftist central bank, it comes from people voluntarily cooperating.

Using bitcoin doesn’t help the globalist/satanist, in any way…… government fiat, the U.S. dollar does, quit using it, you are enabling communists….

Most bitcoin is bought as a sort of digital gold, a store of value.

Out of the three functions of money — store of value, medium of exchange, and unit of account — Bitcoin has excelled at the first but with the other two, the jury is still out.

Most people would argue that even though it can be used as a form of payment in thousands of online and offline vendors, it’s still not the preferred form of payment for most transactions.

However, there are a number of cases where Bitcoin is the favorite currency and this is just the beginning.

https://medium.com/zen-and-the-art-of-crypto/bitcoin-as-a-medium-of-exchange-6d8b7b0526e8

Interesting point, Free-Phi.

I would say a good definition of ‘fiat’ is a currency created by arbitrary rules which is devoid of any intrinsic value, but which enough people put faith in and accept so as to facilitate transactions among a large population.

And a good definition of’ Fiat’ is Fix It Again, Tony!.

Hey no automotive jokes! (They all go over my head!)

If you like enabling communist/marxists use fiat…..

Using Fiat currency = the 5th plank of the communist manifesto

5. Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.

The Federal Reserve System, created by the Federal Reserve Act of Congress in 1913, is indeed such a “national bank” and it politically manipulates interest rates and holds a monopoly on legal counterfeiting in the United States. This is exactly what Marx had in mind and completely fulfills this plank, another major socialist objective. Yet, most Americans naively believe the U.S. of A. is far from a Marxist or socialist nation.

this is what happens….

This is what the communist/marxist bastards have done….with their marxist central bank….

20 U.S. dollars bought one ounce of gold in 1900

In 2022 it takes 1800 U.S. dollars to buy one ounce of gold

That means the U.S. dollar is worth $0.01 now….. that is one cent, it dropped 99%.

Fiat is legal tender, what that means is it is forced tender, you are forced to use it, through using it you give the globalist/communists their source of power. you are forced at gun point to use it.

If it wasn’t forced tender nobody would use it. It enables communists and with printing presses running it becomes worthless.

It gets way worse….

Fiat is legal tender, what that means is it is forced tender, you are forced to use it, through using it you give the globalist/communists their source of power. you are forced at gun point to use it.

If it wasn’t forced tender nobody would use it. It enables communists and with printing presses running it becomes worthless.

All fiat is borrowed into existence and interest is charged, that is evil, it is banned in Islamic and Christian religions. With bitcoin there is no usury or interest charged.

bitcoin isn’t just created with a keystroke like fiat is, bitcoin is mined privately and it requires work, electricity, equipment and a huge amount of calculations, number crunching. (mining is processing the transactions on the network). this is all done by private individuals, no government or bank involved, real free enterprise.

fiat requires no work to create it, fiat is borrowed into existence and interest is charged (usuary), the taxpayers pay the interest…lol…billions and billions of $$$$$$$$$$$$$$$

AND…..through the tax system you are forced to pay the interest, guess why income tax exists……..so you can pay interest to crooked evil banksters….

Hi Anon,

in re: “bitcoin is mined privately and it requires work, electricity, equipment and a huge amount of calculations, number crunching. (mining is processing the transactions on the network). this is all done by private individuals, no government or bank involved, real free enterprise.”

Stating this is different than explaining it. No one seems able to – in terms that make plain sense. Can you do so?

“Mined”? What does that mean? How does one “mine” an online digital totem (or whatever you prefer to call it)? It has no real existence; it’s a conjured electronic . . . what, exactly? And how does this “what” have any value, as such?

Hi Anon,

We’re in agreement about fiat “legal tender.” But is Bitcoin a sounder alternative? I do not consider that it is. In some very important ways, it is worse. The most obvious being it is digital. This is wildly dangerous as anything digital is not under our control and can be “turned off” at will by whomever controls the Internet. Inarguably true. I think encouraging people to use digital “money” is disastrous. I think it is essential to get back to using hard money. Gold and silver aren’t perfect but they have the singular virtue of being impossible to just “cancel” or “turn off.” It is necessary to physically seize it in order to take it from someone and its value cannot be taken away via “inflation,” because it is impossible to print or digitize into existence more of it. This makes it inherently sound and stable – as well as anonymous – in ways digital currency can never be.

