Could you afford to spend $1,000 or more each month on a car payment? Not counting the costs on top of that – such as insurance? Apparently, about 15 percent of the car-buying public is paying that much – or more – each month, on a car payment.

Not counting the costs on top of that.

But can those 15 percent afford it? The credit reporting agencies are doubtful. They point to alarming loan-to-value ratios that are increasingly tilted in the direction of default, as the car is worth less than the loan outstanding. This being a function of depreciation. The car’s value declines with each month, but the monthly payment remains the same. In fact, it goes up – as a practical matter – as the value (buying power) of money goes down.

It is most alarming in the used car market, where the cars depreciate even faster and the loans are more expensive, because the interest applied to them is higher.

According to J.D. Power, the loan-to-value ratio in this market is now 125 – which when parsed means the loan balance outstanding amounts to 125 percent of the market value of the vehicle.

When this happens, what often happens next?

The borrower often decides it is no longer worth making those monthly payments and so stops making them. The loan goes into default and the car is repo’d. It is then put back on the market – often, via auction – where it tends (writ large) to depress the value of used cars generally. This is good news, if you are in the market for a used car.

Assuming you do not need a loan to buy it.

Aye, there’s the rub.

Because most people do – whether for new or for used. Because cars are now so expensive a loan – a long one – is the only way most people can afford to “buy” a new (or used) car. Because most people are not in a position to plunk down more than a small fraction of the almost-$50,000 that the average new car “transacted” for last year. Or the $15,000 or so that it takes to buy a serviceable used car.

So they finance most of the cost – and set in motion the loan-to-value scenario described by J.D. Power. It is worth making the payments for the first three or so years. But by the fourth or fifth it becomes less so.

Time for the heave-ho.

This is done for sound reasons as well as out of desperation. It is stupid, after all, to keep on paying top dollar for a thing that isn’t worth half the dollars it originally sold for. People walk away. People also have to walk away, having assumed more debt than they can pay for.

Twelve grand a year – not counting insurance and not counting gas – is a lot to pay for a car. It is $60,000 over six years – not counting the cost of insurance and gas, which together probably push the total well over $70,000.

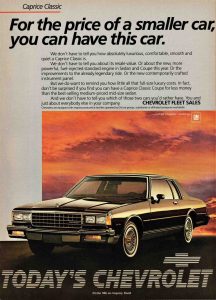

This latter figure is now routinely spent (that is, borrowed, at interest) on a new truck or SUV – the “family cars” of choice as most cars (the few you can still buy) are too small for families. In 1985, one could buy a six passenger family car like the Chevy Caprice sedan for just under $10,000. This amounts to about $28,000 in today’s depreciated-value dollars.

It did not take six years of $1,000-per-month payments to pay off an ’85 Caprice. It took about three years (maybe four) and about $250 per month (in 1985 dollars). This does work out to about $700 per month in today’s devalued dollars but the relevant point is the borrower was only paying that for three or four years rather than six or seven, as is typical today. Put another way, after three or four years, the buyer of the ’85 Caprice was no longer paying anything for the car.

What he paid was also more aligned with the value of the car as it depreciated. By three or four years out, the ’85 Caprice may have only been worth about half what it sold for new – but by then, the borrower had paid it off, so he was “net green,” to borrow a phrase from the very red “environmental” movement. He owed nothing and the car was still worth something. It is not surprising to note that – back in 1985 – most people could afford things, because they weren’t making endless payments on things they could not otherwise afford.

How about a basic transportation car?

In 1985, a new Chevy Chevette cost about half as much as a new Caprice, so it took about half as much money in monthly payments to buy one. Imagine paying around $150 per month for a brand-new car. And paying it off after three or four years. You’ll have to do just that – imagine it – because it’s no longer possible to do that. It costs several times as much to finance a used car now than it cost to finance a new one, once-upon-a-time.

