I was asked by a reader which new car feature is “the worst.”

This one’s tough – like choosing between Hitler and Stalin. On the one hand, you have absurdly complex drivetrains (e.g., twin fuel injection systems, transmissions with three or even four too many gears – or no gears at all) and on the other you have insufferably nannyish “assistance” systems that are worse than any backseat driver – because you can’t kick them to curb.

But if I had to pick the single worst new car feature, it would be the new car itself . . . because of the financial wallop you’ll take by driving home in one.

Any one.

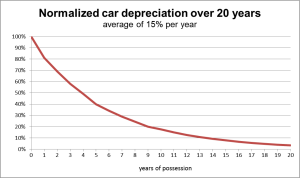

Depreciation averages 25-30 percent of the purchase price over the first two years alone. This is even worse than it sounds because you’re effectively paying (by losing) a sum equivalent to that in addition to what you paid for the vehicle at the time of purchase.

Say you buy a new $50,000 whatever-it-is. Two years from now, its value has depreciated to $37,500. Not only did you pay the $50,000 – you also lost the $12,500. In effect, you paid $62,500 – plus interest.

Plus – as Elvis once said – tax. Including the property tax in states that have it, which is assessed on the value of the vehicle.

There’s another cost, too. The opportunity cost of the money you could have spent on something else instead. Plus the costs of those first – and inevitable – scratches and dings, which further reduce the value of the vehicle.

These are the costs – plural – of depreciation.

It is far wiser to let someone else pay them – by waiting until the vehicle you want has depreciated.

Let a couple of years go by – and then shop for it. By this time, it will have depreciated by 25-30 percent (or more) and you will therefore pay that much less for it.

Because it will depreciate less from that point onward.

The car will continue to lose value, of course – but not at the same rate, which can be a huge savings. Instead of 25-30 percent every 24 months, maybe 5 percent every 12 – and that sum will also be less because it will be a percentage of the already depreciated value of the car at the time of (your) purchase.

Less the dings and dents, which don’t hurt the function – but do reduce the price.

You will also pay less to insure it, because premiums are based on the replacement value of the vehicle.

How much could you save? Let’s tally it all up using our hypothetical $50,000 new car as the starting point.

Instead of buying it new, you wait a couple of years and buy it for $37,500 – which not only saved you from spending $50,000 up front it saved you from losing $12,500 in depreciation down the road – bringing your actual cost down to $37,500 minus the $12,500 you didn’t lose over the first two years of ownership in depreciated value.

The property tax on a 2-3-year old vehicle worth $37,500 will be considerably less than than the property tax hit you’ll take on a brand-vehicle. The savings on these two items alone is probably enough to cover what you would have to come up with as a down payment on the new car.

Which brings up the opportunity cost.

Assuming you only have so much money to spend, whatever you actually spend – or oblige yourself to spend (the monthly payment) necessarily means not having it on hand to spend on other things, should the opportunity arise. It means you won’t be able to take advantage of a great sale – because you can’t afford to buy. It may also mean having to go into debt, for some unforeseen reason that won’t wait – like the water heater dumping its guts. Your choice then will be to go without hot showers until you can afford a new water heater – or go into hock, by putting it on the card.

The more cash you have on hand, the more options you’ve got.

Some worry that buying a used vehicle is risky; they worry about something breaking and being on the hook for costly repairs. They are sold on the security that comes with a new car – and the new car warranty.

But keep in mind that the durability and reliability of late model cars is at least twice that of what was typical a generation ago – and so is the duration of the typical new car warranty, which is usually transferable to the next owner.

Keep in mind, also, that new does not necessarily mean no problems. It just means they are probably “covered,” for whatever that’s worth. And you paid for every bit of that.

It’s mostly a psychological thing.

Many people still operate on the (faulty) premise that a two-or-three-year-old car (or even a five-or-six-year-old car) only has three or four years of reliable life left in it. This is a fiction the car companies want to maintain because it is in their interest to keep you fearful of used cars, in order to sell you new ones.