Hi Eric

Another good quality to bitcoin is there is no usury involved.

All fiat is borrowed into existance and interest is charged, that is evil, it is banned in Islamic and Christian religions. With bitcoin there is no usury or interest charged.

bitcoin isn’t just created with a keystroke like fiat is,

fiat requires no work to create it, fiat is borrowed into existence and interest is charged (usuary), the taxpayers pay the interest…lol…billions and billions of $$$$$$$$$$$$$$$

bitcoin is mined, it requires work, electricity, equipment and a huge amount of calculations, number crunching. (mining is processing the transactions on the network). this is all done by private individuals, no government or bank involved, real free enterprise.

bitcoin mining

https://bitcoinmagazine.com/guides/bitcoin-mining

With the globalist/stanist/banksters and there central bank usury eventually they own everything and everyone else is homeless. The crooked politicians fill their bank accounts with free printing press fiat and you pay the interest on it…lol….

That is the real reason the evil banksters are against bitcoin, they can’t charge interest, no usury involved….

If you are against bitcoin and use/support fiat you are in bed with the globalist/stanist/banksters and supporting evil usury.

gold and silver is still the best, only, money………

Hi Anon,

In re: “If you are against bitcoin and use/support fiat you are in bed with the globalist/stanist/banksters and supporting evil usury.”

I distrust Bitcoin and consider it a speculative scheme. That does not mean I support fiat. I use it because for the most part I must. Because it is the only legal tender for paying certain unavoidable things, such as property taxes. You cannot pay for most things with Bitcoin.

I advocate for a sound money alternative.

Hi Eric

Yes gold and silver are the best, bitcoin is easier to transport and to get money out of the country in one second. For traders or speculators or maybe over the long term there is a possibility of appreciation owning bitcoin, but it is volatile. Cash is best for private transactions.

Right now I like to own the gold and silver mining shares for upside profit. I am bearish on real estate, the stock and bond market, crypto other then bitcoin is a casino, bitcoin trades with nasdaq so maybe there is more downside??

This is why central bank fiat is the worst nightmare:

fiat requires no work to create it, fiat is borrowed into existence it is all debt and interest is charged on it (usuary), the taxpayers pay the interest…lol…billions and billions of $$$$$$$$$$$$$$$

AND…..through the tax system you are forced to pay the interest, guess why income tax exists……..so you can pay interest to crooked evil banksters on their worthless fiat…….

There sure is a lot of people talking up/defending/using/enabling the fiat created by evil globalist/communist/banksters….they must love being forced to pay tax…lol…

gold and silver is not debt it is real money, with a gold standard there is none of this grief, but the banksters don’t like it because they can’t create it, expand it, charge interest on it

Anon,

I am not defending Fiat, yet you continue to imply I am by not embracing Bitcoin, or because I use Fiat (Federal Reserve dollars). I’ll eagerly use sound money when I can use it to pay for the things I need to buy as well as debts I am obliged to pay. Until then, I will use the dollar because it’s what we’ve got to work with until there is something better.

That isn’t Bitcoin.

Hi Eric

bitcoin mining

bitcoin mining

https://bitcoinmagazine.com/guides/bitcoin-mining

Hi Anon,

I understand that computers “mine” (perform these calculations) and expend energy; that “work” is performed. I do not understand how this creates value. I could work very hard doing something but if no one wishes to pay me (exchange a unit of value for the work product) then I’ve simply expended energy. Real money is value incarnated. A physical way to hold and retain the value of good and services so that they might be exchanged for other goods and services of value. Fiat dollars are an echo of that kind money as they were once backed by gold and silver and the paper was merely a kind of convenient receipt for the gold and silver. But even now, the paper has value aside from its diminished value as a stable way to store the value of goods and services because it can be exchanged anonymously. Nothing digital meets that critical criteria, leaving aside considerations about the source of its value and its stability as a way to retain/store the value of goods and services.