And why has this changed? Because the system has changed. It used to be that people bought what they could afford – and if they could not afford it, they waited until they could afford it. Now – courtesy of a system that eggs on debt-serfdom because it profits from debt serfdom – people are effectively forced to buy what they cannot afford, as there is no affordable alternative.

But there is a lot of money to be made – for those entities in a position to loan it (and profit) from it.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

Speaking of new vehicles…

Being that I need to replace the cooling system on my usual Chevy workhorse, I had to pick up some heavy equipment (over 2,000 lbs of scanning electron microscope!) yesterday, and, to do so, I

had a rent a U-haul truck to pull the trailer.

Eric, I’m not sure if you’ve reviewed the 2023 Ram 1500, but I was not impressed!

Well, to be fair, this was the V6 version, so the V8 might’ve been a better experience. I didn’t have to look under the hood to know it was a V6. It was underpowered for this particular mission, and would sometimes rev to 4 or 5,000 RPMs to keep with the speed limit on some rather modest hills.

I thought the transmission knob (!?) was a bit silly, but the fact that it would spontaneously shift from reverse to park when I was trying to line up the hitch to the trailer was perplexing and annoying.

What was worse was the throttle response. It was clearly all drive-by-wire, and I couldn’t get the bastard to reverse gingerly as necessary in these procedures. It wouldn’t “goose” like any other truck I’ve driven. I had to carefully increase pressure on the accelerator pedal, and then it would peel-out anyway. Very difficult to make tiny corrections. NOT a fan. I almost smashed the license-plate with the trailer.

There wasn’t too much in the way of nanny equipment on board, thankfully, but there was a persistent “fasten seatbelt” light and chime that kept admonishing my GF for not promptly strapping in. That was quite annoying.

I don’t like drive-by-wire, and certainly don’t like monthly car payments, ESPECIALLY if they’d be so astronomically high as they are these days.

I’ll keep my 90s-era trucks running forever if I can. I don’t like where things are headed.

The Chevy Caprice ad at the top of the article jumped out at me for reasons totally unrelated to cars or financing.

But explain, to me anyway, why we find ourselves in the nine line bind we are in.

Hi AF,

It’s a long story – going back to the ’70s – when CAFE regs first went into effect. These federal fuel efficiency fatwas served the purpose of forcing full-size/V8-powered mass-market sedans and wagons off the mass-market. They became low-volume/high-priced “luxury” vehicles for the very affluent only. Fo a time – this was in the ’80s and into the ’90s – trucks and SUVs replaced large sedans and wagons as mass-market vehicles that most average people could still afford. They were – for a time – held to a lesser CAFE standard. That changed – and now trucks and SUVs cost as much as luxury cars. But people still “buy” them – because they are able to finance them. Irrespective of their ability to pay.

And so, here we are. It’s easy to see where we’re headed.

Speaking of GM, you’d probably be interested to know that GMAC’s successor company, Ally Financial regularly loans (or did loan) more than 125% of the value of a vehicle. I won’t say how I know that, but a 130% or more loan was not unusual.

It boggles the mind to think that some are shelling out $1,000 every month for a car (or truck) payment. A friend of mine, their great uncle’s first house cost $30,000, and most new cars cost more than that these days. Then again, these were 1960’s prices. I surmise we can thank a worthless dollar and too much money printing for that? Andwhat if the dollar crashes, and/or the rest of the world dumps their dollar holdings back onto U.S. shores for a more stable world currency? Something about being up sh** creek without a paddle comes to mind.

Hi Shadow. Unfortunately you don’t even have to go back to the 60’s for those prices. I bought my first house in 1982 for $32k. It was a modest 5 room ranch with one car garage on a 1/4 acre lot in a middle class Massachusetts suburb. Nothing special, but not a bad place to live either. Left there a long time ago, but I’d guess it’s “worth” about 500k today.

I just had a bit of a shock. Even for a car in the 30k range at a currently special interest rate of 2.9% for 36 months, the monthly payment is well over $900/month. Ouch!

You want me to pay you for stating the obvious? Sorry.

