There will almost certainly be another bailout of the car industry, which is having a time selling new cars to people who are out of work because of the government – not “the pandemic,” it’s important to parse. WuFlu hasn’t kept anyone locked down or taken away anyone’s right to work.

The government – a different kind of virus, which a mask won’t protect you from – did all that.

At any rate, the point is that the unemployed, the broke and those worried about being either are not likely candidates for a new car loan. But there is another disincentive that keeps people who aren’t unemployed or broke from buying a new car – and it comes from the same source as the impoverishing and unemploying of the populace – i.e., the virus that is the government.

Which serially taxes the ownership of new cars – thereby discouraging numerate people from owning them.

This is the property tax applied to cars – in the same manner as the tax on homes and land except largely avoidable by not buying a new car or owning one remotely new.

Both taxes are levied on the basis of the assessed (by government) value of the thing but unlike real estate, cars always depreciate and this fact makes it possible to greatly reduce the amount one . . . “owes.” Fascinating stuff, the way government can not only take your money anytime it likes and as much as it likes but also assumes the moral right to do so.

How in the world did we get to the point that we “owe” money for things we didn’t buy, don’t use and didn’t ask for? On things we already paid for.

Sales, title, registration and gas taxes among the several.

Ay, Carumba!

But there’s an out . . . if you drive something that isn’t worth much. Then they can’t tax it very much. Or at least, they don’t . . . yet.

This can save you literally thousands of dollars – which money you can use to pay off what you . . . “owe” the government (so it claims) each year to be permitted to live in the house you thought you owned, having paid the seller or lender in full for it.

It’s a way of getting the government to steal from itself. Or at least, to steal a bit less from you.

But it also steals from the car companies in a less visible way. How many new cars aren’t sold – even before government stole people’s right to work and earn a living – because of the reluctance of buyers to pay a tax they can largely avoid – by avoiding the purchase of a new car?

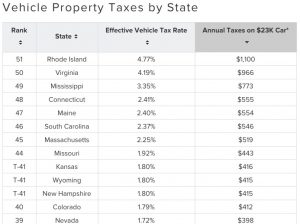

Virginia is one of several states (about half of the states) that serially steals from car “owners” – in air quotes to emphasize the cruel misuse of language – every year using the open threat that it will steal the car if the owner doesn’t hand over what he “owes.” This being the relationship of owner and renter – but never mind the verbiage.

The fact remains. “Own” a car in Virginia and other states that tax property in this manner and you will only be allowed to possess it so long as you keep current with your payments.

In Virginia, which has among the highest of these taxes, the amount you “owe” averages about $4 for every $100 of assessed value.

Thus the “owner” of a new car with an assessed value of $30,000 or so – which is less than the average price paid for a new car these days – will “owe” the government (so it says) north of $1,000 in additional (post-sale/beyond-registration, plus gas) taxes and not just this year but next year and for several years to come – until the car has lost most of its assessed value.

Even the “low tax” states average in the low hundreds.

Factor that over the six years it takes to pay off the typical new car loan. It’s quite a bite – amounting to as much as ten percent of what you paid for the car by the time you pay it off… the additional 10 percent going to the government.

Unless you let depreciation pull out the teeth.

It takes about 8-10 years for a new car to be worth about half what you paid for it. In the meanwhile, you will have also paid out enough to have bought yourself a used car – or most of one.

And paid a fraction of what they say you “owe” in order to “own” it.

This is why I drive a nearly 20-year-old truck rather than a new one. Well, it is one of the reasons why I drive a 20-year-old truck rather than a new one. Other reasons include no driver “assists” and only two air bags (rather none) but that’s another rant.

I still ”owe” on the truck, of course – even though I paid for it in full some 12 years ago. But I pay a great deal less than anyone who buys a new truck – about $60 annually these days vs. four or five times that much, at least, were I to buy a new equivalent truck.

Which is strong inducement to not buy a new equivalent.

Taxes are like termites. They undermine and destroy. They are the natural enemy of growth and the ally of stagnation. Why build what one knows will be eaten almost as fast as it can be built? Just as government steals, those who create what is stolen try to limit what is stolen. Especially when they have the option to avoid the stealing.