It is fundamentally a speculative “investment” – the word you’ve used, which I think is accurate. Real money is not about “investing.” It is about saving. So as to retain value.

Hi Eric

A very important difference

fiat is debt

requires no work to create it, fiat is borrowed into existence, it is debt and interest is charged on it (usuary), the taxpayers pay the interest…lol…billions and billions of $$$$$$$$$$$$$$$

then the government through the tax system forces you to pay the interest on it, no escape

then when you use it you pay again, it becomes worthless over time…

gold and silver is not debt, it is the only real money, no interest is charged

bitcoin is not debt, the creators of it don’t charge interest on it after creating it,

central bankers charge interest on fiat after creating it it is all debt…..these central banksters are smart…..

using fiat makes you a debt serf

Hi Anon,

I’m not and never have defended fiat currency. This doesn’t oblige me or anyone else to defend Bitcoin as the alternative. I’ve explained why I consider Bitcoin both scammy and dangerous. I’ve yet to hear a good counter to either position. I favor sound money, real money, stable money. Digital currency created out of nothing is not that.

Bitcoin is a step towards the currency technocracy has wanted since the 1930s.

Most importantly:

1) It has a logging system of transactions.

2) It represents energy.

A logging system can easily become a monitoring and permisssioning system. The energy feature combined with CO2 driven ‘climate change’ and UBI becomes the energy ration currency.

Get people used to the idea through bitcoin, find a reason to modify it or replace it and there we are. Also keep in mind govt has already found ways to trace bitcoin transactions.

Hi Eric

All fiat is borrowed into existence and interest is charged, that is evil, it is banned in Islamic and Christian religions. With bitcoin there is no usury or interest charged.

bitcoin isn’t just created with a keystroke like fiat is, bitcoin is mined privately and it requires work, electricity, equipment and a huge amount of calculations, number crunching. (mining is processing the transactions on the network). this is all done by private individuals, no government or bank involved, real free enterprise.

fiat requires no work to create it, fiat is borrowed into existence and interest is charged (usury), the taxpayers pay the interest…lol…billions and billions of $$$$$$$$$$$$$$$

AND…..through the tax system you are forced to pay the interest, guess why income tax exists……..so you can pay interest to crooked evil banksters….

working against them…..they don’t collect interest on it, they don’t have piles of money to finance their leftist programs like stealing elections and forced injections, masks, lockdowns, wars…….developing more programs to control you…all that is done with the printing press printing fiat, their source of power……

Hi Anon,

You write (again):

“bitcoin isn’t just created with a keystroke like fiat is, bitcoin is mined privately and it requires work, electricity, equipment and a huge amount of calculations, number crunching. (mining is processing the transactions on the network). this is all done by private individuals, no government or bank involved, real free enterprise.”

But enterprise creating…. what? It could also be said that digging holes in the yard and filling them up again is free enterprise. But is value created thereby? So, these computers run calculations and use electricity. What is produced as a result of this?

Right now, Bitcoin is free of taxes. But – being digital – it could easily become the perfect vehicle for taxing every last cent of currency earned and spent; it holds the potential to eliminate free enterprise – i.e., underground/cash transactions that the eyress doesn’t have any ability to find out about with hard money or even cash (fiat) money.

Neither Bitcoin nor any crypto is “free of taxes.”

https://www.nerdwallet.com/article/investing/bitcoin-taxes

Losses are capped at $3k as well.

Thanks, Anon. No exchange of services or type of currency is safe from Uncle Sam. I don’t know why anyone believe that crypto is free of taxes.

I would honestly state that the IRS and U.S. Government has already well established the taxation of virtual currency before many of us had even heard of such a thing.

On each taxpayer’s annual 1040 form one must answer the following question:

“Please verify at any time during the tax year, the taxpayer received, sold, exchanged, or otherwise disposed of any financial interest in virtual currency.”