Assuming you exercise reasonable caution – as by having any car you’re considering inspected by someone qualified to do so, checking service records and so on – the odds of you ending up with a car any less reliable than a brand-new one are very slim.

Meanwhile, the odds of saving more-than-a-small fortune are very high!

. . .

Got a question about cars, Libertarian politics – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you’d like an ear tag – custom made! – just ask and it will be delivered.

My latest eBook is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

Eric, here’s the problem with “used-up” vehicles that doesn’t give me confidence to be the DIY wrench-twister, working under the proverbial shade tree, that I once was…

They’ve been DELIBERATELY engineered to be impractical to fix once they get to about six/seven years and 100K miles.

Now, the odds are that, if you’re diligent on regular maintenance, and not an abusive driver, you’re going to beat that. You might get ten to twelve years, and 150K to 200K miles. That’s a fairly good, long run. But, since the “bumper-to-bumper” and then the “powertrain” warranties are but memories, every day you’re crossing your fingers…that it’ll still start up, that the transaxle won’t go “thump, thump, thump”, or that the engine doesn’t suck a valve, blow a headgasket, or “spin a bearing”.

Unlike, say, ca. 1984, when I had as a second vehicle a 1971 Pontiac Grand Prix with the 400 4bbl under seven feet of hood, backed up by a Turbohyramatic (it was a graduation present from my grandparents), and I could change the float on the Rochester QuadraJet, or replace the rear wheel bearings in an afternoon, or the alternator, all of which I did quite easily, just TRY to do the equivalent yourself these days. Never mind how items where accessibility was taken for granted can be complete nightmares. Just try to get parts. I can see, if I still had Grandma’s old Grand Prix, where a few parts might be “unobtanium”, but I’ve seen this problem on ten year-old TOYOTAS.

And if parts are readily available at reasonable cost, and diagnosis and R&R aren’t all that intimidating, there’s one greater problem…the DIY “shade tree” mechanic is now see by many as a SCOFFLAW. That’s right, do even something moderately difficult like a CLUTCH replacement or an engine swap, even with CARB (California Air Resources Board, for those with the sense to not brave the once “Golden” State) approved parts, and local “code enforcement” is on your ass, or you get a notice from the Health Department as to disposal of “hazardous waste”. Sheesh. For that, the ultimate solution is straightforward…sell the ol’ homestead, and getting the “Duck outta Fodge…”.

Eric, it’s even WORSE than you have calculated.

Let’s say you buy a $50,000 truck. In order to spend $50,000, you have to earn MORE THAN $50,000 to account for what the government steals from you. You’ll have to pay 7.65% Social Security and Medicare tax on it (15.3% if you’re self-employed, but ;let’s just stick with 7.65% for now). Then, hypothetically, let’s say you’re in the 15% federal income tax bracket. Now, if your state has an income tax, you’ll need to include that — in my state a bit over 6% for working-class people.

In round numbers, you’d have to earn about 28% more than $50,000 to be able to buy the truck, and that’s without sales tax, which in my jurisdiction is over 8%. So now you need to earn 36% more than $50,000. By my guesstimate, you’d need to earn about $78,000 (78,000 x .64 = 49,920) to be able to spend the $50k.

If you can’t afford to pay cash, like a lot of people, you need to factor interest into the cost of the vehicle. THEN start factoring in depreciation.

It’s a massive ripoff of mind-bending proportions when you look at it that way…

One of the most annoying feature of new cars: thick door pillars. People already don’t look out as they drive very well as it is, and this makes it far worse because you CAN’T see out. These stupid government mandated roll over standards has resulted in these huge ugly thick door pillars. The blind spot on many new cars are huge! No wonder people want the backup cameras. Because you can’t see behind yourself.

Going into debt is what allowed me to acquire a Ninja 250R, a CBR600F4i and a GSX-R750 in succession while I was still young enough to ride them, instead of waiting to be able to pay cash and end up being too old to do it at all.