Those books (Blue Book, etc) and other paraphernalia that supposedly determine the ‘value’ of a car are nothing but hogwash propaganda to entice people to spend money they don’t have on junk they don’t need.

Every car I don’t buy I consider as money in the pocket. The 98 Regal I have drove me to work and back nicely. It still drives me where I want to go. Every month I keep it,,, it is equivalent to 500-700 fed bucks. Insurance is cheap and maintenance is minimal. Today’s car are about as junk as it gets (like everything else).

Last big expense was to rebuild the air conditioning system that quit working. New pump, receiver dryer orifice and other misc parts about $1000. I did the work. Took a couple weeks collecting the parts and doing the work. Damn thing freezes me out of there now. I considered a new or newer car but the payments, tax, and other fees + insurance would run about $800 per month. So,,,In about 2 months I am free and clear again. This is equivalent to about $9600 per year in my wallet.

I have a neighbor who is also retired. He has 2 new cars, a nice home he is buying, and a new electric mower (man,,, those things are NOT cheap). He is 76 years old and will likely be slaving away until he is planted. It’s what he ‘thinks’ he wants but I propose he has been brainwashed into ‘believing’ it is what he wants.

The values of your stuff is the value YOU put on them,,, not what someone else says. They are mostly on the take somehow,,, some way,,, relieving you of your fake money. Our entire economy is set up like that which is why it will crash.

Ken: This is great: ” Every month I keep it,,, it is equivalent to 500-700 fed bucks.”

The thing with old cars (and old fridges, phones, lawn mowers) is that they can be repaired, often by the person owning them.

Newer versions are practically impossible to take apart and put back together, in no small part due to the amount of electronics and how it is glued (vs. screwed) in place.

It’s the battery. Buy a new one.

It’s the starter. Buy two.

No, the solenoid. Ain’t that.

No, the battery cables have corrosion.

Clean the battery cable ends, starts right up.

You did it all ass backwards. Nothing new there.

They’ll do it every time.

Not only are the basic payments higher, but the length of the finance period is now 6-7 years, often twice as long as the vehicle’s manufacturer’s warranty, requiring the “owner” to cover an extended warranty unless they are confident they can afford a major repair and willing to gamble.

Last year, the water pump on my wife’s 2016 Explorer started leaking, and the labor to replace the $150 part was nearly $3000 since access required disassembling the front of the engine and was something only the dealer would attempt.

When we took the vehicle to the dealer, the service advisor said he had been seeing more leaking water pumps in that year Explorer, but the Edge had the same problem.

We paid off the vehicle in 4 years, but some were undoubtedly still financed through the beginning of this year.

Everything said here about the depreciation of cars and the loan being underwater, also applies to home lending, and cause the owners to walk – and the principle is, of course, a much bigger number. To protect themselves, banks demand a lean deposit – that way if you walk you lose the 10 or 20% you put down. But because of decades of inflation, which eats what you dollar buys, less and less have deposit money, especially as home appreciate … and thus the Fannie Mae no money down loan was the political solution.

Vets “enjoy” the privilege of VA loan, which is the government guaranteeing the deposit, so that the bank will lend 100% … but then the veteran is getting a loan with a bigger principle, which means the vet ends up paying more in the long run. Hmmm … sounds like a scam the bank enjoys. The VA loan was started after WW2, returning vets had blown their paychecks on French hookers and cigarettes.

What is at the root of this insanity is inflation, the currency value is going down and putting society in a big squeeze. Inflation is like a vacuum cleaner in a savings account. The long term result of inflation are a couple of very bad things:

1. Government has grown huge and onerous as it reaps the rewards of deficit spending, transferring the middle class wealth into it’s own coffers.

2. Savers are punished as the expense of the spendthrifts. Hard work and savings are destroyed, and gambling with money rewarded. People learn that thrift is stupid, and leveraging with debt smart. The road to easy street is to play the stock and housing markets. The stock market booms in nominal dollars creating a culture of speculators. Wild swings in the markets makes the commercial banks take big risks, that when they go sour, get bailed by the state. Socialism for the ultra wealthy.