They have tied virtual currency to the FinCEN which means there will be no place worldwide that a U.S. citizen will be able to hide more than $9999 at any time. Lie (and get caught) and the penalties are huge. FYI: The IRS notice 2014-21 regarding crypto currency was established in and tied to the FinCEN on 3/18/2013. This is not something new. The government knew what was coming and she is prepared.

if one doesn’t know who the miners are and who is initiating the transactions who is to say they aren’t double agents or Feds? The Feds were able to hack into the overseas accounts to retrieve a large portion of the Colonial Pipeline money that was paid by Bitcoin last year. Why does anyone believe that anything they do is unhackable or untraceable? If it was processed with technology, I guarantee they already know about it.

This is why the Mafia and drug cartels love cash.

Anon,

No one seems to understand it – or rather, can clearly explain it in a few sentences. That alone is cause for suspicion. I’m neither old nor stupid and I’ve yet to haver anyone provide an explanation regarding its source of value (other than as derived from speculation) or how it is impervious to devaluation via increased supply or how anything that is online can be “anonymous.”

Stating that “lot of old people don’t understand it” is the kind of gaslighting performed by multi-level marketing “get rich quick” salesmen doing seminars at the Holiday Inn.

“I’ve yet to haver anyone provide an explanation regarding its source of value (other than as derived from speculation) or how it is impervious to devaluation via increased supply or how anything that is online can be “anonymous.” ”

Eric,

They can’t explain it because it is none of those things.

To really understand how much of a scam it is, watch https://www.youtube.com/watch?v=YQ_xWvX1n9g it is a bit long (use 1.5x playback to shorten viewing time), but he does a really good job of explaining why it is a scam and technically susceptible to fraud and attacks. He even shows how it is not anonymous, buy tracking what some memers have done with their NFT funds (NFTs are another scam solely to pump up crypto!)

Anon, Millennials don’t seem to understand it either, if they did they wouldn’t have bought it. Bitcoin is a con, used to catch those millennials who were smart enough not to fall for the stock market con. Something ‘new and exciting, not your father’s old

Buickmoney”.Hi Anon,

It isn’t because of old people don’t understand it, but that they sell a rat and choose not to buy it. When Matt Damon is the spokesperson for crypto the little light bulb in our mind should flash and we should question why celebrity spokesmen are needed. The third richest man in Mexico is promoting it? I am sure he is an upstanding citizen who hasn’t screwed, lied, and scammed people to become so wealthy. We should definitely take his advice. The rich have always advocated for the poor to elevate their status in the world and achieve success that puts them on the same playing field as the world’s oligarchy, right?

Amen, RG –

The bottom line objection to crypto, for me, is that it is digital. How anyone can trust anything digital given what we know about digital (online) anything astounds me. I think that it is absolutely essential to return to sound/hard money if stable/anonymous money is wanted. Gold and silver cannot be “mined” except in reality – and that limits how much can be mined – and put into circulation. Bitcoin can be “mined” to infinity. It can also be seized by anyone who has control over the digital/online “asset,” which could be anyone, anytime. It certainly will cease to exist if the Internet is closed down or control given over to the government, which seems a not unlikely prospect.

The whole thing reeks of scamminess. Maybe some Millennial hipster types and other speculators are making money – or were. But I prefer to stick with tangible money of real value that is under my control.

Hi Eric,

It also reeks of government establishment, much like the Internet. When there are no faces of the founders, I cannot help but opine that the profiles are nonexistent for a reason.

RG, there is no face of those who really control the dollar, yet you and many millions use it each and every day. Its not a matter of trust or faith. Its a matter of utility. If crypto ever becomes generally accepted (in spite of the gangs and those who own them) it will be because a sufficient number of people found some utility to it. The idea that the Masters of the Universe™ are going to turn off the internet, is an example of people not thinking through the implications. Those implications are dire in the extreme in the modern world. We may well lose it, just as we may lose the power grid. We may also see the various gangs attempt to control it. But any one familiar with the Great Firewall of China, and their endless attempts to control their own section, would understand its not nearly as simple as the gangs would like one to believe.

Hi BJ,

I see Jay Powell’s face pretty much every time I turn on Bloomberg. The US dollar was established after the Federal Reserve was implemented in 1914. We can track US currency back to the US Mint. Who do we track BitCoin and crypto back to?