If I hadn’t gone into debt, I doubt I would’ve ever been able to experience the fun of riding motorcycles.

Debt’s not inherently bad, it’s just a tool, and Dave Ramsey can go eat a whole bag of dicks.

Worst new car feature: the ever-growing LCD screen. In Tesla vehicles, it’s up to 12.3 inches.

The LCD screen replaces former individual instruments and controls, increasing the risk of a total loss of function if the black box that powers the LCD screen hiccups or croaks.

As we all know, Tesla’s full self-driving mode is a crock. Already scary videos are being posted of alarming wobbles in the last beta release.

But the long-term objective is clear: to put home theater quality entertainment into the front seat as well as the back seat, so that former “drivers” will be as engrossed with the big dashboard display as they are with their phones the rest of the time.

They won’t even know what hit them, when full self driving mode makes a fatal mistake.

Depreciation is an actuarial assumption. The conventional wisdom on a new car losing so much value the minute you drive it off the lot is curious. This appears to be a net negative for individual buyers. However, for business buyers, fleet purchasers especially, this dramatic depreciation is rung up immediately and over the first few years as an extremely beneficial tax deduction.

Why BUY when you can LEASE? Save your down payment for something you need more, or can at least invest in the stock market or even just a decent “no-load” fund, and FULLY DEDUCT those lease payments. Moreover, often many leases can be negotiated with pre-scheduled maintenance, and often both you and the leasing company unload the vehicles before they become a PITA.

Yes, I know, Rodney Dangerfield reminded the snotty Business School Department Head at some fictional University of that common sense approach in “Back to School” from 1986. On some things, it’s not always the best move to buy, just RENT…or as an old friend that many years ago I cleaned office buildings with at night in Fresno put it..”if it floats, flies, or fucks, it’s CHEAPER to RENT!”

You’re thinking too small. If a biz throws off a ton of cash, think construction especially gov’t infrastructure like bridges & roads, why not depreciate 24k a year on a buy vs. 6k a year for a lease on a 50-60k new one ton pickup (or each on a fleet of them). Then sell into the dealer oriented hot used market and rinse and repeat with new trucks every 4-5 years. There are even gov’t purchase incentives (may have expired but in effect for the past coupla years) that further entrenched and sweetened this deal for buyers AND manufacturers. Sure, it’s all fascism but if that doesn’t bother ya… it’s better than ol’ Rodney doing a triple Lindy.

There is a car that you can buy, use, maintain, insure, repair, pay tax on and still have appreciation that outpaces all the costs- a 20+ year old Ferrari. Even the 80s mid engine V8s outpace the costs of owning and operating one. Some are cheap- like a mid-80s Mondial (about 50K) Any Enzo era Ferrari appreciates about 10% or greater per year- regardless of miles. Some double every 4 years- like the Dino.

Just because I can’t afford one does not mean that the opportunity to make money on a Ferrari does not exist. I just need to figure out how to earn more money. That is still an option in America- for now. In spite of the financial and educational system doing their damndest to make us all debt serfs.

My advice to any young person who will listen: Never go into personal debt. Ever. While you are living at home work and save like it’s you last hope. Buy carefully with cash. Lease/Option a beater house and fix it up, then sell it. Do that 5 times and you can pay cash for a nice home. Do that 5 more times and buy income producing property for cash. In 20 years- by the time you hit 40somethng your are relatively wealthy- and very free. College? Don’t bother unless you are going into medicine, law, engineering, or accounting. Bullshit college degrees and their attendant indenture is a scam to keep you down.

Excellent, Magnum!

And the same – only more so – is true of classic American muscle from the same era. My ’76 Trans-Am is worth several times what I paid for it back in the ’90s. Unless the system entirely implodes, I will never lose money on it.

Magnum- Personally, I agree with your recommendations, especially about college. However, debt/leverage is simply a tool that magnifies gains AND losses. Furthermore, in an inflationary monetary system like the one we have lived in our whole lives, debts are repaid in devalued dollars. Then there are the hidden tax benefits in our Byzantine tax code.