3. We end up being lectured by the insane, like (((Paul Krugman))), crackpot economist, are telling us debt is no big deal, just money owed to ourselves, and we should keep the scam going by minting trillion dollar platinum coins.

https://markets.businessinsider.com/news/currencies/paul-krugman-economy-debt-ceiling-crisis-solution-1-trillion-coin-2023-5?op=1

4. With home values going up 10x, soon there is a class of incredibly stupid nouveau riche, who buy huge flat screens and watch FauxNews 24-7 and are running out to buy a $70,000 Tesla to save the planet. It’s the bonfire of the vanities and the rise of the stoopids. The comedy Idiocracy is really a documentary.

IDIOCRACY Clip – State of the Union

https://www.youtube.com/watch?v=ig446isvXlI

5. As society is turned upside down by a century of Federal Reserve intervention and endemic inflation, con men put up jobs like Elron Muskrat became the richest man on the planet farming government EV subsidies. Another interesting tidbit, GM’s loan division became the only part of GM making a profit.

Interest on the National Debt goes vertical, approaching a trillion a year:

https://fred.stlouisfed.org/series/A091RC1Q027SBEA

(But no worries Goyim, it is owed to ourselves, guvment econamyst)

We just need more M, making more M is the path to nirvana:

https://fred.stlouisfed.org/series/M1SL

——————–

How does all this insanity end? I think it is ending now, the world is decoupling from the dollar system, and Uncle Sam’s free ride pawning off the national debt on other nations is ending, and thus they will have to continue to raise interest rates, and with the world is choking on debt (now over 300 trillion).

Russia, BTW, is debt free.

Cant imagine a thousand $$$ a month going toward a depreciating asset. Maybe loading them up with all the bells, whistles, and saaaaafety features is a means of distracting the masses from the devaluation of Dollah Bill. In the days of my youth I used to dream of the day when I could buy any car I wanted, cash. Now that day has come and not a single one inspires the least interest.

Yet in this country you can’t live in your travel trailer on your own property! Or on “Public lands.”

Hi Peter,

“Yet in this country you can’t live in your travel trailer on your own property!”

This is especially obnoxious, isn’t it? It also says much about who owns “your” land.

And it says much about what the government thinks of the poor and those of modest means it is always pretending to care about. If it actually did care, it would not care that a person of modest means bought a trailer or RV to live in; indeed, this would be encouraged as RVs and trailers can be very nice – certainly nicer than being homeless – and are a very affordable alternative to a conventional house or even an apartment. Young people could use them as stepping stones to getting a stick built home, if they wanted one. Or just as a way to live inexpensively, so as to not always be broke or on the verge thereof.

Hey Eric, as an aside, I know about a year or so ago, you were talking about buying a camper. Did you ever get one?

Hi Floriduh,

No – on the camper. It’s just too much money right now. I wish I could, but I just can’t.

In Oregon, (or should I say the People’s Republik of Orygun) whole lot of RVers live on their land, or BLM land, tax free. If a house has wheels you do not have to pay property tax on it.

https://oregon.public.law/statutes/ors_197.493

“A state agency or local government may not prohibit the placement or occupancy of a recreational vehicle, or impose any limit on the length of occupancy of a recreational vehicle as a residential dwelling, solely on the grounds that the occupancy is in a recreational vehicle,”

———————

https://oregon.public.law/statutes/ors_446.125

Occupancy on private land:

A person may occupy a manufactured dwelling or a camping vehicle on private land with the consent of the owner of the land if:

(1)

The lot, tract or parcel of land upon which the manufactured dwelling or camping vehicle is situated has an area adequate to provide safe, approved water supply and sewage disposal facilities and is not in conflict with ORS 446.310 (Definitions for ORS 446.310 to 446.350) (9).