Sure, we can go down a rabbit hole and question who setup the Federal Reserve and why did they do it, but we do have an organization as the face of the US Monetary Fund. If the US dollar becomes worthless we have homes that we show up in front of with our pitchforks and torches. Whose house do we burn down when crypto is delisted and Americans lose their asses?

Hi RG. If you think that the chairman of the Fed, controls the dollar (or even the Fed), you need to do a bit more research. I’d start with why this is the *third* attempt to foist a central bank on the US. After that, I’d look at those who have been behind all three attempts. The Fed was created in 1913. After a group of bankers and others formed a real conspiracy to do so. The details are laid out in G. Edward Giffin’s The creature from jekyll island. Follow that with the Secrets of the Federal Reserve by Eustace Mullins.

But before you start with torches and pitchforks, it might be a good idea to have an idea who the real enemy is. They always act from the shadows, and always through proxies.

Other wise, you are simply playing into their hands. Always keep in mind that they consider their proxies expendable.

As for crypto, its a matter of personal choice. Some of them show promise from a technology perspective (which is my main focus). Understanding the social/political/economic implications is what makes it so fascinating.

But if you think that you or anyone else, is ever going to be able to hold those who are really responsible for most of the corruption/misery over the last few centuries accountable, you don’t understand the nature of their power, nor what they are willing to do to keep it.

It has been said that; “Its good to be the King!”. Its even better to own the king. That way, when the rabble come for the king, one simply slides back into the shadows, waits for the next king to arise, and then buy them. Rinse, repeat…

https://www.youtube.com/watch?v=9DxJ-zUtl60&ab_channel=TheOfficialMELBROOKSChannel

Hi BJ,

Nowhere did I say the Fed Chairman controlled the dollar. I think many of us realize that the establishment is much bigger than that. I clearly stated we had a face to the institution, which is a lot more than crypto has.

The ones who control never get the blame, that is why they remain nameless and faceless. I just merely stating from your original post that the US Dollar (which was established in 1914) after the Fed and income state were implemented in 1913, that there is a hangman available. There is none for crypto. To put allegiance onto something that no one knows who started it, controls it, or governs it is putting the horse before the cart.

Hi RG. So yet another proxy takes a fall. How does that help? As for holding institutions accountable, that’s even more pointless than hanging proxies. Institutions are as abstract as societies or even civilizations are. It is in the illusions/delusions that bind us to these abstracts that they find their power. Once we move beyond those, perhaps our species will mature enough not to need monsters any more. We appear to be in a race between growing up and extinction. The next few years look to be critical to how this all turns out.

As I’ve stated, I’m no real advocate for crypto. Its simply a test bed for various technologies to me. Its a new tool, just as many other disruptive technologies are. But like any tool it can be abused, as well as used. I’m not asking anyone to trust or use it. But I do think it should be observed carefully. It has the potential for great good, as well as incredible evil. Only time will tell the tale of which it will be. If history is any judge of such matters, it will likely be a mixture of both.

BJ, The “just-a-tool” fallacy regarding technology is known as “instrumentalism” and was debunked by Heidegger, at the latest. Heidegger appreciated that technology is not merely a potential danger, but “it is the supreme danger.” (“The Question Concerning Technology”; 1954.) Technology is “danger as such“.

Every instantiation of technology has a conspicuously predictable teleological trajectory. To the extent it can function to subjugate, enslave, and curtail humanity, it will do so. This unmistakable, invariable pattern of technological development and dominance is precisely so because technology is an autonomous force of nature. Even though humans may be the substrate through which this force emerges, mankind is never in control of it, and it is never a mere neutral “instrument.” It’s not “just-a-tool,” but it is instead an end to itself. Indeed, it is the end unto itslef. As in The End. Digital currency is actually one of the most obvious and blatant examples of this, because frankly there’s no value or upside to it whatsoever. It’s just digital bits floating in a cloud, to which mindless monkeys devote enormous resources, attention, and energy. It’s a behavioral black hole.

Digital currency has no potential to do anything but evil. It provides no food. No warmth. No sustenance. No pleasure. No value. To the contrary, it sucks up all these things like a cosmic vacuum. Yes, “time will tell.” And I’m telling you what time will tell, and it’s painfully obvious what time will tell. (Hint: It won’t be a “mixture of both” good and evil. It will be nothing less than the perpetual, cybernetic slavery of the entire human species. To pretend there is an alternate possibility is an exercise in Panglossian fantasy.)