It would be interesting indeed to calculate how many new car sales are lost to new car property taxes. One way to find out would be to eliminate this especially obnoxious tax, which (like the real estate tax) affronts the very concept of ownership by making such a thing literally impossible as it is risible to describe anyone as the “owner” of a thing who is obliged to make payments on a thing. Such a person is being allowed conditional possession and use of the thing, which is a very different thing than ownership.

Imagine it – actually owning the car you paid for.

It might provide a stimulus for people to buy them.

Got a question about cars, Libertarian politics – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you’d like an ear tag – custom made! – just ask and it will be delivered.

My latest eBook is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

Given the fact there are only two things that can stop an economy from growing, natural disaster and government interference, It never ceases to amaze me that the sheeple insist that “proper” government can improve economics. An entity that takes twice as much as it gives, by armed robbery and borrowing from future generations, is not an economic solution. It’s a chain around the neck of a drowning victim.

Off Topic

In case anyone is interested which way Trump is going on the Mask this link should help.

https://www.rt.com/usa/494509-trump-coronavirus-mask-memes/

he always folds. woudl love to play him in poker

Hi Ken,

When I saw the Orange Man in his mask, I lost most of any remaining hope I had that he might be an ally in the fight against all of this. His wearing the Diaper legitimizes the wearing of the Diaper. It conveys that he agrees Diapering is wise, even if you’re not sick. If the president Diapers, how can anyone not Diaper?

The image of this is, I think, politically devastating. Why support the light-Diaperer when you can have the 100 proof Diaperer? In any case, Diapers for all, regardless.

Well, not for me. I am prepared to lose every friend – I already have lost many – and fight to the end, if it comes to it – over this. I’d sooner put a bit in my mouth than a Diaper over my face.

They can go to Hell – all of them.

eric, I don’t know that a bit wouldn’t be more comfortable to me. Texas give(sic) a little break on tags if you use “farm tags” so I use them. I don’t pull a boat any longer so accusing me of not being doing farm work(about all I do no matter where I’m going)is a joke.

I was fishing one day and came back to find a note on the windshield of a pickup I no longer have and should have my ass kicked for selling. It had farm tags. The note said You can’t park in this lot with farm tags”. I wrote a reply Well, I fished all day before finding this and I had a good day fishing if anyone cares. I put it on a windshield beside me hoping somebody would get a laugh out of it.

I was fishing one day at that same place and got back to find every pickup with farm tags but mine which was parked off in the weeds but still had the Ranger Trails trailer on it. That was a head scratcher. Maybe they didn’t want to walk through weeds. Those badged fuckers are pretty soft.

Hi Eric, here in Taxachusetts it’s called an “excise” tax, based on what govco says your car is worth. Every year when the bill comes for my now 20 year old Corolla I feel like driving it to the assessor’s office and demanding they give me that amount of cash and they can take the car. Good luck with that, right. Another great thing about owning an older car is how much less you have to pay the insurance mafia; any new car, especially if it’s financed, will require full collision/theft/etc. coverage for many years. I’ve probably saved enough in insurance payments alone to buy an 8-10 year old used car (no way do I want anything newer) when my present ride finally succumbs to rust.

Well, at least the roads and bridges in Boston are in good shape. 🤦♂️

Mike, same thing in Texas though it didn’t used to be. If they had to sell my truck for what they say it’s worth before they got paid, they’d be starving and working two jobs. I know most everyone at the courthouse and tax office. That doesn’t mean I had a shred of respect for them.

Speaking of wasted taxes,,, the Los Angeles “teachers” union refuses to go back to work until the police are defunded. According to them:

” Police violence is a leading cause of death and trauma for Black people, and is a serious public health and moral issue,” the union said. “.

Funny they don’t mention the Black on Black killings in Chicago, Baltimore, etc on one weekend exceed that of the police, nor that police kill more whites.

They want to eliminate Charter schools as apparently they present too much competition.

They want the masks and social distancing, temperature checks before getting on the bus or going into school buildings.

They want Medicare for all.

They want a Federal bailout of their pension plan, a millionaire and Wealth tax, and more….

People will now be fleeing California even more infecting other States with their socialist virus.

No longer the land of the Free,,, now the land of the Fee.

Do they honestly think they are that important? All one has to do is look at their final product to see what incompetent nincompoops they are.

I honestly think the children would be better off never returning to these indoctrination camps.