(2)

The person complies with all applicable standards of sanitation, water, plumbing and electrical and sewerage installations prescribed by the laws of this state and the rules issued thereunder, or by local authorities…

—————–

https://www.boondockersbible.com/knowledgebase/arizona-blm-camping-rules/

Quartzsite’s consummate event is the PowWow Gem and Mineral Show every January.

http://www.wheelingit.us/2013/01/25/the-biggest-rv-gathering-on-earth-quartzsite-az/

BTW moving your RV every two weeks becomes old in a hurry.

——————-

Tiny homes on wheels:

https://duckduckgo.com/?q=house+with+wheels&t=ffab&iar=images&iax=images&ia=images

It’s the “Democratic People’s Republic of Origoyim”…

FIFY…

Those public lands are basically collateral for the federal debt. That’s why they keep adding more.

Add in yearly property taxes in most localities and you have a unaffordable financial burden! I prefer to not buy anymore new autos. I will save my money for other luxuries such as for groceries!

Hi Allen,

Indeed. Here in VA, the property tax on vehicles is extortionate. It can easily be $500-$1,000 annually on a new vehicle. I will not pay such a vig. It is part of the reason why I buy and keep old stuff that has a low “book value” but which is invaluable, to me!

When I was still working and living up north (taxachusetts) the wife and I both had great jobs and made lots of money. We each got new cars about every 2 years or so. They called the personal property tax on cars an “excise tax” and it was based on the value of the vehicle – according to them, of course. We paid about 3 grand a year on that. I know, I didn’t need a new car every 2 years, but hey, we were flush with money and I like cars. Whatever happened to equal protection under the law? Doesn’t matter if you’re driving a $130,000 Mercedes or a $1500 Saturn, you’re still creating the same wear and tear on the road, the same traffic congestion, etc. Taxes that are based on value drive me nuts. The guy who lives in a $500k house gets the exact same services from the city/county as the guy who lives in a $300k house, why does he have to pay more?

When I lived in California in the late 90’s I worked with a man who bought a new pickup and was showing it off to everyone one day. So I asked him (if he didn’t mind saying) what he had to pay for registration on the truck. His response about caused my jaw to hit the floor – $1000 per year! He responded to my astonishment that the registration cost would go down over the years as the price of the truck depreciated. That just blew my mind….I had recently moved to CA from Maryland, where, at that time, registration was $75 a year for the lowest weight class (I had a Chevy Cavalier).

Needless to say, I kept my Cavalier registered in Maryland using my parents’ address!

And my co-worker’s answer to my question also answered another question I had – why there were so many old cars on California’s roads….

Some states (such as Montana) include a property tax the price when you are renewing your license plates every year, which can increase the price significantly. And then you have places like Virginia, where Eric lives, where they have to have their inspection sticker…OR ELSE! So there is more money you are paying. In my neck of the woods, we renew plates every two years, and after so many years, in some areas of the state, you can have a black, “Z” plate sticker, which means that due to the car being old enough, you no longer have to renew every two years. I will not complain, as it is the only thing that is cheap in these parts. Everything else costs an arm, a leg, and your first born. I have a friend who lives in Tax-a-Chusetts. I do even want to imagine how much money he forks over every year.

“It can easily be $500-$1,000 annually on a new vehicle.”

LOL. No, that is a ten to twenty year old used vehicle. New ones in VA – Tesla – $3500, GMAC Denali – $3200, Volvo XC60 – $2125, etc. I pay $450 a year on an almost 10 year old SUV. Hubby’s car is over 20 years old and it is $800+ per year. I expect the Escalade is probably going to cost around $3800/annually. Personal property taxes is Virginia’s cash cow.

It is ridiculous.

Hi RG,

Terrible! I knew it was bad.. but not that bad. I am so glad I escaped Loudoun County!

It isn’t just Loudoun County, Eric.