Hi FP,

One of my favorite sci-fi series is Dune, by Frank Herbert. He envisions a future after a “machine war” – specifically, a war against thinking machines (computers/AI) after which human beings revert to using their natural intelligence to perform complex math and so on. The first book in the series was written 50-something years ago. I found it quite prophetic as well as a good read.

Technology is inherently problematic because there are always people who will use it, whether consciously not, to further ends that end up being catastrophically bad for most people. Cell phones provide an excellent example. Their antecedent was the pager. Doctors had them so that they could be summoned in the event of some urgent occurrence. Most everyone else had a wall phone and for that reason had a life. Most people went the whole day without making or receiving a call – and most of the calls that were made/received were when you were at home. Was life better – or worse – before people were able to (and addicted to) making calls (and sending texts) all day long and everywhere they went? I remember the Before Time and think it was better. People had more real conversations and spent more time in reality than on their phones. Now, people are on the phone – staring at it, tapping and swiping it – almost constantly, like rhesus monkeys enraptured by a shiny, blinking object.

Even those of us who dislike these things are obliged to have them on account of the fact that everyone else does – and because work often requires it. Not in the Face Diaper way but rather in that it’s expected and if you tell a prospective employer you haven’t got a “smart” phone and are only reachable via a land line, it’s likely you won’t be hired on account of not being “reachable” at all times, especially on the way to/from work – which was formerly a sanctuary of downtime away from being stalked by work.

There are other examples, too.

Computers being the best example of inherently dangerous technology from the human point of view. Even as I type using one and disseminate what I type via them. Yes, that’s an upside. But it is a bigger downside in terms of what I do being an attempt to warn of the very dangers created by computers. When I wrote something back in the early ’90s, it had to be printed and then physically distributed. It was more “clunky” than now, certainly. But also less ephemeral and more tangible; more real. Was it better? That, of course, is a value judgment. But – again – I can recall the Before Time – and in my estimation, it was better. People seemed less harried and regimented; there was more genuine difference/individuality expressed. Certainly, the conformity-tyranny rampant today was not possible, technologically speaking, in the Before Time.

I’d go back, if I could.

Hi BJ,

I’m on FP’s side regarding crypto – digital currency of any kind. Whatever potential it may have for good is certain to be cancelled out by its monumental danger for evil. The profit and control factors assure this. Digital money could – and so, will – be used to eliminate all “off the books” transactions, to account for and tax every single digital “penny” you earn – and spend. It will also be used to control you by threatening to cut off your ability to earn – and to get paid and to spend what you have earned – if you aren’t obedient. Try to imagine – it is not difficult – what Fauci or someone like him will do if given the capability to “lock down” anyone who doesn’t wear the Diaper or get the Jab. Think about what these people will do if they can do it. Based upon what they have already done.

People concerned about salvaging any vestige of anonymity and control over their financial affairs – over their lives – ought to be opposed to digital money in principle, irrespective of the form it takes. No – zero – good can come of it. Much bad is assured to come from it.

eric, I can’t agree any more strongly than I do with all these sentiments. The history of the adoption of mass communication and digital technology has been the history of the mechanization of man, and the modification of man and his habits to suit the needs of technology—not vice versa. We have now reached the point where technology has been erected as a barrier between every human and the entire universe of his desiderata. There is virtually no end that can be achieved without working through (or around) a digital intermediary. Digital currencies are the final barrier, giving the Machine perfect, granular, real-time control over every single action of every human on Earth, with a kill-switch. Once the Machine can starve us at will by simply switching off our means of exchange, we will be Its completely helpless meat-puppet slaves, and only then will we begin to see the true designs It has in store for us.

“A man would die of hunger who, having decided that money is real wealth, should carry out the idea to the end” …

https://mises.org/library/what-money-1

Hi Eric.