H- I get it but the problem is you have to play their game with the tax code.

Indeed. I haven’t filed a tax return in over 40 years so any “tax benefits” are not a consideration. I’ve avoided debt like the black plague. Shakespeare had it down pat when he wrote “Neither a Borrower Nor a Lender Be”.

Hattarasman; I agree that there is a place for leverage- it’s in a business. My conclusion after 40 years in finance is that personal debt is, as Livermore said: “the unwinnable game”.

Fresh out of college (and in debt) in 1983 I learned that banks give “sweet” low cost loans to their new employees- to keep them employed! Yes, they use debt to keep the employee at his job and compliant. That goes for us too- debt serfs are less likely to revolt due to the risk of loosing their car , house, TV, etc.

As for the tax advantages of personal debt let’s look at the home mortgage. In debt you pay let say $20,000/yr in interest. You earn enough to be in the 25% tax bracket. Now you get to deduct 1/4th of that 20K in interest- $5 grand. How did you win? you still have $15,000 in non-deductible burden. That makes zero business sense.

How about the repayment of debt in depreciated dollars? The Fed’s Dollar devaluation goal is 2% per year. Lately it’s been running at under 1%/year. Back to the above scenario: You repay that mortgage debt in dollars that are 2% less valuable next year. that’s still only a $400/yr reduction on that 20K so using the paragraph 2 math you saved $5400/yr but spent $14,600 in real cash to get it!

In no common scenario does personal leverage get you ahead.

Morning, Auric!

I’ve done my best to live as debt-free as possible. While I understand that some people are able to”leverage” debt to build capital, such a scheme is not for me. The goal of a paid-for (or at least, mortgage-free) home and no car payment and no credit card payments makes it feasible to live on very little capital. This is itself freeing in that you’re not as bound to the system, to some job you loathe but must kowtow to . . . in order to make all those payments.

Were it not for real-estate taxes, a man with a paid-off home and no other debt would only need to earn enough money to pay for food, utilities and other necessary things, all of which together ought to amount to more than $1,000 a month. In normal times, one could earn that and then some part-time, doing whatever work appealed to you.

That is what debt costs.

Eric-

Agreed. I’ve basically lived the life you described for the past decade. This coincided with my learning about Ron Paul then libertarianism generally. The two things are of a piece in my mind. That being said, I am sorta playing devil’s advocate here. Because, from some of my own experience and that of observing others, personal debt has made some positive things happen financially that otherwise would not have. I’ve also seen some train wrecks. Such is life. I certainly don’t recommend it (debt).

Auric-

Your examples leave out the important fact that, with a mortgage, you are acquiring an asset. If you buy a house for 100k with 10k down and a 90k mortgage and pay on that for a few years then sell for say, 160k, even with taxes, including the inflation tax, you’ve made money. Leverage has magnified your gain. I would argue this is has been a pretty common scenario for folks over the past few decades. Obviously, it works against you if you sell for less or even the same as your purchase price.

Hi Hattars,

Your point is valid; but I prefer a more conservative approach. One that does not hinge on my being able to make those payments. I’m not claiming making payments doesn’t pay. I’m saying that when you don’t have them, you’ve got a unique type of flexibility very few people other than the very wealthy ever experience.

Also: When one regards a home as a home rather than an “investment,” it eliminates worry about asset appreciation or depreciation. The value of the thing itself – as a home – has great value.

Not to prolong this but… Cash purchase of a home, if you can, is obviously best. Yet, in most cases, for those that cannot buy with cash, good argument can be made for personal debt (mortgage) to buy a home vs. paying rent. A home is neither always just a house nor just an asset but these considerations affect the overall calculus.

Hi Hatteras,

I’ve given the following advice to young people: Do not follow the script of buying a progressively larger/more expensive house. Instead, pick your first house wisely; ideally a fixer-upper of some kind that you can buy for not much money that needs work, which you can (or should) be able to do a lot of yourself, or learn how – being young. Then sell it for a profit and buy a less expensive house to live in, permanently. This becomes your asset base – by eliminating the single largest revolving expense most people labor under for their entire lives. No tax deduction will ever make up for not having a monthly payment.