Roanoke’s rate is $3.45 per $100. If someone buys a 2022 Toyota Tundra for $46K the assessed tax on it for the first year is roughly $1587. True, that same car in Loudoun would cost $1909 (rate of $4.15 per $100), but the whole damn state is robbing you.

Umm, I’ve never even heard of a property tax on vehicles. The registration is bad enough.

The unleashing of credit has really only been around for about 50-70 years. Prior to that most people just paid cash, or did lay-a-way. If you needed a car and didn’t have much money you bought used, or got a hand me down from a family member or friend. They were available. Throw a little sweat into the engine and you’ll have transportation.

GM sold cars to everyone who could afford one. Then they began floating loans themselves because they wanted to sell more cars and banks got in the way. This made more money for GM than selling cars, so eventually GM became a bank that sold cars. One of the banks that failed in 2008 was Ally, which was GMAC. Why would GMAC fail because of a housing bubble? Because they had a lot of mortgages on the books. Of course GM held mortgages. Every car needs a garage right?

The new-car answer to the problem (right now, anyway) is 4-cyl. Toyota Camry. Nearly full-size, 203hp, 7.3 sec. 0-60, 30+ mpg, under $30k msrp. According to the gubmint inflation calculator, it’s virtually the same price as a Caprice in 1985.

Putting aside the electronic nannies and data tracking telemetry (both tough to swallow), this car is orders of magnitude better than 1985 Caprice and will last twice as long. The cost of ownership and depreciation will almost assuredly be significantly less.

I agree, Mister – because it’s true!

I’ve recommended the Camry to many people, some of whom decided to buy one (including a close friend of mine) and they love the car. It’s hard not to.

Granted you are right that the current Camry is a better basic vehicle than a 1985 version, but I’d much prefer a 15 to 20 year old Camry (or similar) at 70% to 85% off the price of a new one and without any of the complex systems that will break and cost a fortune to fix. Much cheaper to insure, too.

I don’t have the $30k to put in a depreciating vehicle and haven’t bought a car with credit since my new 1979 RX7 (about $220/mo for 36 mo.)

Even without the electronic nanny crap, there’s no way that a 2023 Camry will last half as long as a 1995 Camry. From a build quality standpoint, the two don’t even close to compare.

Based on what? I’m curious to know how you are comparing “build quality” between a 2023 car and a 1995 car.

My 2005 Camry went 215,000 miles before needing more repairs than the car was worth, thanks to the wife backing it into a pole. I could live with a big dent in the “bumper”, but the car needed to be repainted after about 15 years. Our 2016 Camry was reasonably priced, but we got the SE stiff suspension that the wife likes, but it’s too stiff for the usual Michigan potholes that Governor Witless promised to fix to get elected, then did not. I lower the back tire pressure from 35 to 30 pounds, but that doesn’t solve the problem. The hybrid Camry is a good deal if you drive enough miles to pay back the extra cost.

As a former Ford product development employee, for 27 years, I could get a good deal on Ford products. But I wanted a reliable car for the first time in my life. With some Lincoln Continental company cars I have had in the past, I had to find a Ford engineer to call a Ford dealership and explain directly to a mechanic how to fix a puzzling electrical problem. The electronics in 2023 models must be even more difficult to troubleshoot and fix.

Old engineering Rules of Thumb: More parts standard on a car means more cost, more weight, and more parts that can break. More electronics means more hard to diagnose problems, and Ford dealer mechanics don’t work cheap.

I bought a new Chrysler 300 Touring for $30,400! Looks like the S model meaning wheels and blacked out trim,very sharp car! Loaded with options too!

0-60 in 6.2 seconds mid 14 second 1/4 mile and 33 mpg on my route to work from 55-65 mph…Mix in city its 27.7 mpg with my driving style! Car is roomy,comfortable,good looking.