I’m quite surprised that a old time gear head would have that attitude about technology. I expect such from agents of despair. Technology is simply the result of human creativity applied to various problems. It has vastly expanded our populations standard of living and life span. The fact that its been used by evil people, speaks more about their mental pathologies than it does about the technology they are abusing. Without our technology we’d still be living short brutish lives in caves. The idea that technology is some alien construct, meant to destroy humanity is the type of nonsense I’ve come to expect from those preaching the Gospel of Despair. Science is up stream from technology. Its concepts

and precepts are used to craft technology. Unfortunately, simply because a thing can be done, doesn’t mean it should be. But that would require insight, foresight and personal responsibility, which is sadly lacking.

As for crypto in general, yes it has much potential for evil. I’d rather see gold/silver or commodities used myself. That may end up being the basis for the next war. The Empire isn’t going to allow the rest of the world to drop the dollar as the reserve currency without a great deal of bloodshed. Neither are those behind the global cartel of central banks. Unless they can get their hooks into what ever comes next. CBDC’s are a very real danger, but far too many people can’t see that. But technology can always be turned against those abusing it, if one understands its principles. That’s one of the lessons that Lind teaches those who study his methods. Don’t give up hope. This fight is far from over.

Hi BJ,

I have reluctantly come to the conclusion that, while technology can and has benefitted most people in quantifiable ways, it has also cost them. And the accelerated pace of technological development, particularly with regard to computers and especially “connected” ones – tips this balance more and more toward cost rather than benefit, for most people.

At least, within the context of the current system. And therein lies what may prove to be the most beneficial aspect of technology, if it is used to undermine and – ultimately – end the current system in favor of one more decentralized and individualistic. But is that likely to happen? Or is it more likely that technology will be used more and more to enserf us?

I hope the choice is not between going Amish and going Borg. But I fear there may not be a middle ground in the future.

Hi Eric. As I’ve stated technology simply produces tools. Its how those are used that determines the out comes. I know you dislike computers. Many people do. But they have been one of the most revolutionary developments of the last century. But again they are only tools. I’ve seen their development from the time they filled entire rooms, to today’s hand held. I also have a smart phone. I consider it a marvel. With it I can connect to a good fraction of human knowledge, read books, watch videos and listen to my favorite classical music. I also have a very nice programmable calculator on it. Round that out with VPN and security software, and that’s in something that fits in the palm of your hand. Amazing. As I said, its all in how you use it.

I’ve found over the decades that perception of technology is often based on knowledge of it.

I’ve seen it used to for good and evil. But the users are the ones that determine the out comes.

Look at firearms as an example. They can be used to protect ourselves and our families or they can be used for great evil. Again, its the users that determine that.

At the very bottom of the vast majority of our problems, one find the various gangs (and those who own them). Its their various scams/hoaxes that are leading our people towards

destruction. Fortunately, they are not the only ones moving pieces around in the shadows.

Prepare for the worst, and hope for the best.

BJ: “computers … have been one of the most revolutionary developments of the last century. But again they are only tools.”

Plainly incorrect. In my relatively short time in the legal field, computers have been systematically mandated for every aspect of practice: first for all legal research to meet standard-of-care; then for all filings that were once done in paper, by hand, with human clerks; then, in 2020, for all depositions and hearings, which are now mandatorily done by use of computerized telecommunications videoconferencing. These top-down impositions are not “tools”. They are control and surveillance mechanisms that have completely encased the legal justice system in a technocratic shell, constituting a threshhold boundary separating humans from justice, and requiring enormous infrastructural adoptions, adaptations, and accomodations by all practitioners and litigants. It’s a robot-insectoid nightmare not of the making of any human by means of voluntary adoption, but rather a faceless, inexorable encroachment of technical mandates and costly barriers. Medicine is very similar in that regard. Doctors don’t voluntarily choose to use computers for all medical records or for “tele-medicine”. This is mandated on them by legislation and regulation, to the benefit of the technocratic management class alone.

Your insistent fantasy of “just-a-tool” is entirely unreflective of reality, and seems rather to evince your relatively low level of engagement with the real world before the computing revolution, so you are simply ignorant of just how much the real world has been damaged and cut off by the overweening and involuntary metastasis of computers into all corners of civiliztion.