Also, when you own your home, you can skip the insurance on it – which is just as sensible as not buying health insurance if you are healthy.

Good advice. For some time, I’ve been grappling with whether debt is intrinsically evil or just a tool. Certain cultures/religions actually forbid usury as taboo. Others, like ours, glorify it. Trump proudly refers to himself as the King of Debt! And I just pulled a lever for that guy in the hope he might serve to preserve some remaining tatter of Liberty.

As far as cash purchase of a home, you are the only other person I know of who has done so. No insurance here either… When I mention this to anyone else it’s like I’m speaking in tongues. Even people I know who could buy with cash, don’t, and leverage their money to buy more houses or other assets. I wouldn’t do it but folks have the right to choose what’s best for them financially and live with the consequences of those decisions. So I just chalk it up to another occasion to practice live and let live.

Magnum- amen. I just wish someone had told me that before I wasted 8 years of my life forcing myself to get my engineering degree. It took me 8 years because I found academia so awful I took off several years and semesters off to work and make money- still being programmed by public schooling enough to not figure out for myself what I was doing. I’m proud of the accomplishment, mostly because I learned discipline to force myself to finish.

And FWIW- an engineering degree isn’t really all that valuable- what little I learned in engineering school I would have learned anyway and the degree gets you a JOB working for corporate idiots and a$$holes.

Save for the needful professional education that you described, the only purpose of a college diploma, insofar as career/income opportunities, is to open doors that’d otherwise be closed. They are NOT a predictor of usefulness nor marketability.

Simple engineering fundamental: The more complex a system, the more likely it is to fail. Given the ever increasing complexity of motor vehicles, whether a new one is more reliable than a less complex used one is debatable. Likewise the ever growing abundance of fatwas imposed on motor vehicles, the makers have less inclination to place any engineering effort into durability or reliability, and more on compliance. If one could save half what you claim Eric, that would still leave $6k in your pocket, and you can do a LOT of work on a car for $6k. When I was working in construction I bought two new trucks, hoping for the extended reliability, which didn’t happen. Mechanical issues surfaced that were covered by warranty, but took the truck out of service for as much as two weeks. I had far better results with older trucks I bought used. Excepting true collectibles, vehicles are not an investment, they are a liability, and the less cost the better.

This principle is ever so true when it comes to firearms. While I can appreciate the gadgetry of a typical AR pattern semi-automatic carbine, there’s nothing as sweet as a decent, well-cared-for M1 carbine or even a 1903 Springfield (itself a copy of the German Mauser Gewehr 98, so blatant that up to and even DURING WWI, at least until April 6, 1917, a US Court ordered the US Government to pay the German Mauser company for patent infringements). Give me a SIMPLE weapon, but well-made, that’s straightforward to field strip and clean.

J. Paul Getty said if appreciates buy it, if it depreciates rent it.

He also said own nothing, control everything. I would guess civil lawsuit attorneys hated him.

There are some times when you must buy a new car to get what you want. I could have purchased used the last two vehicles I bought but finding them in red without cruise control, back-up cameras, infotainment system, etc. would have been impossible. Also, another reason for buying new was my Audi S1 was going to be discontinued the following year and my VW T6 twin turbo diesel with a 6 speed manual was soon going to be available only with an automatic. If I looked at cars only as transportation, then purchasing used is the smart thing to do – but I don’t.