I had a 2013 Charger with the same 3.6 V6 and I bought it used X rental with 15,000 miles in 2015 and never toughed anything on that car! I traded it in it had 181,000 miles…I drive roughly 20,000 per year lots of city driving too.. Charger had many miles left but was the base,base model and had hail damage from 8 years ago while I lived in Colorado,since moved and no hail here!! I only changed the oil,brake job once and never did spark plugs! It still ran perfect!! 100,000 miles plugs were supposed to be done,but the hail damage always turned me off and caused me to neglect it! I do add stp fuel injector cleaner at every oil change,keep injectors clean and I would assume spark plugs..

This 300 will be treated better hopefully Chrysler/Dodge still will offer a gas powered next generation Charger,rumors say so..Wife does drive a Toyota Rav 4 with 5,000 miles she works at a Toyota dealer,and its a lease I bought mine outright..I looked at the Camry but not my kind of car,she took one home a few times already..The top model V6 is decent but still more tuner type car with that trim imo.

The devaluation of money is theft right under your nose of your previous earned human efforts. Taken by the Fed Reserve and given to government to keep spending into slavery.

Taking a loan is agreeing voluntarily to enter into a slave agreement, it better be worth it. Maybe a mortgage but for an electric car?

Big corporations love employees who have lots of shylocks to pay, you are a slave and can’t say no to them as long as you have payments to make. They have leverage over you. (Did you complete your DEI Training module yet?)

Could you afford to spend $300 a month for a daily cup of coffee? Try Starbucks, the Butt Light of java:

‘Some organized Starbucks stores will strike across the U.S. at more than 150 locations starting Friday in Seattle, after the union representing baristas claimed some cafes were not allowed to put up Pride decorations.’ — CNBC

And speaking of Butt Light …

‘In just a one-minute ad, Bud Light drinkers are shown being too stupid to put on shoes before walking across hot pavement, too dumb to put on shoes before carrying a full keg across rocks, trying to slam shut an obviously overfilled refrigerator, sun-burning the outline of a cell phone on their stomach, ineptly trying to balance on a paddle board, walking through a closed screen door and dropping a tray of snacks, clumsily flipping out of a hammock, and failing to tap a keg and getting sprayed with foam.

‘Consistent with a trend observable across all manner of brands, none of the people who are made to look foolish are black.’ — ZH

*sigh*

It’s gonna be a long, hot summer in Bidenville.

I dunno about you, but oftentimes, while reading Eric’s articles I’m reminded of this short bit from Yellowstone Season 3 :

https://www.youtube.com/shorts/RwHj8Pcj_Ig

“So you sell electricity and then you rent all the things that need electricity?”

Since not long after the dollar went full fiat, savings has been punished and debt rewarded. It’s been about that long since savings account interest exceeded inflation. And with that inflation, you pay debt back with dollars that are worth less. All hail the Fed.

For a sick laugh, peruse the Daily Treasury Statement — the ledger of Big Gov’s checking account.

Table IIIC — Debt Subject to Limit — shows that fedgov debt has blown through $32 trillion. That’s 121% of nominal GDP, $26.5 trillion.

Debt above 90% of GDP, research shows, slows economic growth to a crawl. The US fedgov is now a feckless, bombastic giant, helplessly tied down by 32 trillion Lilliputians.

https://tinyurl.com/ycya2c4t

Victory in Ukrainia! /sarc

Part of the natural progression of an empire. The plunderers have to plunder you know. Has the US entered the late stages yet? Tough to know for sure as that can only be determined after-the-fact.

Hold onto you trousers. The late stages of the Roman Empire were, shall we say, tumultuous.

There’s no incentive to save so may as well spend what ya have because it’ll be worth less tomorrow.

‘Merica: Punish success and reward failure. Punish law abiding and reward criminals. Punish citizens and reward illegals. Punish caution and reward wrecklessness.

This article covers quite a bit of what I was thinking about RG’s comment a few days ago about people getting new cars when the odometer hit 200,000 miles.

Seems like the way RG put it, no one actually reached the point they owned the car and they were forever on the payment treadmill.

All the fancy nice high Dollar vehicles driving by my place, I wonder, how Do they make the payments?