Hi FP,

Computers have a seductive aspect to them to the people not directly harmed by the them – as they see it (they may see differently, eventually). A good example of this is my own profession. I have the perspective of having been a working journalist before the advent of connected computers and – specifically – the Internet. When I was a young reporter, I carried a notepad with me. I took notes. I then wrote my article on an unconnected/in-house primitive computer which wasn’t far advanced from an electric typewriter except in that what I wrote could routed to the copy desk/editors in a non-physical way.

The article was read by copy editors, who made adjustments for grammar and double-checked assertions and so on within the article for veracity. The proofed article then went to the make-up room where it and the other articles for the day’s edition would be formatted and master dummies created that would serve as the template for the eventually finished day’s paper. There were graphic artists who added photography, cartoons and so on.

Fast forward just a few years and most of these people no longer had jobs. I still have mine because – so far – computers cannot do what I can do. I am grateful for this – but also saddened by the fact that probably two-thirds of the people once employed in my business no longer are. It is (as you’ve written) no longer possible to write – well, to publish – without these connected computers, unless you wish to write things that almost no one will ever read. The online rip tide has seen to that.

Now, some in my position are happy about the freedom computers have given them, the power to compete with even a major newspaper as what I or anyone else writes has the potential to reach as large and even a larger audience than what the Times prints. However, I have worried from the beginning of the connected computer era that, once online is all there is, the consolidation phase will end and the control phase will begin. And it has. Government now uses centralized computing to end-run the protections of the First Amendment, which only applies to government censoring speech. When a few “private” entities have de facto control over speech, then somehow it’s not censorship. It could devolve into something far worse.

The underlying problem here may not be the computers/connectedness as such, however. The basic problem may be that of centralization. If that knot could be undone – if people lived in communities, among people they knew and trusted as they once did – the grip around our throats of these remorseless computers might be lessened. Here the Amish provide a rough example. They do not couple with the system and thereby, avoid many of the system’s pernicious aspects. I think that – absent “the machine” exterminating millions of people, to get rid of the resistors – decentralization stands a chance of saving humanity. But I agree we ride on the edge of the razor blade, as of right now.

Hi Eric. Its not the computers that are the threat. They have no grip on our throats. Its the gangs and their cronies that are abusing them. Would you claim that it was a firearm in the hands of a criminal that was responsible for the crime?

As I said, distributed and decentralized systems are the hope of the future. I’m involved in several projects working on such applications. There are many more people involved in such efforts than many appear to realize. There are many, very talented and experienced people working on these projects. Why? Because they can see the future as well. Its not just the gangs and the merchants of despair that are in operation. Speaking of which, can you think of a better way to undermine potential resistance, than to convince as many people as possible, that there is no hope, and that despair is the only option? Keep that in mind as we move forward.

By the way, given our discussion on sound money, I thought you might find this of interest.

https://mises.org/wire/freedom-and-sound-money-two-sides-coin

“There are many, very talented and experienced people working on these projects.”

Top men, I have no doubt! Top! Men!

Interestingly, no names are named. On the other hand, one can read many granular specifics about lavishly-Rockefeller-funded, big-name public projects designed to build “the collective cybernetic nervous system of an evolving transhuman superorganism, [called] the HeartMath Institute’s Global Coherence Network of wearable neurofeedback technologies that interlink human biorhythms through smartphones across the planet”.

https://unlimitedhangout.com/2022/05/investigative-reports/barbara-marx-hubbard-godmother-of-transhumanism-and-synthetic-spirituality/

Industry titans—with massive governmental and corporate funding—like Ray Kurzweil, Mikey Siegel, Claudia Welss, Josh Whiton, Deborah Rozman, Lynn McTaggart, Nina Rothschild Utne and Dean Rudin, just to name a few, are energetically pursuing this technology. Once developed and ready to scale, will this neuro-collectivizing technology be mandated, just like computers, the internet, fondleslabs, and Zoom have been already? To ask the question is, obviously, to answer. Compulsory tethering all of humanity to the global hive mind is, of course, the entire point.

Is this tech “just-a-tool” too? And if so: whose tool is it, is this really a “useful end”, by whose metric is it “useful”, and what is its possible benefit, really?