OMG. “land of the FEE” for sure.

ken, those a-holes sell their homes and other real estate. They bring what amounts to a fortune in Texas and drive our tax rates up very quickly. If Texas ever gets some federal funding for a wall, it needs to go all the way around. If I could manage, I cut off west Texas from a line west of Ft. Worth and west of the San Antonio area to the Rio Grande, put up a wall, divert the Rio Grande to run inside the wall as well as outside for 100 miles. then build that wall up to the 100 mile mark of what the feds say they have control over(nearly all of some states)and leave them to play with the people way out west and wish those poor land owners out there the best. I suspect that part would get cut up again and the wall would finally circle EP or just get NM to take it but they wouldn’t have it.

Take the wall north on the NM border to the top of the panhandle and follow the boundary back round to where the wall started at the Red River. If the people on the high plains didn’t want in, that would be fine too since the rest of the state is covered by ERCOT except for the high plains. They have plenty power up there and it’s up to them to hang onto it. The only blackouts we have is from high winds, generally circular.

“It would be interesting indeed to calculate how many new car sales are lost to new car property taxes.”

Until now, the yawning gap between the new car cost burden and what buyers actually can afford was papered over with E-Z loan terms, from financing subsidiaries where negative auto equity has become as common and accepted a condition as having hypertension or being overweight.

But as banks slash credit to all but the most creditworthy borrowers, consumers are doing what they did in the 1930s depression: slashing expenses, paying down debt and saving like crazy. Pathological thrift, Federal Reserve eclownomists call it.

Buyers hunkering down means the Bubble-times business model of ever more debt to finance ever more negative equity (and confiscatory taxes) has gone stone dead overnight.

It’s not a coincidence that the longest-running automotive design in history — the Volkswagen — was conceived in the 1930s as a small, light, and economical peoples car: the kind of car that federal ukases make illegal to build anymore.

The time is right for a new peoples car (or more likely, truck or SUV) for the depressionary 2020s. But such a vehicle is more likely to emerge from a place like India than from the US, where self-driving electric vehicles are still fantasized as the ticket to a glowing future.

Meanwhile, Prophet Elon is about to announce brain implants which will give everyone an effective IQ of 300. This will have the unforeseen consequence of setting folks to wondering: if I’m so damned smart, why can’t I escape from neofeudalism?

Thankfully, I have no vehicle property tax where I live. If I did, I’d buy something worth a lot less too.

I’m in OR — no vehicle property tax here. Which is amazing since the gov is trying to tax everything else… their latest corporate & element taxes [element as in periodic table of the elements, pick one any one will do] will probly bankrupt the state — I predict mass exodus in coming years. Of course they don’t NEED the money, nah, they’re swimming in money, it’s just never enough for them. I hate money — this world SUCKS.

Hi Harry,

I hate government-controlled money. The money itself is a useful tool. But it’s being used against us by the people who control it. As via tax-theft and inflation, a more insidious form of the same thing. If what you earned was yours entirely and if what you earned retained its value, then money would be what it is supposed to be – a convenient means of exchanging value and storing it – rather than a means of controlling and bleeding us.

I try to point out to people how much money they’d have if the government hadn’t spent (and inflated) it. Imagine if you’d been able to keep every cent you ever earned from the time you were a teenager to say 40 – and those cents and dollars had the same buying power today, at 40, as they did when you were a 14-year-old cutting lawns and such.

A prudent person who saved/invested and worked almost any kind of full-time job during those years would have accrued enough money by 40 to no longer have to work. That was the idea.

Instead, somehow, the idea was abandoned in favor of – literally – the bullet points of the Communist Manifesto. Including income and property taxes and a central bank controlling the money. These make it almost impossible to ever stop working – because you are forced to always pay taxes, unless you are homeless. The value of your money is systematically diminished at the same time, so whatever you have buys less and less. Only a very few very rich people ever escape.

We literally live in a Marxist system – and it’s not a new thing, either.

A friend of mine has her vehicle registered in South Dakota. Apparently they’re pretty much willing to register anything from anywhere, and it might be cheaper than your state (although it looks like it might not be as good a “deal” as she thinks it is). I understand that Oregon is similar because a lot of full time RVers have their vehicles registered in OR.