It’s an echo of the housing bubble.

Some related titles:

‘Panicking Borrowers Screaming For Help’

‘No One Wants To Be A Loser And Say, Oh Yeah, I Overpaid’

‘Landlords Have Seen Their Simple, Modest Investment Spiral Into A Money Pit They Can’t Wait To Get Rid Of’

‘Sometimes I Wonder If The Juice Is Worth The Squeeze’

‘Some Sell At 75 Per Cent Of Value Just To Get Rid Of Them’

http://housingbubble.blog/

Hey helot,

At least when those people dump their money pit houses they’ll have nice cars to live in 😆

Everything is fine. If the cost to live gets too much, we’ll just all get government subsidies. Government will move us into a nice apartment in a walkable city. We’ll get our food from their mobile food station trucks.

And the bankers will be fine too. Instead of being annoyed by high car payments (which we won’t need anymore), we will be freed up to take out loans for clothes and going out to eat at the local lab grown meat restaurant.

Ford Gets $9.2 billion from Government for EV batteries:

https://www.bloomberg.com/graphics/2023-ford-ev-battery-plant-funding-biden-green-technology/

Corporatism.

‘Transactions of decline,’ as the late Jane Jacobs used to say.

Ford’s white elephant battery plants are “Biden’s” answer to Nikolae Ceausescu’s Palace of the Parliament:

‘Palace of the Parliament is the heaviest building in the world, weighing about 4.10 million tonnes. Events organized by state institutions and international bodies such as conferences and symposia take place there, but despite this about 70% of the building remains empty.

‘As of 2020, the Palace of the Parliament is valued at €4 billion, making it the most expensive administrative building in the world. The cost of heating, electricity, and lighting alone exceeds $6 million per year.’ — Wikipedia

Value subtraction [finished products worth less than their input costs] featured in communist economies, and now in “Biden’s” crumbling American empire.

Thanks for the link, X. I don’t think any of us could come up with stupider schemes if we tried.

“You can imagine if [Ford] did it purely on Wall Street, without using our [government loan] program, the terms may have been quite a bit less favorable,” [government toadie] Shah says, “to the point where Ford would have to think twice about whether they could make the transition at the speed and scale necessary for what we need to combat climate change.”

Perish the thought: businesses having to “think twice” about what consumers really want. Un-American!

Ford also said they expect to sell 3 million EV’s/year starting in 2026. Hahahaha; I’ll take the opposite side of that bet anytime.

In the United States, Ford F-Series deliveries totaled 170,377 units in Q1 2023, an increase of about 21 percent compared to 140,701 units sold in Q1 2022. Of these, Ford F-150 EV Lightning sales totaled 4,291 units.

Profits on F-150 ICE and Large SUV ICE keep Ford in business. Their EV sales so far are way below projections. Engineers still working there see a disaster coming. They don’t like the EVs they are designing because of the high price and inconvenience. So far potential Ford customers agree.

Hi Ya Mike!

Those execs must be taking some serious drugs!

Ford can’t give away their Mach-E “Mustang”.

Their F150 EV “Lightning” (Aptly-named for something that spontaneously bursts into flames) is bankrupting them….

Yes-siree-bob, them Eeee-Veees are the future! (And the future is not looking bright!)

Ford Preparing from More Layoffs:

“The cuts are expected to affect employees on Ford’s gas-engine side of the business”

“The CEO has said its legacy side (i.e., ICE vehicles) was holding the company back”

https://www.wsj.com/articles/ford-prepares-new-round-of-layoffs-for-u-s-salaried-workers-a533a7a4?mod=business_lead_pos2

Unreal. You’re watching the suicide in real time of a 120-year-old company that was almost singlehandedly responsible for putting America on wheels.

Link was behind a paywall for me. ICE holding F back? I thought it was the cash cow to pay for the big “transition” to EeeeeeVeeees. Farley must be under the influence of that 9.2 billion loan from Uncle. This stuff is so insane it makes my head hurt.