Hi Doug,

Sure! And there’s nothing wrong with buying what you want. I did it once, too – my ’03 Kawasaki ZR31200. It’s the only new vehicle I’ve ever bought 🙂

I’ve bought new for my two last main rides because I’m too busy to fuck around with an old beater IF I have to rely on it for my primary transportation. I’m well-pleased with the 2020 Ford Fusion that I’ve had for a year and will drive the thing as long as it’s practical. However, I’m taking on my 86 y.o. father’s 2013 Toyota Corolla, which is still quite “basic” (less gadgets than what you’ll see in a new Corolla today) but has but 24K on the clock. Yes, that I’ll just have to “cross my fingers”, but Dad kept it up, so as long as I likewise am diligent about the upkeep, I should get ten years or more out of this thing and keep the Fusion (which will be in the garage and used mainly for trips) until the proverbial cows come home. Anything else for specialty purposes, like another pickup or jeep, will be well-used and ON THE CHEAP.

I own and maintain a fleet of antiques and derelicts. The newest is my daily, a 13 year old grand caravan which works as a great utility carryall with the bonus of a set of useable seats folded into the floor. I have 340k on that one, still strong and low maintenance. The next newest is the 20 year old Cummins which pulls trailers with parts cars and such on it. After that the average age is around 50 years.

The only thing which entices me to any new vehicle is how very quiet they are! I have ridden recently in a couple eco-boosted F-150s. I was very impressed that they were so quiet I was wondering if they were hybrid running on electric! Also amazed that the eco-boosted 2015 had almost 200k on it and was still running great! Otherwise, any improved mileage would never pay for a newer vehicle, and the increased maintenance cost and hassle pretty much quash any interest I might have. I can’t even justify a VW TDI when my BMW diesel still gets 40mpg in a classy low maintenance package.

My lifestyle is a dying one. We’ve lived through the peak flowering of western civilization and the industrial arts. I’m saddened by what my kids are going to have to deal with as so much has been destroyed by the greedy and power hungry.

Ditto, Ernie –

I hope I can preserve my Orange Barchetta as a relic of that better, vanished time – and that it survives me and gets preserved by others, in their turn.

You gave me an idea for the de facto remake of the 2008 movie “Gran Torino”…”Orange Barchetta”…an old fart from Virginia shows some punk kid the “ropes” that his single mom was in no position to impart, and the kid pulls his head out of his ass and, once Eric is worm food, is happily cruising around in the Trans Am…provided the Commonwealth of Virginia hasn’t deemed it unfit for its roads by fiat.

Hi Doug,

I am working on that scenario. Since I have no kids of my own, at some point, the Orange Barchetta will pass to a new disciple. The good news is I still have plenty of time to find one. The bad news is there may not be much time left.

Hi Eric,

I agree with your general premise, but question the accuracy of your generalized depreciation statistics. Some brands may lose even more during the first two years, while others lose a lot less.

For instance, Kia and Hyundai depreciate viciously. I bet that many GM and Nissan products do too much better than the Koreans. Conversely, Honda and Toyota probably lose closer to 20%, instead of the 25-30% that you cite. And…although it may take more than two years, I think that hi-performance V-8s from Ford, Mopar or chevvy may rise to “collectable” status much sooner than most people realize.

So yes, depreciation makes many new car purchases a bad investment. But one has to do a lot more research and calculating before concluding how big a hit any specific brand and model may take. In a few cases, buying the “right” model new might make a sweet investment indeed.

Hi Mike,

I’d like to think that some of the cars you mention will become collectible but doubt it, for several reasons – the main one being that car culture is fading fast. Who mostly buys the cars you mention? Middle-aged guys. Because mostly the only ones who can afford to spend $40-$50k on a new muscle car plus the insurance and so on. They won’t be reliving their youth in 30 years. Also, the cars – like all modern cars – are disposable. They will run great for 10-15 and then get thrown away. Restoring a 2020 car in 2050 will be cost-prohibitive, even assuming it’s allowed, because of the myriad complex systems and electronic parts that would need to be replaced. It’s doubtful the parts will even be available.

Damn, I was hoping it was actually going to be wooden spoilers.

If I can continue to drive my ’90s-era trucks ad infinitum, then I will. Nothing that has been done with cars since then has warranted any extra expense in my life.

Those galvanized siding ground effects are awesome too! I can’t tell if that’s a Fiat or a Lada or some other square s#!tbox but it is so awful I kind of like it.