Before registering your vehicle out-of-state, you might want to check the laws in your state of residence. Nevada requires residents to register their vehicles here within 30 days. If you’re sufficiently mobile that you spend less than 6 months in any one place (like an RVer, I suppose), you might be able to dodge that requirement by claiming residency elsewhere.

Now here’s the weird part: back while my father was in the Air Force, he nearly always kept his cars registered in Virginia because it was one of the cheapest places to have your cars registered: something like $50 for two years. While on active duty, you’re exempt from laws (such as the one in Nevada mentioned above) that require local registration, so you can register your cars in any state willing to take your money. If you didn’t live in Virginia (he was stationed at Langley AFB and the Pentagon for maybe 8-10 years between them, but spent most of his career elsewhere), you didn’t have to bother with the annual safety inspection either.

This would’ve been from the early ’70s until he retired in 2002. Is this sky-high property tax something that’s a fairly recent development, or was the property tax also waived (like the inspection requirement) for vehicles that were registered in Virginia, but garaged and driven elsewhere?

Realistically, I’d say the residency/30 day thing depends on where you live (the law not withstanding). In the small New England town where I originally lived, if you had plates from halfway across the country, it would definitely be noticed and some nosy neighbors would likely complain to the authoritahs, cuz you aren’t paying your “fair share”. Where I am now in FL, at least half of the cars are from another state. Snowbirds, vacationers, tourists from all over the country are here year round. Nobody even notices different license plates and couldn’t care less.

In Virginia, the property tax goes to the locality where the car is garaged, so if it’s garaged outside of Virginia, no property tax is owed.

WA State required WA plates on the car within 30 days of registering your kids in school.

During our first couple of years living there, the Principal at the elementary school in our neighborhood had city cops at the dropoff lane exit of the school every September enforcing the law. It wasn’t so much that he was concerned about, say, my Florida plates, as much as he was vehicles from Oregon sneaking the kids into the school using friends/relatives/employers addresses.

Hi Ready,

Due to mobile work, we have been full timing in an RV for 20+ years. South Dakota is very friendly to RV’ers as is Montana. With the help of a law firm that works with full timers, we formed an LLC for use as a “holding” company meaning it holds property but does not generate income, so no tax id number is required. Our vehicles and RV are registered in Montana in the name of the LLC that is owned by the wife and I. After vehicles are ten years old (all of ours are) they are registered permanently. No safety inspections, property tax or other BS. The registration on the vehicles reflects the name of the LLC. The attorney acts as our registered agent for the state of Montana for 125 bucks a year….

Good deal. Too bad you have to jump through so many hoops thanks to Uncle though.

BTW, pretty envious of you full-timers! Lots of days (I imagine this morning will be one) I think about getting on the westbound ramp of I-70 instead of eastbound and not looking back!

Property taxes are akin to The Stamp Act. When the government has it’s day of reckoning to pay itself falls flat, then there will be property taxes on furniture, tools, utensils, clothes, and maybe your living being itself.

I’ve about paid off my truck loan and after it is paid off, no more! What they have taken out of me in property taxes in the past twenty years would make bank robbery look like pick pocketing. A friend and his wife purchased a new a Suburban 3 years ago and the county property tax was almost $1,800.00 a year! F’n OUCH !! Unless I’m photographed holding a giant check after winning, I’m done!

The one that sticks in my craw is the sales tax on used cars. Not enough that it’s taxed hundreds, maybe thousands of dollars when brand new, but they have to shove it up somebody’s arse again and again, every time the vehicle changes hands. At some point the bastards will probably be looking for sales and income taxes on my yard sale. Just wait, a lot of government jurisdictions are going broke because of the “virus“. You can bet your bippy they won’t address that by reducing services, eliminating “workers”, closing facilities, etc. They’ll just take a bigger piece of my ass. Oh wait, not true. They will close libraries and parks and anything else that might actually annoy me, but they themselves won’t suffer any inconvenience.

I agree Floriduh man! I’ve never done this personally, but I’ve heard of others who have successfully put down “trade” when purchasing a used vehicle (could be anything of value really but have to make sure it’s not something that needs to be registered). This will generally probably only work for vehicles under say, $10,000 or so. The state DMW is probably not going to put forth the effort to prove otherwise in order to gain several hundred dollars. It probably helps if both parties are on the same page and willing to stick to their guns if the state does come a knockin’ though. Food for thought.